TIMELINEJapan intervenes in FX market first time in 6 yrs

Post on: 11 Июль, 2015 No Comment

Related Topics

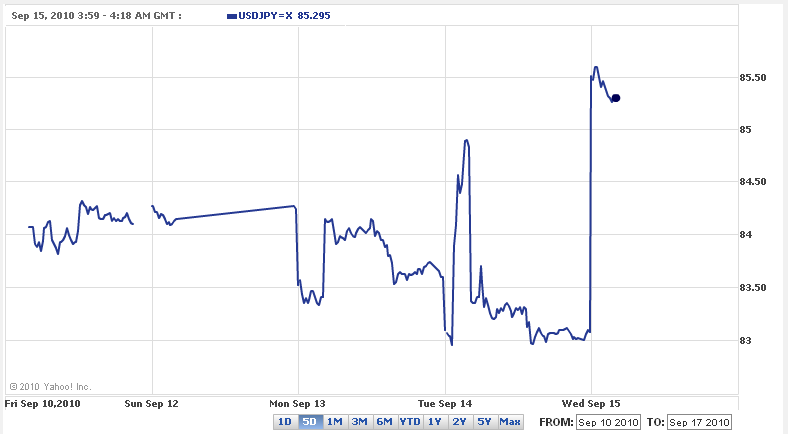

Sept 15 (Reuters) — Japan intervened in the currency market on Wednesday for the first time in six years, selling yen to stem a rise in the currency that is threatening a fragile economic recovery. [ID:nTOE68E02W]

Here are some milestones in the yen’s 138-year history:

1871 — The yen becomes Japan’s currency as part of the Meiji Restoration, which marked the start of Japan’s modernisation and opening to the rest of the world. Japan adopts the gold standard.

1949 — After World War Two the dollar’s fixed rate is set at 360 yen via the Bretton Woods system, partly to help stabilise prices in the Japanese economy.

1959 — The dollar/yen exchange rate is liberalised. The margin of fluctuation is set at 0.5 percent on either side of its dollar parity.

1963 — The margin of fluctuation is widened to 0.75 percent.

1971 — United States abandons gold standard. The end of Bretton Woods system of fixed exchange rates forces a realignment of world currencies.

Dec. 1971 — Smithsonian Agreement sets the dollar/yen exchange rate at 308 yen, and allows it to fluctuate in a wider band between 301.07 yen and 314.93 yen.

1973 — Japanese monetary authorities decide to let the yen float freely against the dollar, and the yen appreciates as far as 263 to the dollar.

1978 — The yen pushes through 200 to the dollar for the first time, strengthening as far as 177.

1980 to 1985 — Yen’s appreciation halts and partially reverses despite Japan’s big trade surpluses. Higher U.S. interest rates see Japanese investors put money in dollar assets.

1985 — The Group of Five industrial nations, the predecessor to the G7, sign the Plaza Accord in which they agree that the dollar is overvalued and that they will move to weaken it. The yen climbs from its pre-accord level around 240 to 211 in October and 200 in November, a 20 percent rise in just a few months.

1986 — The U.S. currency falls further to around 190 yen in January, 167 yen in April and 153 yen in August.

1987 — In February, six of the G7 nations sign the Louvre Accord, which aims to stabilise currencies and halt the dollar’s broad decline. The dollar still falls from near 153 to 137 in April and 120.80 by the end of the year.

1988 — On Jan. 4, the dollar falls to a post-war low of 120.45 yen in Tokyo trade, a level that holds as the low for more than five years. The Bank of Japan intervenes to buy dollars and sell yen that day on behalf of the Ministry of Finance.

Aug. 17, 1993 — The dollar declines to a new post-war low of 100.40 yen in Tokyo.

June 21, 1994 — The dollar falls through the key 100 yen level and touches a record postwar low of 99.85 yen in New York trade before finishing at 100.30 yen.

April 19, 1995 — The dollar hits a record postwar low at 79.75 yen after U.S.-Japanese trade frictions spark heavy selling. By the end of the year it is near 103.40.

1998 — Asian financial crisis sees yen weaken to nearly 148 yen vs dollar in August, even after U.S. authorities join the Bank of Japan to buy yen, spending $833 million, in June.

In October, dollar tumbles from near 136 yen to 111.50 yen, as carry trades unwind following the near-collapse of hedge fund major Long-Term Capital Management.

