Value Investing

Post on: 3 Май, 2015 No Comment

How does the Chart Analysis offered by us help me?

What is Value Investing?

Value Investing is a strategy of applying a targeted selection of shares of undervalued companies to achieve superior returns.

To find these undervalued stocks or companies, use is made of this particular fundamental analysis called value investing.

Benjamin Graham is the founder of value investing. Even today, his book Security Analysis is considered to be the Bible for traditional value investors.

The methods of value-oriented investing make use of the analysis of corporate data, specifically amongst others the current and past book value and return on invested capital, earnings per share, sales and cash flow.

Probably the best known and perhaps the most successful investor is Warren Buffett. a student of Benjamin Graham.

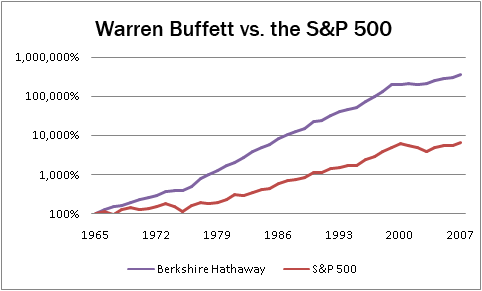

Due to the consistent application of value investing since 1965, success can be seen within his company Berkshire Hathaway as follows:

In the recent years, Phil Town has divulged a value investing strategy reduced to its bottom goal.

Value Investing deals with looking for undervalued companies that have excellent corporate data and business models and have the highest possible competitive advantages.

In the analysis, the future profitability relative to the current valuation of the company is set (analysis of the intrinsic value). If the current price is traded at a significant discount to the intrinsic value of the company, it will take a disciplined value investor with the intension of buying a company’s share.

This discount is necessary so that the so-called margin of safety can be ensured, i.e. the necessary financial security clearance for an investment. In our analysis this is generally 50%. The safety margin is the central investment concept for value investing. We therefore buy, for example, $ 1 for 50 Cent.

It is a fact that today in the stock market, more than ever, the psychology and computer-aided calculation models with automated buy and sell orders dictate work day life. Thus it is possible by determining the intrinsic value of a company and by keeping the safety margin to mitigate potential losses.

This fundamental analysis with keeping the Margin of Safety consistent, is the basic idea of value investing.

If desired, you can connect this special and profound fundamental analysis with the modern technical analysis and have the two most important areas of equity research cover for your investment decision.

How can this market letter help me?

We collect for you all worldwide relevant data from thousands of companies within indices which are examined by us and calculate the most significant results with specially developed algorithms. Within the indices, we create a classified ranking according to the companies’ data quality. This ranking is called the PURE Index.

We are currently investigating automated companies listed for instance in the Dow Jones, S & P 500, NASDAQ 100, DAX 30, MDAX, SDAX, TEC DAX, EURO STOXX 50, CAC40, FTSE 100 and many more .

Manual analysis of this complexity and extent is nearly impossible. A manual analysis for only one company, providing help is given by a computerized spreadsheet, would take about 30 minutes to complete. For the S & P 500, with 500 companies alone would take about 250 hours, i.e. completion within more than 10 days, if you worked 7 days a week, 24 hours a day.

By purchasing PURE Index, we offer you the opportunity from our analyses of thousands of businesses worldwide to benefit in the best possible way.

Investigation of the high number of companies month after month is almost an impossible task. We provide these analyses in an adequate amount of time, with our unique automated analysis which is available here online.

At a high level analysis you will get comprehensive fundamental analyses of companies on the international financial markets. The important, is separated from the irrelevant information to maximize your success for your investment decisions.

What are we analyzing exactly?

We examine first the 5 most important company data of any company. Publications of these data are obligatory several times a year.

We will deal in depth with the return on invested capital (ROIC ), the earnings per share (EPS ), Sales. the cash flow and the book value per share (BVPS ), last representing approximately the simplified liquidation value of the company.

We calculate for each of the 5 mentioned company data their growth rates over the past 10, 5, 3 and the final last year and we will basically only accept a minimum growth rate of 10% for each specified time period.

With the aid of the past P/E ratio (price earnings ratio), the future P/E ratio, the growth of the past and future earnings per share we calculate the future stock price of the companies share for the next 5 and 10 years, which can be expected because of the public released company data.

This is compared with the current stock price traded on the markets; taking into account the margin of safety (MOS), which is usually 50%. Therefore, we call it the ‘Margin of Safety Price’ (MOS Price).

Then, if the current traded price on the markets is cheaper than the MOS Price (Margin of Safety Price), a buy recommendation arises in each case on the next 5 and / or 10 years.

Finally, we consider, of course, the debt of each company, which must be melted off in the near future by the current cash flow.

How do I read the market letter?

The interpretation of the table functions are as follows:

Under A you will find the index which you have selected by purchase, e.g. the S&P 500. B describes which area of the respective index was evaluated for you. All = all companies of the index have been evaluated. TOP 10 = only the top 10 companies within the ranking of the index are indicated. Last 10 and last 20 respectively. Under C you will find the name of the company, e.g. Apple or German Bank and under D the accompanying stock market symbol, e.g. AAPL or DBK. Columns E and F are the calculated MOS prices (Margin of Safety Price) based on the moderate 5 year development of the company ( 5 yr mod ), or the moderate 10 year development of the company ( 10 yr mod ).

