Using Elliot Wave Theory to Trade Commodities Futures

Post on: 10 Май, 2015 No Comment

Early in my career, I was fortunate enough to meet and befriend Vernon Nord. He made his first fortune in the wheat market in 1973 and his second, in gold, later in the decade. A student of the Elliot Wave Theory, he had come across some of R. N. Elliot’s original work while living in Australia. Vernon taught me the basic patterns of the theory, which I have successfully applied to market analysis throughout my career.

As a Wall Street trader during the 1920s, Elliot discovered that stock prices fell into patterns so complete and comprehensive that he could know at any given time where prices stood in the development of a bull or bear market.

The basic theory states that prices move in a five-wave sequence, in line with the direction of the main trend. When moving against the main trend, they follow a three-wave sequence. In addition, each wave is broken up into sub-waves of its own (either three or five waves).

These waves can be broken down again and again until each individual trade is being counted. Elliot theorized that some waves in prices are centuries long. His system of labeling waves is extremely complicated and can’t be covered here.

Elliot used his theory for trading stocks and didn’t originally intend that it be used for commodities. However, Charles Collins and Hamilton Bolten, contemporaries and friends of Elliot, were both commodities traders. They insisted that the theory worked just as well with commodities trading as it did with stocks.

What is a “wave”?

Elliot himself gave no answer to that question. Therefore, the technician is forced to use highly subjective judgment to label a wave on a chart and to identify the time scale where it fits. Occasionally, the last wave of a bull market breaks up into more than five sub-waves, which makes interpretation of waves very significant and challenging.

Some theorists believe that Elliot’s principles were based upon the golden mean, used in architecture. The golden mean is a theory developed by the Italian mathematician Fibonacci. The Fibonacci summation adds a number with the number preceding it, and looks like this:

1+1 = 2, 1+2 = 3, 2+3 = 5, 3+5 = 8…

(1) – 1 – 2 – 3 – 5 – 8 – 13 – 21 – 34 – 55 – 89 – 144 233, etc.

The use of this theory makes it possible for scientists to predict how populations of animals, among other things found in nature, multiply. When studying the wave count that Elliot developed, you will notice how fractions of Fibonacci numbers correlate to the wave count.

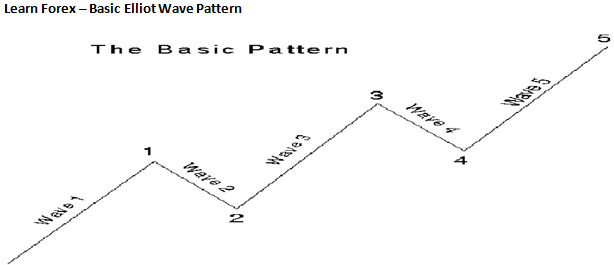

The Basic Pattern

While errors in interpreting the wave theory are inevitable, the strength of the principles could help to keep you out of trouble when trading. By better understanding the wave principle, you have a clearer understanding of the trend.

Elliot points out that the markets unfold according to a basic rhythm, a pattern of five waves up and three waves down, which form a complete cycle of eight waves. The three waves down, which are lettered, are referred to as a correction of the preceding five waves up, which are numbered. These waves are also referred to as “legs”.

Examine Figure 1 for the following pattern: notice that waves one, three, and five are trending up. These are called the impulsive waves. Now, look at how waves two and four seem to make a slight correction after one and three. These are the corrective waves. Wave two corrects wave one; wave four corrects three. The entire one-through-five sequence is corrected by A, B, and C coming down the other side. The lettered phase of the cycle completes the eight waves, thereby forming a complete cycle.

Figure 1 Elliot’s Basic Wave Pattern Cycle

Look at the very top of the peak in Figure 2. When the fifth wave turns around to become the A wave down, we can see that the count of the sub-waves changes. The main wave (A) now has five sub-waves instead of three. This is because the trend has changed. The five sub-waves down void the main trend, which confirms the main-wave count.

The first sequence described may be a sub-wave of something bigger. Following this eight-count cycle will be a similar cycle of five upward waves and three downward waves. A third and final advance then develops, consisting again of five waves up. (Figure 2)

Figure 2 Thirty-four sub-waves complete this eight-wave cycle.

Notice how the A wave has sub-waves one through five, and not ABC? This confirms a trend change. After the fifth wave has completed, we look for a trend change.

For the beginner, this is confusing, but once you get past all of the labeling and just see it, it makes more sense. This cycle can be broken down into four waves of a lower degree. These four can be further broken down into thirty-four individual waves. The Elliot Wave Theory states that waves of any degree in any sequence can always be subdivided into waves of a lesser degree. Conversely, the cycles can be expanded into waves of a higher degree.

