Value Averaging

Post on: 16 Март, 2015 No Comment

Sorry. I guess I’m being a tad judgmental. Let me simply say, I’m not smart enough to time the markets. Neither are about a million other super intelligent people (unfortunately, most didn’t know it until it was too late).

Since your emotions are the greatest enemy of successful investing, you need a system and a structure in place to help you navigate the emotional waves of investing.

Many people use a simple and effective strategy called dollar cost averaging. This is a great way to start investing . However, today I want to introduce you to another simple, yet effective, investing strategy called – value averaging. Remember, a winning combination is choosing the best investments and the best investing strategy.

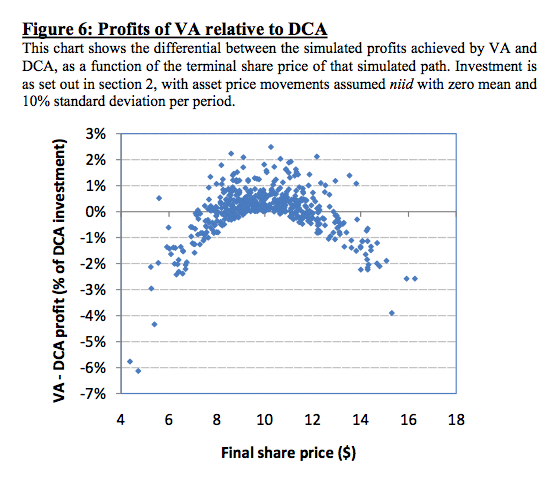

As for the strategy, value averaging has been shown to consistently provide better returns than dollar cost averaging.

What is Value Averaging?

Value Averaging is an investing strategy where the amount you invest is determined by the current condition of the market . This might sound like market timing, but instead it is a disciplined investment strategy that helps you purchase more shares when shares are lower.

When the market is strong, you will not put as much money into the market. When the market is weak, you put more money into the market.

Value Averaging is based on the investment research done by Michael Edleson.

How To Start A Value Averaging Investment Strategy

When you start value averaging, you will need to answer two important questions:

- What is your total savings goal? In other words, how much money do you want to have saved and by what date?

- What rate of return can you reasonably expect? This illusive number should probably be between 8-10%.

Implement a Value Averaging Investment Strategy by Creating an Investing Path or Road Map

Now that you have your investing timeframe and dollar amount, you simply do reverse calculations to determine how much money you should save each year. These yearly amounts make up your investing path. This will be your personal investing plan .

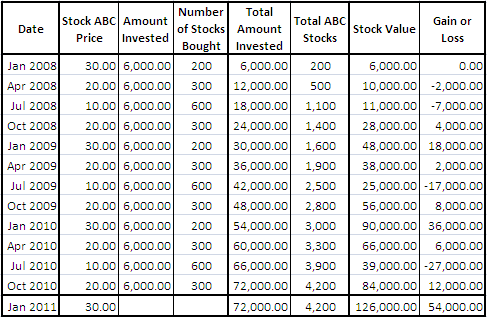

An Example: Joe and Jill Investor

Joe and Jill investor want $30,000 in ten years. Joe and Jill expect an average return of 8%. Assuming an 8% rate of return they would need to invest $2,000 each year for the next 10 years.

Their investing road map would look like the following: