Understanding the Economy Consumer Spending Economic Indicators

Post on: 16 Март, 2015 No Comment

You probably, like most people in business, try to keep abreast of the latest financial news; maybe you read the Ahead of the Tape column in The Wall Street Journal out of habit and a sense of obligation. But how do you interpret what you read? That can be tricky.

Pick up the newspaper one day, and youll learn that retail sales posted a nice gain. A month later, however, retail sales growth slackens and the previously released data have been revised downward, creating the sense that the economy is faltering. A few weeks later, a third report is released, and retail sales have magically bounced back. This month-by-month whipsaw in data is, of course, accompanied by randomly improving and deteriorating statistics for inflation, employment, industrial production, durable-goods orders, consumer confidence, overall consumer spending, and myriad other monthly and quarterly indicators. Layer on top of that fluctuations in the Dow Jones Industrial Average and the Nasdaq Composite Index and the ever-present buzz over the Feds approach to interest rates, and you have a very blurry picture.

Faced with this barrage of anecdotal and conflicting information, even the most seasoned businesspeople are bound to feel hopelessly lost in watching the economy. But in truth, there is much you can do to allay that confusion. For many years, I was a retail analyst at Goldman Sachs. and part of my job was to provide clients with the forecasting data they needed to set strategy. Over time, I came to see that there was a pattern to economic activity that one could almost always rely on. (Although the current economic cycle has deviated from the norm, for reasons I will explain.)

My model for forecasting business conditions was based on three rules.

Rule No. 1: Ignore any piece of data that tracks a rate of change on a quarter-over-quarter or month-over-month basis. Theres too much volatility in that approach. The same data have much greater clarity when you look at them on the basis of year-over-year rates of change. Plotted on a simple chart, annualized data show you how the economy is doing within the context of the patterns of growth and contraction that occur over many decades. You will find that most indicators cyclical patterns bear far more similarity than differences to one another from cycle to cycle.

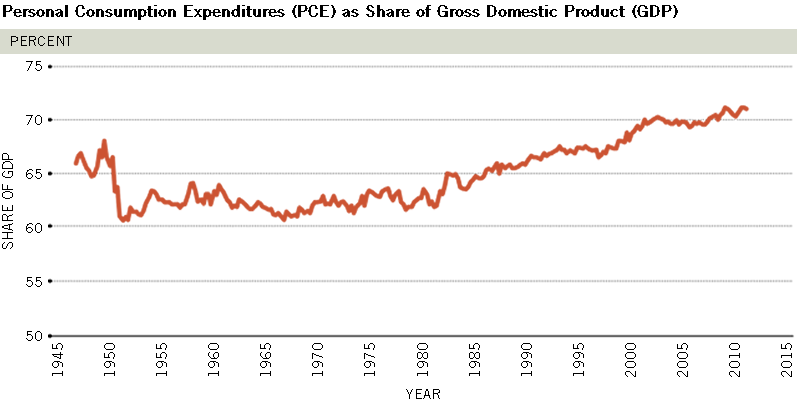

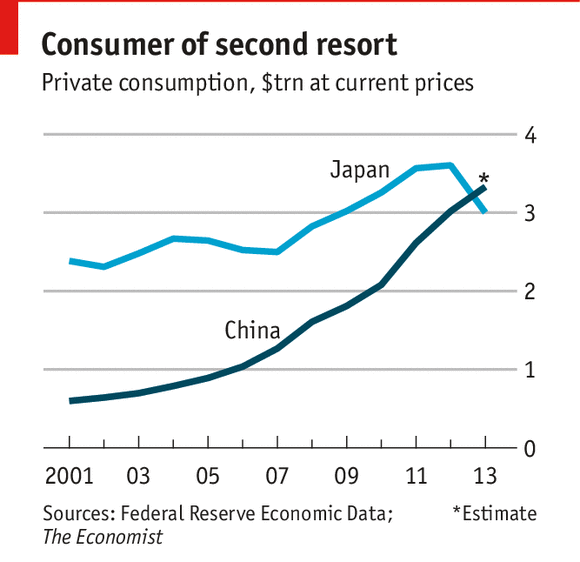

Rule No. 2: Economic causes and effects exist, and the sequence of indicators in the economy typically repeats itself cycle after cycle. In other words, there are real leading indicators, and there are real laggards. Growth in real wages, for example, drives consumer spending, which accounts for more than two-thirds of the U.S. economy. Consumer spending, then, is a meaningful leading indicator. As it improves, youll see demand in the manufacturing and service sectors pick up, too. Consumer spending is also the key driver of corporate profits, which in turn drive the stock market. In fact, nearly every bear market in the past four decades began almost precisely when the year-over-year rate of growth in real consumer spending peaked and began to slow. Meanwhile, capital spending and employment are lagging indicators, making them the most deceptive of all economic data. They typically tell us where the economy has been, not where its headed.

