United States s Current Account Deficit

Post on: 21 Апрель, 2015 No Comment

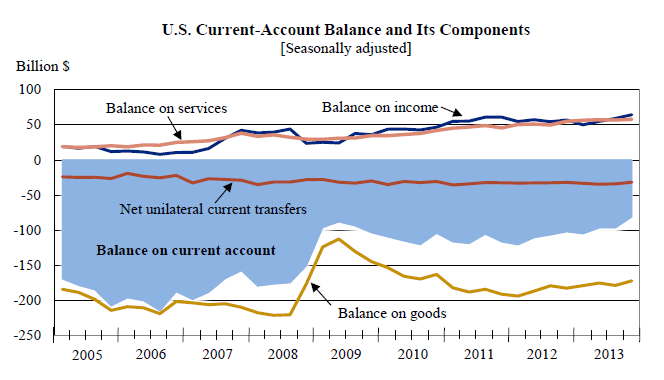

As on 2005 The Current account deficit of US is 6 percent of gross domestic product, this is the US’s largest current account deficit in its history. The deficit is large because growth in exports which averaged 7.5 percent per annum is much less than growth in imports which is 11 percent a year since 90s.

The United States is importing 16 percent of its gross domestic product, and it is exporting a bit less than 11 per-cent of its gross domestic product. So exports are about two-thirds of imports, or imports are about 50 percent larger than exports.

Each $1 increase in U.S. exports is associated with an additional $1.50 in U.S. imports. Hence the current account deficit reflects the excess of the country’s imports over the exports; the determinants of the current account balance are exchange rates, prices, and incomes at home and abroad. Accordingly, the widening of the U.S. current account deficit is frequently attributed to the strengthening of the dollar since the mid-1990s, which led U.S. imports to be cheaper measured in dollars and U.S. exports to be more expensive in foreign currency.

Several reasons which can be cited for increase in the deficit:

1) Imports of goods, services and income are 40% bigger than exports. And this ratio is on the rise again.

2) Higher US interest rates increase debt payments to foreign debt holders.

3) Slowdown in global growth, especially in Asia.

4) Soaring cost of imported oil: it is worth noting that our oil import bill has risen by about $110 billion, from $68 billion in 1999 to $180 billion in 2004, and most of this increase reflects higher oil prices.

5.) Negative Real Interest Rates in Reserve Currency (US dollar):

The Fed has been lowering rates since the tech bubble burst in 2000. Interest rates have gone from a high of 6.5% to a low of 1% over the course of 3 years. This coincided with an 18% fall in the US dollar index over the same period. Between 2003 and 2004, the dollar continued to decline another 18% against the euro as countries such as the UK, Australia, and New Zealand all began raising rates while the Fed dragged its heels.

One of the factors driving the U.S. economic expansion has been productivity growth, itself driven by rising investment rates, sound investment decisions, and globalization.

Consequently, rapid productivity growth has made the United States extremely attractive to both domestic and international investors, reflected in a growing appetite for U.S. assets. In 1998, 45 percent of international debt securities outstanding, and 57 percent of new security issues, were in dollars. U.S. government bonds accounted for about 30 percent of the entire global bond marketcommercial and sovereign. If about 50 percent of the projected increase in the value of the global portfolio is invested in U.S. assets, the United States will, roughly, maintain its share of world asset markets.

The size and composition of foreign capital inflows enable the U.S. deficit to widen further. The United States’ net external financial obligations, in terms of both the total stock outstanding (about $1.5 trillion) and net service payments ($25 billion) are small in relation to its $9 trillion economy. The United States borrows almost exclusively in domestic currency; more than 90 percent of its external debt to banks is in dollars. In addition, most of the private capital flowing into the United States consists of foreign direct investment and portfolio investment.

United States can afford to carry a larger external deficit than a country whose obligations consist primarily of contractually fixed, short-term bank loans denominated in foreign currencies. Thus the major advantages are:

Advantages

* U.S. firms find it easier to sell goods in foreign markets.

* U.S. firms find less competitive pressure to keep prices low.

* More foreign tourists can afford to visit the U.S.

* U.S. capital markets become more attractive to foreign investors.

Some disadvantages of the current account deficit leads to weakening of dollar. It has got following implications:

* Consumers face higher prices on foreign products/services.

* Higher prices on foreign products contribute to higher cost-of-living.

* U.S. consumers find traveling abroad more costly.

* Harder for U.S. firms and investors to expand into foreign markets.

Relationship with Balance of payments

BALANCE OF PAYMENT MAY BE DEFINED AS SYSTEMATIC RECORD OF ALL ECONOMIC TRANSACTIONS BETWEEN A RESIDENT OF THE COUNTRY AND THE REST OF THE WORLD DURING THE GIVEN PERIOD.

Thus the Balance of Payments BOP’ is an account of all transactions between one country and all other countries—transactions that are measured in terms of receipts and payments. From the U.S. perspective, a receipt represents any dollars flowing into the country or any transaction that require the exchange of foreign currency into dollars. A payment represents dollars flowing out of the country or any transaction that requires the conversion of dollars into some other currency. The three main components of the Balance of Payments are:

1. The Current Account including Merchandise (Exports Imports), Investment income (rents, profits, interest)

2. The Capital Account measuring Foreign investment in the U.S. and U.S. investment abroad, and

3. The Balancing Account allowing for changes in official reserve assets (SDR’s, Gold, other payments)

In long term the balance of payment should be in equilibrium. Excess of surplus or deficit can create problems for the economy. Ideally, currency values and balance of payments should be relatively stable and at a level that can sustain long-term economic growth both here and abroad. Sustainability requires structural changes. Fiscal discipline has been key to the U.S. economic expansion, but fiscal irresponsibility was replaced by excessive household spending. A global expansion would benefit the U.S. economy; obviously, it would also be good for other countries. There, as in the United States, the key to raising long-term sustainable growth is faster productivity growth, which will come with increased market flexibility and globalization. This recipe would raise U.S. and global growth rates and put the U.S. trade and current account deficits on a sustainable trajectory.

REFERENCE:

MACRO ECONOMICS: BY MISHRA & PURI

WWW.REDIFF.COM

Analyses of the widening of the deficit include, among others, Catherine L. Mann (2002), Perspectives on the U.S. Current Account Deficit and Sustainability, Journal of Economic Perspectives, vol. 16 (Summer), pp.131-52;

Nouriel Roubini and Brad Setser (2004), The U.S. as a Net Debtor: The Sustainability of the US External Imbalances, (679 KB PDF)