Trading The GoldSilver Ratio_2

Post on: 24 Июль, 2015 No Comment

Resistance is at 46, then 50. Gold could advance to $1650 with Silver dropping to $33

Silver bulls all sing from the same hymnal. One of the songs they sing insists on a Gold/Silver ratio of 20 to 1. After all, the song goes, the ratio was set by the Spanish at 15-1/2 to 1 in the 1500s, traded at about 28 to 1 when, in March 1964, the U.S. Treasury stopped issuing Silver Certificates, and was set at 18 to 1 when President Nixon officially announced that the U.S. would no longer redeem U.S. Dollars for Silver or Gold.

So, the Silver bulls claim, a Gold price of $1,550 would equate to a Silver price of $77.50. The only problem is that the non-Silver-bull world does not know the song .

The chart below displays the Gold/Silver ratio for the past 110 sorry, Silver bulls, but the ratio does not extend back to the Spanish Gold Age of Global Expansion.

It is all well and good that the King of Spain set the Gold/Silver ratio at 15-1/2 to 1 in the 1500s, but the free market has a different idea. As the chart above shows, a Gold/Silver ratio less than 30 is a rare occurance. The trendline for the ratio presently is about 60 to 1.

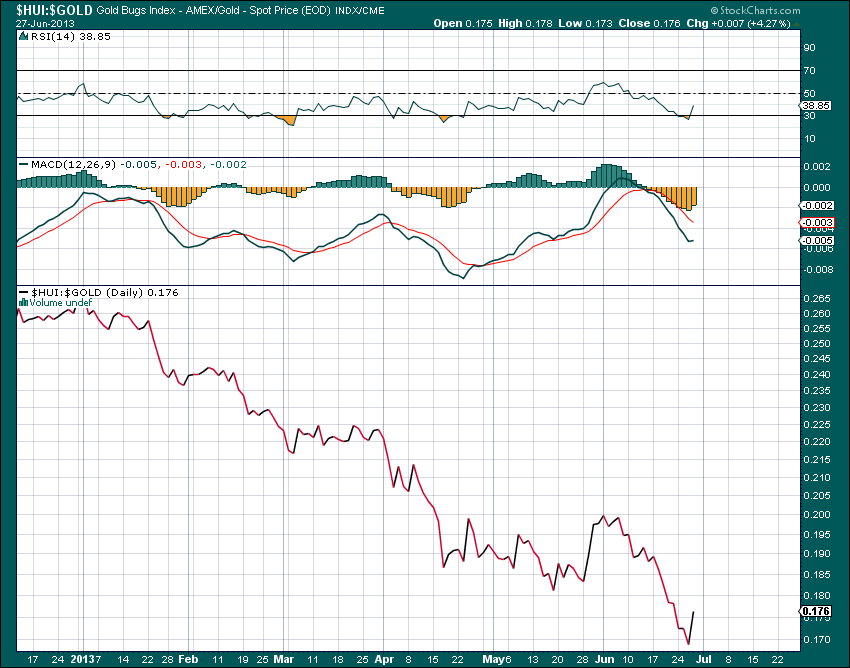

The chart below shows the ratio dating back to the mid 1970s. This chart shows that Silver is in a bull trend against Gold, and after reaching 31.7 to 1 on April 28 the ratio has moved back to its present value of 43.4 to 1. The monthly chart shows resistance in the zone of about 46 to 1 to 50 to 1.

I am presently constructive on Gold. I will be more constructive if Gold closes above 1565. I will abandon a bullish stance on Gold if prices close below 1470.

Assuming that Gold trades to $1,700 and the Gold/Silver ratio returns to 50 to 1 this means that Silver prices could drop slightly to $34 despite strength in Gold.

Of course, Silver bulls will insist that Gold cannot advance without a bull move in Silver. But, does history support this thesis.

- From February 1998 through March 2008, Gold prices advanced from $300 to $975 without a change in the Gold/Silver ratio.

- Gold declined from the March 2008 high at $975 down to $725 by November of 2008. During the decline the Gold/Silver ratio exploded to 1 to 80 to 1.

I would change my mind on the Gold/Silver ratio if Silver closes above $39. Such a close would indicate that the ratio could move back into the low 30 to 1 region.

###

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.