Topic 11 Financial Leverage And Capital Structure Uni Study Guides

Post on: 16 Март, 2015 No Comment

Contents

Required Reading

Essentials of Corporate Finance (2nd Australian and New Zealand edition), by Stephen A. Ross, Rowan Traylor, Ron Bird, Randolph W. Westerfield and Bradford D. Jordan, McGraw Hill Irwin, 2010. pp. 399-428.

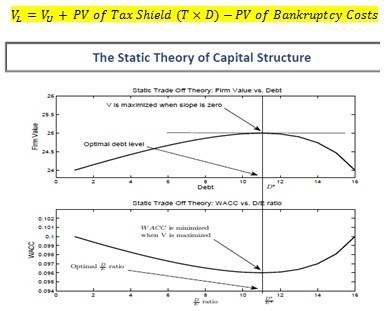

To maximise firm value, we need to minimise the WACC (choosing the optimal capital structure).

Financial Leverage

[1] Financial Leverage is the extent to which a company is committed to fixed charges related to interest payments. Capital Structure is the mix of debt & equity that makes up a company’s total market value.

The Effect of Financial Leverage – Example

We conclude that the effect of financial leverage depends on EBIT ;

- When EBIT is High, financial leverage raises ROE & EPS (Earnings Per Share)

- When EBIT is Low, financial leverage lowers ROE & EPS

Thus, a higher leveraged firm as higher highs & lower lows than a low leverage firms, & the variability of ROE & EPS increases with financial leverage. Overall, financial leverage amplifies the effect of changes in EBIT (more sensitive) on ROE & EPS. Using more debt makes ROE/EPS more risky. However, capital structure may not be a vital decision due to homemade leverage.

Corporate Borrowing And Homemade Leverage

Homemade Leverage is the use of personal borrowing/lending to change the overall amount of financial leverage to which the individual is exposed.

Suppose the firms didn’t leverage is capital structure. An investor can still replicate the returns from the leveraged structure. If an investor wants to invest $100 and prefers the leveraged structure, he would buy 5 shares with his own money & 5 shares with borrowed money at 10%.

If investors can borrow/lend at the same rate as the corporation (perfect capital markets), than homemade leverage can be used to alter capital structure to attain the same CF’s that the firm would with any capital structure. Therefore, investors are indifferent to changes in the firm’s capital structure & its share price should be the same regardless of capital structure.

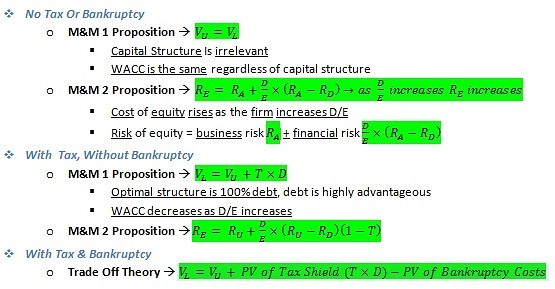

Modigliani & Miller (M&M) Proposition 1

Assumptions

Proposition

The size of the pie (assets/value) does not depend on how it is sliced (debt/equity).

The value of the firm is independent of its capital structure (WACC is constant).

Understanding

Consider 2 firms with the same operating income of $X each year. Firm L is levered & Firm U is unlevered.