Understanding the Gold Futures Market

Post on: 22 Май, 2015 No Comment

February 27, 2012 By Gold-Rate

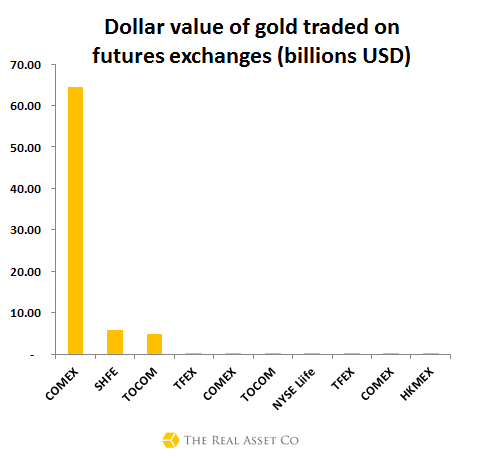

Futures give an investor the opportunity to earn a lot of money in a short period of time. The downside however, is that an investor can also lose a lot of money very quickly. Gold futures are traded in the United States in New York and Chicago and in other countries such as Dubai, London and Hong Kong.

Futures are a speculation, rather than an investment per se. The term, taking a long position, refers to a belief that the price of gold will rise by the end of the contract, whereas taking a short position refers to the belief that the price of gold will fall by the end of the agreed upon time frame.

How Gold Futures Work

An investor agrees to buy a set quantity of gold at an agreed upon price at a time in the near future – usually about three months, but up to about one year. The price the investor agrees to pay depends on his or her belief that the price of gold will go up or down on the agreed upon settlement date.

Futures are bought on margin, meaning that the investor just has to pay a small fraction of the contract’s total worth at the time he or she purchases the contract. This down payment is put in an account managed by an independent central clearer. The margin tends to be between two to five percent of the total value of the contract.

The goal is to close out the contract before its expiration date so the investor does not take possession of any real gold. The contract is sold, once it has made the investor a suitable profit, or to prevent further losses.

How Gold Futures Differ from Buying Gold as a Commodity

If an investor pays $10,000 for gold bullion, he or she pays this entire amount and takes ownership of the gold itself. If the price of gold increases by 10 percent, he or she makes $1,000 on their investment. If the price of gold falls by 10 percent, he or she loses $1,000, but retains ownership of the gold and can continue to make a profit or take a loss on the original investment.

By contrast, for the same $10,000, an investor can buy $200,000 of futures at a margin of 5 percent. If the price of gold increases by 10 percent, he or she makes $20,000 on the investment. By contrast, if the price goes down by 10 percent, he or she owes $20,000 and will have to put down more on the margin to retain the contract. This is called topping off the margin. The only way the investor can get out of the contract is to sell it and take a huge loss on his or her initial investment.