1999 — The yen strengthens further despite repeated intervention, reaching 102 in November.

2001 — Following the Sept 11 attacks on the United States, Bank of Japan intervenes to sell yen for dollars.

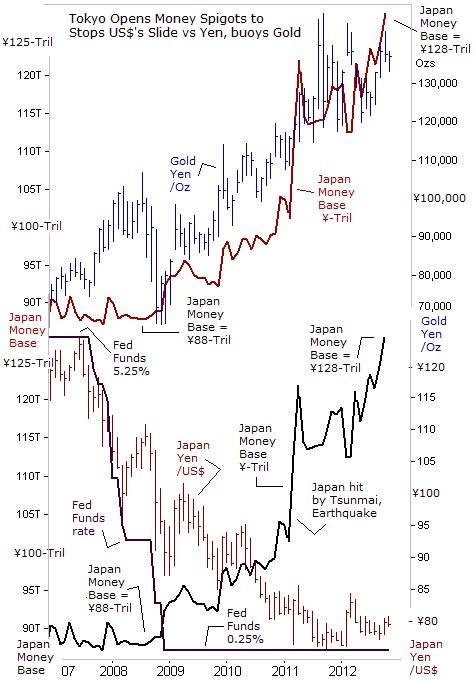

2003 — The Ministry of Finance begins massive intervention to halt the yen’s rise against the dollar, partly to shield Japanese exporters as the economy remains stuck in its post-bubble slump and deflation. The MOF spends 20.4 trillion yen ($200 billion) over the year, nearly all of it to buy dollars and sell yen.

2004 — The MOF spends 14.8 trillion yen ($145 billion) intervening in the first quarter of the year, including 1.67 trillion yen buying dollars on Jan. 9 alone. But the MOF ceases intervention in March and has never since resumed.

2005 — The yen hits a high of 101.67 yen in January but then falls, hitting 121.40 in December. Yen carry trades and Japanese investors shifting funds into foreign assets drive the slide.

June 2007 — The dollar hits a 4-1/2-year high of 124.14 yen.

July 2007 — Yen’s broad depreciation takes it to a 22-year low on a real effective exchange rate (REER) basis. Since January 2005 the yen loses 25 percent of its value on a REER basis.

March 13, 2008 — The yen hits a 12-year high of 99.77.

Oct. 24, 2008 — Yen hits 13-year high of 90.87 vs the dollar. Also sets an all-time high of 55.11 against the Australian dollar, which loses almost a third of its value in just a month on a massive unwind of carry trades.

Oct. 27, 2008 — The yen’s surge prompts the G7 to issue statement singling out the yen in warning on currency market volatility.

Dec. 12, 2008 — The dollar falls through 90 yen for the first time in 13 years after a bill to rescue U.S. automakers fails in the Senate.

Jan. 22, 2009 — Hits fresh 13-year high of 87.10 against dollar, driven up by risk aversion and option-led dollar selling.

Sept. 28, 2009 — Marks 8-month high of 88.23 against greenback, but later loses ground as Japan’s finance minister tries to tone down earlier comments suggesting intervention was unlikely.

Oct. 7, 2009 — Yen reaches fresh 8-month high versus the greenback of 88.01 as market players probe how far Japanese authorities will allow the yen to rise.

Nov. 27, 2009 — Hits 14-year high of 84.82 on trading platform EBS.

Aug. 11 — Dollar marks 15-year low of 84.72 yen on electronic trading platform EBS, after taking out option barriers at 85.00 and 84.75, fuelled by a narrowing of the spread between U.S. and Japanese two-year bond yields.

Aug. 24 — The dollar hits a fresh 15-year trough of 83.58 yen on EBS on fears the global economy is slowing, testing Japanese authorities’ resolve to stem the yen’s climb.

Sept. 8 — Yen strikes a new 15-year high against the dollar of 83.34 on EBS as concerns about euro zone banks and sovereign debt prompt a flight to safety.

Sept. 15 — Japan intervenes in the currency market for the first time in six years, selling yen to stem a rise in the currency after the dollar hit a 15-year-low at 82.87 yen JPY= earlier in the day. Sources: Reuters, Bank of Japan, Bank of England (Writing by Mathew Veedon and Eric Burroughs ; Editing by Chris Gallagher)