Water ETF A Precious Commodity Despite Its Abundancy

Post on: 7 Август, 2015 No Comment

More and more specialized exchange traded funds (ETFs) are being introduced in to the market. And sure enough, Powershares decided it was time for a water ETF. At first I thought this was another commodity play like the commodities ETF or gold ETF. But I was wrong.

The water ETF is instead a sector-based ETF that focuses on companies involved in the water industry. The average market cap of its holdings is around $8.7 billion putting it in upper end of the smallcap category. Here are the top 10 holdings of the water ETF. Note that at the time of this writing, none of these companies made up more than 5 percent of the total value of the fund.

- American States Water (AWR)

- Companhia De Sanea (SBS)

- Aqua America (WTR)

- Layne Christensen (LAYN)

- Franklin Electric (FELE)

- Southwest Water (SWWC)

- Watts Water Tech (WTS)

- California Water (CWT)

- Calgon Carbon Corp (CCC)

- Consolidated Water Co (CWCO)

According to an article on Marketwatch, some arguments for investing in water include:

- Less than 1% of all water on earth is available as fresh water.

- Of the above amount, only about 1/100th is usable or accessible

- Only 20% of the world’s population has running water.

- 50% of the world’s population uses unclean water and have no basic sanitary facilities often leading to disease and health-care issues.

- 1/3 of all nations suffer from water stress.

- Since 1950 the world population has doubled but water use has tripled.

In addition, reports of pollution in China’s Yellow River and continued competition for water in India could be the first signs of what may someday become commonplace around the world especially in third-world countries. And a history of poor environmental controls threatens water supply in fast-growing areas in the former Soviet states and Central Asia.

In some cases even corporations are running in to clean water shortages. Take for example this snippet of a recent story reported by a piece from the ETF Zone and syndicated on Yahoo:

Coca Cola and Pepsi, two of the most successful companies ever to operate in the global arena, find themselves banned in five Indian states because of pesticide residues found in soda drinks. Coke and Pepsi weren’t doing anything exceptional. They were producing according to the same methods as in the U.S, using the same water as other local drink providers. But they were not of course producing beverages with water of the same standard as in the U.S. For Coke and Pepsi to operate in India, clean water must be found— or cost-efficiently made.

And Alligator Investor offers this pretty scary list of water-shortage related news from around the world:

- Low water supply in China portends a rise in global grain costs reported by IHT.

- Water shortage worsens in the Philippines according to Manila Standard.

- Critical water shortage in Pakistan forces people to drink polluted water.

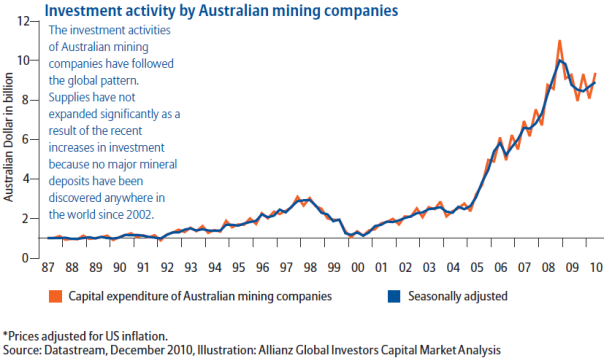

- Australian companies cash in on water shortage.

- Water shortage in Florida forces agricultural users to reduce consumption 15%.

- Petroleum refinery in Kenya shut down due to water shortage.

- Water shortage in Dominican Republic leads to violent protests.

- In Colorado, where they actually have water courts to resolve disputes over limited supplies, construction of new homes and commercial buildings has been halted in some areas due to lack of water.

- Water shortage in South Africa reaches crisis proportions.

As with much of my writing on this site, I have an opinion (not to be construed as advice) about the water ETF. I think it is simply too targeted an offering for my investing style. On top of that, as a commodity, I have to ask if water really is worth investing in. Oil, for example, costs $1.67 a gallon. For water, we pay about one-third of a cent per gallon of high-quality water from our taps. Is anyone going to make a fortune investing in something so inexpensive? And in countries such as the US, water use is becoming more efficient such that there is less water being used today than 20 years ago even as the population and economy grows.

Check out these related articles: