Trading The Average True Range (ATR) Indicator

Post on: 16 Март, 2015 No Comment

The Average True Range (ATR) is an indicator that was developed by J. Welles Wilder, Jr. who introduced it along with a few other indicators (Parabolic SAR, RSI and the Directional Movement Concept) in his book, “New Concepts in Technical Trading Systems” in 1978.

The ATR was originally designed by Wilder to appropriately measure the volatility of Commodities, an instrument that typically has gaps and limit moves that occur when a commodity opens up or down its maximum allowed move for the session.

Today, the ATR may be one of the oldest indicators that exist but it is far from being obsolete. What’s very interesting about this indicator is its universal and adaptive nature. That’s why it remains applicable and popular among good trading systems and is used with a wide variety of instruments.

Many trading systems use the ATR as an essential tool for measuring the volatility of the market. The Average True Range reveals the volatility in a particular instrument but it does not indicate the price direction.

Any trader who is keen on designing an excellent trading system should be familiar with the Average True Range and the many ways it can be used to improve the performance of any trading system.

The ATR has numerous functions and it’s generally applicable in finding trade setups, entry points, stop loss levels and take profit levels with reasonable money management technique.

Volatility is directly proportional to the range, so if range increases, it also increases. If the range decreases, so does the volatility of the instrument.

Range is the distance that the price moves per increment of time. It is the distance from the highest price to the lowest price of the day, in other words, equivalent to the height of 1 bar or candlestick. It is calculated by taking the difference between the high point and the low point.

However, if the current candle is a Doji where the price does not move at all, the real price range is actually the distance from the previous close to the open price of the Dogi (current candle). Also, if the close of the previous candle is not within the current candle, the range begins from the close of the previous candle.

It follows that the True Range (TR) is the maximum range that the price has moved either during the current candle or from the previous close to the highest point reached during the candle. True Range is defined as the greatest distance of the following:

A. Current High to the Current Low

B. Previous Close to the Current High

C. Previous Close to the Current Low

Absolute values will be used for the calculations to get the distance between the two points. This is because the aim is to get the distance and not the direction. The first range will be used for the calculation of the initial True Range. We will talk more about that in another section.

According to Wilder, you must consider the value of the range for a number of periods in order for it to be a useful tool to measure volatility. This is why an average of the true range over a number of periods must be obtained. A sufficient number of periods must be used to provide sufficient sample size to obtain an accurate indication of an instrument’s price movement. He considers 14 bars to be the best indicator of volatility and uses it for his Volatility system. You will know more about this system as we go along.

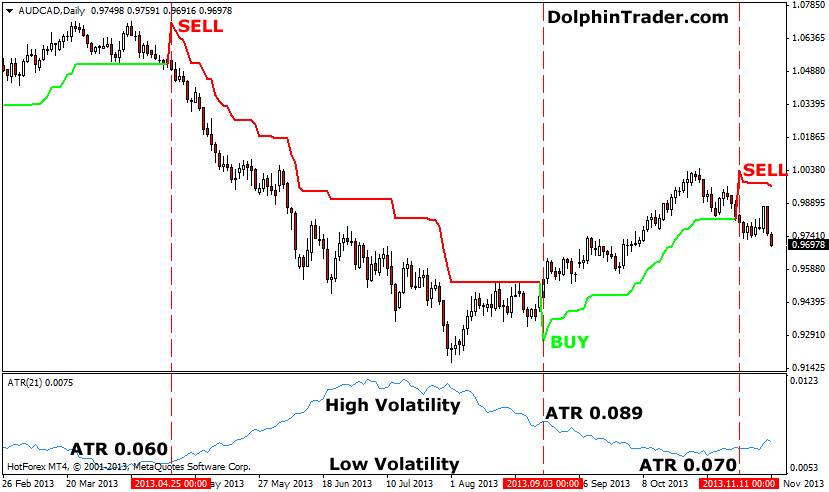

Here is how the ATR looks like when applied on your chart:

ATR Advantages

There are 2 main reasons that made the Average True Rage (ATR) remain popularly used with many trading systems through the decades. The ATR is a remarkable measure of market price movement because it can be used across different financial securities and it also adapts to changing market volatility. Because of this, it plays a vital role in setting your stops or take profit levels.

Useful Across Different Financial Securities

A system that can only be used to trade in one market can be used to trade other markets just by changing the way the calculations are expressed. Using units or multiples of ATR instead of using definitive values such as dollars, points or pips can turn any simple system into a universal trading system.

One of the most common uses of the ATR is setting the stop loss level. Below is a typical scenario of how the ATR can be applied to set your stop for different financial instruments.

Imagine that we are using a simple system to trade with 2 different instruments, a currency pair (A) and a commodity (B).

Given that A’s ATR is $0.0020 and B’s ATR is $300, the huge difference between the volatility levels would require us to set 2 different stop loss levels. For instance, our stops may be $0.0030 for A and $450 for B.

On the other hand, if we use values in units or multiples of ATR to set our stop loss for our system, we will need only 1 value to compute the stop loss level for both markets. We can set our stop 1.5 ATRs from the entry price.

A’s stop loss level would still be $0.0030 (computed from 1.5 x $0.0020) and B’s stop loss level would also be at $450 (computed from 1.5 x $300).

Adaptive To Changing Market Conditions

Substituting units or multiples of ATR to the usual dollar, point, pip or whatever units of measure used in your system can make it remain applicable in the long run without reoptimization despite any changes in price movement or volatility.

We are well aware that market conditions and, consequently, price movement or volatility, can change and will change either abruptly or gradually.

Since the ATR changes in direct proportion to changes in volatility, it can easily bring your stop closer or farther to allow enough space for price movement normally expected for that particular volatility level. Unless the market has changed in direction, you will not be stopped out.

Here’s a typical scenario to prove this point

If the market quiets down and the ATR of A changes to $0.0010 and B changes to $150, the $0.0030 stop for A and $450 stop for B are now too far, causing you to lose an unnecessarily large amount from every single trade. Similarly, if the market becomes extremely volatile and the ATR of A increases to $0.0040 and B increases to $600, the $0.0030 stop for A and $450 for B are now too close, causing you a higher percentage of losing trades. We need to reoptimize our system to suit the current market conditions.

On the other hand, if we substitute units of ATR to the amounts we were originally using as our stop, our system would greatly improve. When volatility changes, our stops would automatically adjust to accommodate the change. So, if the market quiets down and the ATR of A changes to $0.0010 and B changes to $150, our new stop for A would be $0.0015 (computed from 1.5 x $0.0010) and our stop for B would be $225 (computed from 1.5 x $150). Similarly, if the market becomes extremely volatile and ATR changes to 40 pips, our stop would now be at 60 pips (1.5 x 40).

Notice that the stop loss level is adjusted automatically even if we are still using the same stop loss value which is 1.5 ATR. Our improved system is still applicable and there is no need for reoptimization.

That is the essence of using the ATR in any trading system. Because it can adapt to change and can be used with different markets without altering its value, it significantly cuts off a big chunk of hard work when looking into different markets and its accompanying fluctuations in volatility.

Most systems that use the ATR are applicable not only in the past and the present, but also in the future despite any changes in market volatility.

Interpreting the ATR

Now that we know what the Average True Rage (ATR) is and how it is computed, we need to know what the values of the ATR mean. Depending on its readings, the ATR can be used in all aspects of the trading process.

Low ATR Reading

A low reading of ATR simply indicates that the market is quiet and less volatile. The volume of the market is light. This may mean any of the following:

1. The market is ranging when the ATR is relatively low. There isn’t enough volatility to move the market in an uptrend or a downtrend.

2. Price has reached the bottom or top, which is eventually be followed by price reversal.

High ATR Reading

On the other hand, an increased ATR simply indicates that the market is very active and is highly volatile. This would indicate that a much stable trend is imminent because there is sufficient movement in the market for the price to move in an uptrend or a downtrend. The ATR peaks when any of the following situations occur:

1. During a rally or a period of sustained increase in price.

2. During a sustained period of decline in price.

Trading The ATR

Now that we know what the readings of the Average True Range Mean, we’ll find out how it these concepts can be used with logic in the various aspects of our trading – Entry, Stop Loss, Take Profit.