Figure 3 Five Down, Signaling a Change in the Previous Trend

Extensions

For the most part, five-wave formations have clear-cut and well-defined characteristics, except in the case of fifth-wave extensions. When a market becomes exceedingly bullish or bearish, the fifth wave will develop a series of sub-waves that can count all the way to nine. That is why it is necessary to wait for the proper signal to sell or buy, and not attempt to pick tops or bottoms.

Figure 4 Extensions

Extensions occur only in new-price territory of the main trend. If the market has moved up or down too fast, the fifth wave may have some irregularities. Diagonal triangles occur in the fifth wave and the chart may have the appearance of flattening or rounding out. This is an indication that a trend change is about to occur. The five-count sequence may still be going on, but the price moves become smaller until they break out of the triangle and away from the main trend. Watching the volume and open interest during the narrowing of the triangle should indicate what is happening.

Failures

Elliot used the word failure to describe a five-wave pattern of movement in which the fifth wave fails to move higher than the top of the third wave. If the fifth wave contains the same sub-waves as wave one and does not move higher, it is called a failure. This action gives some indication of the underlying strength or weakness in the market. Failures occur when the fundamentals about the market have changed and the price structure is either too bullish or bearish for the facts presented. (Figure 5)

Figure 5 Failure: Fifth wave fails to break above wave 3

Corrective Waves

Corrective waves can be defined as a series of wave counts contrary to the main trend. Market swings of any degree tend to move more easily with the main trend than against it. Therefore, it can be more difficult to identify the corrective waves than the impulse waves.

When we see that the top of B is lower than the top of five and the bottom of C is lower than the bottom of A, we can label it as a corrective wave. In the actual marketplace, the Bears gain control, while the Bulls take profit during the A wave. During the B wave, the Bulls again gain control and the Bears relinquish. Finally, the nasty C wave develops. This is where the Bulls finally give way to the Bears and the market overreacts.

The C wave, in general, will be longer in time and price than the A wave and will have a well-defined five-wave sub-count. Using the Fibonacci fraction, it is generally expected that wave C will be 1.38 to 1.50 the length of wave A in price structure. Ideally, that is what would happen; however, it may not always be the case.

When a market is extremely bullish or bearish, the B wave may be equal to, or exceed the price level of the impulse wave five. It is very important to have the correct wave count on the main trend and not be misled into believing that this is the beginning of a new sequence.

Occasionally, the market will do what appears to be a five-count corrective wave. The market does an irregular zigzag with a combination of A, B, and C, and does not have the appearance of a corrective wave. Importantly, wave C will have a dramatic move contrary to the main trend. This type of formation is found more often in markets with big ranges such as soybeans, bonds, coffee, and silver.

Sashay: Building Momentum

Some analysts believe that the third wave has extensions. As a reminder, the third wave is the longest and strongest, due to the extremely bullish or bearish fundamentals. I believe that the extension is merely a congestive area that occurs in the middle of the third leg, which I call the sashay.

(Figures 3, 4, and 5)

From this irregular formation, the market will break away in the direction of the main trend. When studying a daily chart, this activity will become more apparent. The sashay usually occurs at about the middle of the move, and marks a good reference point for measuring the length of wave three. By labeling the sashay, I have been able to find the internal five-count sub-waves.

While the third leg is lengthy in price and time, waves one and five of the sequence are usually equal in time and price. However, if waves one and three are equal in time and price, then the length of wave five will likely be stunted. Wave five may even show a certain degree of failure and it is important to be aware of this when trading in a weak bull market.

Remember, bull markets in commodities struggle during wave five, because of the dominance of commercial short selling. In a bear market, the fifth wave may have extensions, due to hedging of producers and commercials.

The previous illustrations show the congestive activity taking place during the formation of the sashay. The market is taking a much-needed break and building momentum during this phase. As it begins to break away, it will be much stronger and very powerful. This power builds from the repositioning of traders, because stop-loss orders are triggered, and strength in fundamental concerns is increasing.

Think of it as hiking up a mountain. As you get about halfway up, you begin to tire and stop to take a break. When you’re ready to finish the hike, you feel rested and reinvigorated, ready to take on the rest of the climb. Because the markets are driven by people’s emotions, it seems logical that taking a break is healthy for the system. I love to be involved with a market during this transformation and have learned great respect for its power.

Applying the Elliot Wave Theory

Now that the basic principles of Elliot Wave Theory have been reviewed, it’s time to apply them to the market. This method will help to signal when a bull or bear market is near completion and when a new trend is about to begin. Don’t get discouraged if you don’t see the formations immediately.