Columns numbered 1 to 5 are the analysed growth rates of the most important five enterprise data within the the last 10, 5, 3 years and the last year. The growth rates for the ROIC, EPS and Sales/turnover as well the Cash Flow (Free Cash Flow) and the BVPS (Book value per share) must go at best more than 10% for each respective time period. Only then it is worth considering purchasing shares of the company. The growth rates of all green fields are higher than 10%, i.e. the more green fields in a row belonging to the analysed companies, the better.

The theory is that an investment should only be considered if all the growth-rate-fields mentioned for all the years and all 5 company figures are green.

In particular it is read as the following: G has a green box that shows the growth rate of the ROIC, in this example within the last 5 years, higher than 10%. H with an orange box indicates the growth rate of ROIC between 5% and 10%. I with a red box indicates the growth rate, example chosen is EPS, is below 5%. J with the name N/A indicates that currently at the moment none of the underlying calculations are available.

K with a white box means that for these years no form of the companies base values are published. L with a red box indicates that the debt (Long Term Debt) of the company could not be diminished within 4 years by the current Free Cash Flow. M with an orange box indicates that the debt (Long Term Debt) could be diminished within the next 3 4 years by the current Free Cash Flow. N with a green box indicates to the fact that the debt (Long Term Debt) could be diminished within the next 3 years by the current Free Cash Flow. Q is the current price of the stock in the market, highlighted in red which means that this price is higher than any of the calculated MOS prices (Margin of Safety Price) for the moderate development.

This stock would be traded at present in the market as too expensive!

O is the current price of the stock in the market, highlighted in light green which indicates that this price lies below the MOS (Margin of Safety Price) of the 10-year moderate development ( 10 yr mod – the right one of the both MOS columns).

The stock would be a long-term purchase consideration!

P is the current price of the share in the market, highlighted in dark green which indicates that this price lies at or below the MOS (Margin of Safety Price) of the 5-year moderate development ( 5 yr mod – the left one of the both MOS columns).

This stock would be a definitive purchase consideration in conjunction with the principles of the Value Investing!

What information does the Risk Analysis provide that we have available?

Subscribers of the Platinum package will receive the risk analysis within the Index-market letters, e.g. PURE Index Dow, or DAX, etc. So they will also receive information about the current beta factor of the stock and the current P/R (price earnings ratio).

Thereafter, the PURE Bond-Share P/E Ratio is calculated which is determined from the current P/E and the return P/E. This provides you with information about the profit earnings ratio compared to the government bond.

The beta factor

In finance the beta factor of a stock is a derived number from the beta which indicates the volatility of a financial instrument to its overall market (index). It is therefore also a risk indicator of assets.

It was developed by William Sharpe, who subsequently won the Nobel Prize.

Stocks with a beta greater than plus 1 are also referred to in Anglo-American specialist jargon as „aggressive stocks.“ On the other hand, stocks with a beta of less than plus 1 are considered to be „defensive issues.“

Comparison: P/E (price earnings ratio) and bond yields

US investors like to use the bond P/E to determine whether the market is stock-friendly. The thought behind this is that competition exists between a supposedly safe bond investment on the one hand, and a dividend earning stock with potential for price appreciation, on the other hand.

If the interest rate level of the bond is attractive then it will be more difficult for the stock to attract the attention of investors. However, if interest rates fall back to unattractive levels then stocks are quite often the better investment.

Consequently, the stock P/Es of the individual stocks and the bond P/E of 10 year bonds in a similar market environment are compared to each other and correlated.

The PURE Bond-Share P/E Ratio or the quotient of the two P/Es is important when considering this ratio.

Benjamin Graham. forefather of value-investing theorized that a stock was worth buying if its earnings yield was at least twice as high or higher than the bond yield.

How does the Chart Analysis offered by us help me?

The PURE Rating Chart Analysis is a perfect complement to the PURE Index .

The products cover two large areas of financial analysis. fundamental analysis on the one hand, as depicted here by the PURE Index, which reflects the principles of value investing, and chart analysis as demonstrated here by the PURE Rating Chart Analysis .

Whereas the PURE Index deals with classic key economic indicators of companies and follows the principles of value investing to determine the core value of a business, chart analysis concentrates on the price movements of securities and attempts to draw conclusions regarding future performance based on historical patterns and price trends.

Numerous techniques, trends, averages, trend followers, etc. exist for predicting future stock prices. The objective, however, is to identify likely purchasing and selling signals of individual values, to monitor daily investor behavior and to point out significant changes in trends.

Different indicators and oscillators may be used in addition to various chart types, e.g. bars, lines, candlestick charts, etc. for determining forecasts.

A dictionary of additional terminology can be found here .

Another important argument for the inclusion of charting methods in financial analysis is their widespread distribution and general popularity in the financial world. A large volume of capital is being moved every day based on the belief in chart analysis which also leads to the self-fulfilling prophecy phenomenon taught to us through the field of psychology.

Our chart analyses are offered in Gold or Platinum Packages and can be selected by subscribing to the PURE Index Ratio 5y and / or the PURE Index Ratio 10y.

In the PURE Index Ratio companies are displayed which have the best ratio between the current share price trading on the market and the margin of safety price thereby giving you the best potential for return since the absolute value between the share price and the MOS price (margin of safety price) is the highest for the companies being analyzed. Consequently, these company gems are traded on the market as most favorable in terms of their core value (intrinsic value ).

Therefore it only makes sense to offer you a chart analysis for exactly this type of company.

Chart analyses are only prepared for those companies whose current share price is either lower than the MOS price 10y or lower than the MOS price 5y.

The chart analyses for PURE Rating are prepared by a professional technical analyst, Stefan Salomon.