Warren Buffett accused of scapegoating former heir apparent

Post on: 16 Март, 2015 No Comment

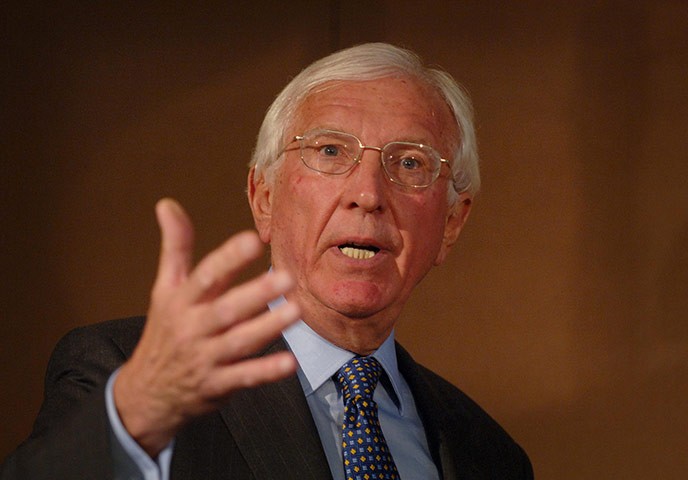

The former heir apparent to Warren Buffett has accused the investment guru of scapegoating him and says he is deeply saddened by Buffett’s decision to publicly disparage him over a controversial share deal.

In a statement, lawyers for David Sokol, a former director of Buffett’s Berkshire Hathaway investment firm, said Sokol had considered Buffett a friend and mentor. Sokol resigned earlier this month after Berkshire disclosed he had invested $10m (6m) in Lubrizol, a chemical firm that he later advised Buffett to buy. Sokol made $3m profit on the deal.

Speaking this weekend, Buffett called Sokol’s behaviour inexcusable and incomprehensible. But in a statement at the time of the resignation Buffett had said: Neither Dave nor I feel his Lubrizol purchases were in any way unlawful. Buffett had also described Sokol’s contribution to the company as extraordinary and said the resignation had been a total surprise. Sokol had run several Berkshire subsidiaries, including MidAmerican Energy and NetJets, which sells fractional ownerships of private jets.

At his annual meeting, Buffett said he had made a big mistake in not quizzing his former potential heir about the controversial share deal. He said he had paid Sokol $24m last year; Sokol is believed to be worth more than $100m. Buffett said Sokol once volunteered to give up $12.5m of a bonus compensation to Greg Abel, his colleague in Berkshire-owned energy firm MidAmerican, because he thought the money should be shared. Last year Sokol was a hit with shareholders, who wanted their photo taken with a man tipped as Buffett’s likely successor.

Buffett said he would never understand why Sokol made the Lubrizol deal. His business partner Charlie Munger blamed hubris. Buffett’s most fancied successor is now Ajit Jain, head of Berkshire’s reinsurance businesses. To an extraordinary degree, he thinks about Berkshire first, Buffett told shareholders.

Last week, Berkshire issued a damning report from its audit committee accusing Sokol of violating company policy and withholding information. It said the director could be subject to legal action. The sale is now the subject of a regulatory inquiry and a shareholder lawsuit.

Through his lawyers Sokol said: It is alarming that Mr Buffett would be advised to so completely flip-flop and resort to transparent scapegoatism. After 11 years of dedicated and hugely successful service to various Berkshire Hathaway subsidiaries, Mr Sokol would have expected to be treated fairly. That would have been in Berkshire’s interest.

Sokol’s lawyers said neither Buffett nor the audit committee had asked to speak nor had spoken to Sokol since his resignation was made public. Mr Buffett drafted the March 30th press release announcing Mr Sokol’s resignation in cooperation with Mr Charlie Munger and Mr Ronald Olson, both of whom are Berkshire Board Members. They know the law and they know the Berkshire policies. In that context, Mr Buffett correctly declared Mr Sokol’s conduct lawful and indeed was effusive of his praise of him, said the statement.

There is no new information or new fact which has become available to them since that press release was issued on March 30th. At no time did Mr Sokol attempt to withhold information from Mr Buffett, Berkshire Hathaway or the Audit Committee. Every question asked of Mr Sokol on or prior to March 30th and any information requested of him has been provided. The Audit Committee report, which was prepared by the law firm of Munger Tolles & Olson contains errors and omissions, both of which could have been avoided if the Audit Committee had inquired of Mr Sokol.

Sokol’s lawyers said their client had not broken the the law or any Berkshire policy. At no time did Mr Sokol intend to personally profit at the expense of Berkshire or its shareholders. At no time did Mr Sokol mislead or deceive. Such a conclusion would be wholly out of character and the Berkshire Board is keenly aware of that. At all times he faithfully discharged his fiduciary duties to Berkshire, a company he heroically served and continues to regard with reverence.

After the weekend meeting shareholders seemed satisfied with Buffett’s account. Shrini Ganediwal, a software consultant from Florida, said: He explained himself very well … He did what he thought was right. Buffett is a very nice person who doesn’t like to criticise people.