Normally, it’s not wise to pick the bottom or top of a market. However, once we recognize that a trend may be changing, it’s time to look for the first wave. After the first wave has been completed, we apply Elliot’s principles. During wave two (the first corrective wave), we will begin placing orders. The corrective wave will be a Fibonacci fraction of wave one (3/8, 1/2 or 5/8). This is where the window of opportunity occurs in trading commodities.

When the market corrects to one of the three fractions, we will place the first limit orders, provided the corrective wave has a three-section count (A, B, and C). Then we place stop-loss orders below or above the low or high of the last major trend.

As the progression of wave three moves above leg one, it is time to purchase the second position. We move the stop-loss order on both positions to the bottom or top of wave two. Remember, this is wave three, which is the “monster” and the one we try always to trade to achieve the best results. The market is now in its most bullish or bearish mode and has dynamic expectations. The open interest is increasing. New players are entering the market and those on the wrong side are exiting.

Figure 16

Seeing an “inside day” signals us to keep an eye out for a reversal, and since the sashay appears to be approximately in the middle of the move, this is a good place to exit.

When the market congests and has some sort of triangular activity before breaking out of the sashay, the opportunity opens for us to enter into our third position. We move our stop-loss orders on all three positions to the lowest low that occurred during the congestive activity of the sashay. During this period, new counter-trend traders have tried to pick the top or bottom and again. As the market breaks away, they are exiting their positions. The fundamental news has now gotten extremely bullish or bearish.

The second half of wave three is where the commercials begin to take profits on their positions. They are early trend-setters and trend-wreckers. Approaching the top of wave three, the news is still extremely favorable to the trend. It is important to recognize a sub-wave four. When this happens, we move the stop-loss orders to the bottom of this sub-wave, while the market is moving into the final phase of wave three.

We must follow the market closely at the top of wave three and anticipate a reversal day. (Reversal day is when the market opens higher, trades higher most of the session, and is followed by a sharply lower close.)

We will be closely following the market using a 45-minute chart and looking for a market “reversal.” Such a chart should show a well defined five sub-waves in this last section. This is the day the trader exits all positions on the close. In the case of a bull market, the price structure is nearing retail (in a bear market: wholesale). The action becomes menacing; the Bulls or the Bears are taking profits and each is preparing for trend change.

Wave four begins now, and in the case of a bull market, the Bears are digging in their claws and prices are more volatile. When wave four moves against the main trend, its price structure should not enter into the configuration of wave one. If it does, the trend is over and there will be no wave five, only a corrective move in the direction of the new trend. When trading, we exit at the end of wave three, because it is unclear whether this is a bull market or a correction of the previous bear market.

In the case of a bull market, wave five is where the commercials are getting extremely short. If we have a bear market, they have liquidated their short positions. During this time, the open interest will be changing and reflecting what the commercials and large traders are doing. The news is always the best at the top and the worst at the bottom. During the culmination of wave five, clues from open interest will indicate the trend is nearing completion.

An oscillator can be used as a great indicator for the completion of wave five. During wave five, the oscillator may not reach levels of over-bought before rolling over and heading back down. If the oscillator flattens out and begins tipping over during the market advance, it creates a situation called divergence. Divergence is a good indication that the trend is about to end and we should be ready to exit the market. At this point, the market is losing momentum because the commercials are moving in or out of the market.

I have just described an intermediate type of move that has taken several months to complete. Choose any commodity and analyze its 45-minute chart for any given week and you will see the same type of activity. You will see it again in a weekly or even a yearly chart. The difference between the sequence of a 45-minute chart and that of a weekly chart is the amount of risk capital required when placing stop-loss orders.

When markets go through a long period of bottom basing and break out to the upside, there is a very well-defined five-wave rally that develops. I like trading these, because they generally are coming from wholesale-price levels. The risk/reward is greater, as long as you follow the rules for trading the first five-count described earlier and you don’t try picking bottoms.

Before trying to do any price forecasting of your own, it is important that you study some old charts of previous market activities in order to apply the basic concepts of the Elliot Wave Theory. Each commodity has a different personality and will react differently to fundamentals, seasons and cycles. Remember that as markets move from wholesale to retail, there will be five waves in both the bull-market trends and the bear-market trends. These waves will have corrective waves contrary to the main trend.

Ralph Elliot published his works many years ago. His trading principles applied to the markets then and they still apply today. As the trader becomes more accustomed to working with Elliot’s principles, he will notice that some markets are more manageable than others.

I have merely touched on the basics of Elliot’s theories, but if you are interested in the inner working of the markets read more of his works for yourself. Comparing the commodities markets of yesteryear to todays will give you insight into the future.