Tutor2u interest rates and economic activity

Post on: 16 Март, 2015 No Comment

How do changes in interest rates affect the economy?

The transmission mechanism of monetary policy means the ways in which changes in interest rates affect the spending and savings decisions of millions of households and thousands of businesses throughout the economy. The impact of rate changes can be quite complex and there are inevitable time lags between the Bank of England announcing a change in interest rates and it having an effect on demand, output and (finally) inflation.

It is also important to distinguish between the effects of interest rate changes on the household sector (i.e. affecting consumption and savings decisions) and the corporate sector (i.e. affecting output and investment decisions)

Interest rate changes work through the economy in various ways including the following:

Housing market & house prices (wealth effects)

High interest rates increase the cost of mortgages and reduce the demand for most types of housing. Conversely, a fall in interest rates should stimulate higher market demand and put upward pressure on house prices. This should increase consumption associated with house-buying and the rise in prices will increase total housing wealth and make consumers more confident about their personal finances.

The cut in interest rates from 7.5% in October 1998 to 5% in June 1999 was said to be a major factor in the acceleration in housing market activity during the summer of 1999. Equally the series of increases in interest rates from 5% in June 1999 to 6% by February 2000 helped to take some of the excess demand for housing out of the market and contributed to a slowdown in the rate of house price inflation during the summer of 2000.

Effective disposable incomes of mortgage payers

If interest rates fall, the effective disposable income of home-owners who have variable-rate mortgages with their building society or bank will increase – leading to an rise in their purchasing power. Home-buyers with fixed-rate loans will not be affected much in the short term. Lower mortgage rates should stimulate an increase in new mortgage approvals and generally cause an expansion in housing market activity (see above)

Credit demand

Lower interest rates encourages people to spend using various forms of credit and should boost demand for big ticket consumer durables and high street spending generally.

A redistribution of income for savers & borrowers

When interest rates fall, there is a re-distribution of income away from lenders (who receive less) towards those with variable rate loans. People with positive net savings also stand to lose out from big cuts in interest rates.

Generally changes in interest rates have an effect on consumer confidence. Only when people are reasonably confident about their own financial position will they be willing and able to enter into large scale purchases. Higher interest rates have a negative effect on consumer confidence — lower rates have the reverse effect, although again there are time lags to consider.

Investment & Stockbuilding

Firms take interest rates into account when deciding whether or not they go ahead with new capital investment spending. A fall in interest rates should help to increase business confidence and raise the level of planned fixed investment. See the pages on investment theory and the discussion of the marginal efficiency of capital.

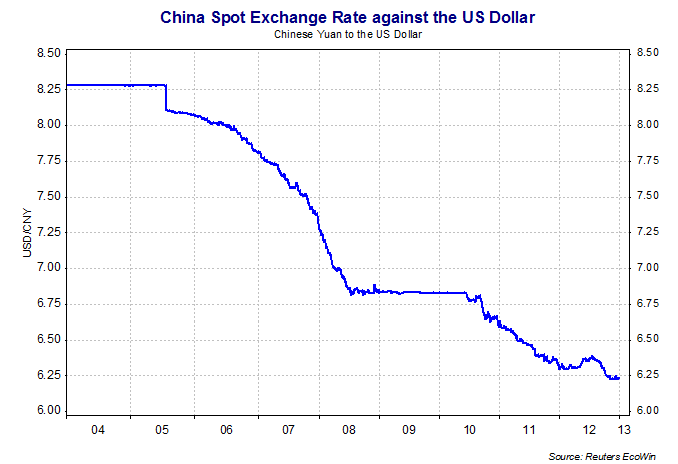

Sterling Exchange Rates

Lower interest rates might cause a depreciation of the exchange rate and boost demand for domestic producers who sell goods and services in internationally traded markets. A rise in the growth of exports is an injection of aggregate demand into the economy and increases the factor incomes of those in work. This should lead to an increase in the equilibrium level of national income and a multiplier effect.

Remember that although a change in interest rates clearly affects the economy in many ways, there are inevitable time lags involved.

It is also worth stressing that some industries are more affected by base rate changes than others (for example exporters) and some regions of the economy are also more exposed (sensitive) to a change in the direction of interest rates. The impact of interest rate movements is not uniform throughout the economy.

The conventional assumption is that it takes around a year for interest rate changes to feed through to the real economy and a further year for the impact to become evident in the price level (the ‘1+1′ rule). Richard Jeffrey Economist, Charterhouse Bank