Low ATR Reading

When the ATR reaches its lowest levels, a change in price direction usually follows. Here’s how we can use this information to our advantage. When the market is trending, enter only after the price has retraced and is returning to the general trend. Here, we will buy once a retracement has ended and the price continues going up in the uptrend. Inversely, we will only sell once a retracement in a downtrend has ended and the price continues going down.

For example, a 50 period moving average (MA) is used to identify the general trend. The current close must be 2 ATRs or more than the 50 MA to ensure that the general trend is up. To ensure that we are in a retracement (dip), the current close should be 2 ATRs or more below the close 5 days ago. You will know when the dip has ended when a new candle opens and reaches 1 ATR above the previous low. The price is now returning to the general trend, and this is when you enter the buy trade. The opposite of the above conditions will be the rules for entering a sell trade.

High ATR Reading

The market usually becomes very volatile when a new trend is now forming. This is called a breakout, and we can use the ATR values to confirm it. Since the price normally only reaches up to a number of ATRs only, exceeding that level indicates that an unusual phenomenon occurred, a breakout is happening and thus the beginning of a new trend.

Here’s an example. Supposing that the price normally rises or falls 2 ATRs from the previous close, you will only buy if the price reaches 3 ATRs higher from the previous close. Inversely, you will only sell if the price reaches 3 ATRs lower than the previous close.

ATR Cycle

In the previous images, you will notice that a low ATR reading is always followed by a high reading. The ATR is cyclical in nature, increasing and decreasing alternately.

Knowing when the market is quiet is important because it means that the volatility will increase soon indicating a possible trade setup. If we want to refine our signals, we can begin with a period of low volatility and wait for an increase in volatility before looking to enter the trade.

Note however, that the ATR only indicates the volatility and not the direction. You will either sell or buy depending on the direction of the trend.

Some trading systems only place trades after the price has reached the extreme peak or extreme bottom and has reversed. Here, you will buy only after the market has reached a significant decline in price, and you will sell only after a sustained period of increase in price. As soon as the price reversed, traders wait for it to reach a number of ATRs in the new direction before entering the trade. Depending on the system, the values of the number of ATRs and periods vary.

The Average True Range plays an important role in selecting the stop loss level in a trade. It can also be used to trail your stops. One great example would be Chuck LeBeau’s famous Chandelier Exit. Here, the stop loss level is expressed in ATRs so it also adjusts to the changing market conditions. The stop loss level will be set an N number ATRs from the highest high/close for a buy trade or from the lowest low/close is reached for a sell trade. The Chandelier Exit is so called because it hangs downward from the ceiling of the market. Note, however, that the movement of the Chandelier Exit is only in one direction. It only goes up for a buy trade or down for a sell trade.

The exit rules for systems using the Chandelier Exit may let you stop your loss when the price reaches the highest high of the trade minus 3 ATRs (computed as Highest High 3ATR) or when the price reaches the highest close reached during the trade minus 3 ATRs (computed as Highest Close 3ATR).

The Average true range is not only used as a basis for the stop loss level, it also plays a significant role in setting the take profit level.

Our discussion on the use of dollars to express the value of the stop loss level goes the same way if we express it as number of periods or pips. Let’s apply the same principle in setting the take profit. We know that even backtests indicate that a certain value such as 40 pips is the best take profit level, it will only hold true for the time being and may need reoptimization as the market condition changes.

But again, market conditions are ever changing and degree of volatility will always change. If the markets are unusually quiet, we may not reach our 40-pip take profit level. On the other hand, if the market is extremely volatile, you can only take 40 pips even if you could have taken much more than 40 pips. Because of this, 40 pips is not an ideal measure of our profit target.

To have a more stable system, we need a profit target that can adapt to changes in volatility. This can be achieved when we express our profit target in terms of ATRs.