Rule No. 3: Abolish what I call the recession obsession—the undue attention given by economists, journalists, and politicians to recession as the primary measurement of economic harm. A recession is generally defined as two successive quarters of absolute decline in real gross domestic product, or GDP. But by the time real GDP is in actual decline, its rate of growth will have been falling from its peak for as long as 18 to 24 months, and typically we will already be deep into a bear market. By this time, business conditions, corporate profits, and the stock market will have been getting progressively worse for more than a year, and it is far too late for businesses and investors to get out of the way. We must literally redefine the economic downturn as beginning when rates of growth peak and begin to slow, as opposed to when the economy is in actual decline.

So if we use the latest data and keep these three rules in mind, where is the economy headed today? I would have expected the economy to enter a recession by now, given the generally unimpressive gains and volatile trends in real wages—that is, the purchasing power of hourly wages—during the past three or four years. I have found historically that it was possible to predict the direction of consumer-spending growth by monitoring real-wage growth. The slowing growth in consumers real average hourly earnings that occurred from 2003 to 2006 should have led to a sharp slowdown in consumer spending. But it didnt. Why?

Because the slowing of real-wage growth was offset—to a degree never seen before—by artificially low interest rates and the rampant promotion of low-cost mortgages and home equity loans. This led to the highly unusual phenomenon of a negative savings rate. Put another way, since 2005, consumers have been spending more than they have been earning. Consequently, the downturn in consumer spending that should have led us into a recession, and the downturn in most other economic activity, never occurred.

Unfortunately, all those excesses in spending and the debt associated with them are likely to reverse themselves before long. Consumers cant continue to spend more than their disposable incomes, and when the savings rate goes back into positive territory, consumer spending is likely to come under pressure. This suggests that businesses remain very cautious about the outlook at this time.

When faced with a likely slower economy, how should CEOs proceed? There are really three answers to this question. First, dont panic. Even if the economy is within a year of segueing into a slowdown, you should not alter your companys fundamental growth strategy. However, in the late stages of the growth cycle, you should take extra care in hiring and committing to investments that could represent excess capacity in a downturn. Such investments may best be postponed until consumer spending and the economy in general have weakened considerably, since the costs incurred when you expand are likely to be much lower in the buyers market of a downturn.

Second, remember that whether the economy is headed higher or lower, some businesses are affected earlier in the cycle and some later. If you cater directly to consumers, you must be quicker on your feet, because consumer spending leads the economy up or down. Companies in the capital-spending sector of the economy have a bit more time to respond, as it takes time for downturns and upturns in consumer demand to be reflected in their business.

Finally, dont be afraid to do your own economic detective work. As a manager, you should chart year-over-year changes in the individual economic data series that you think most likely affect your business. Then compare them on a single chart with year-over-year sales comparisons for your industry, or even the sales of your own company. The exercise requires only Excel or some similarly simple data-management software, the data, and computer literacy (or an employee who possesses computer literacy). If you do this, you can determine for yourself whether there are leading indicators that are specific to your business. You may very well find new perspective in cyclical patterns and cause-and-effect relationships you didnt realize existed.

Redefining how we monitor economic statistics and mastering a simple working discipline for analysis greatly improve our chances of looking forward and making wiser decisions. Businesspeople and investment managers can hardly afford not to try. Forecasting apathy—letting the anecdotal flow of economic news reports wash over you—is not a course I would recommend.

Joseph H. Ellis, formerly a partner and head of retail research at Goldman Sachs, is the founder of Blue Tulip, a chain of gift shops in the Northeast. He is also the author of Ahead of the Curve: A Commonsense Guide to Forecasting Business and Market Cycles.