Three Types of Trends in Forex

Post on: 3 Май, 2015 No Comment

Written by Dean Kleb

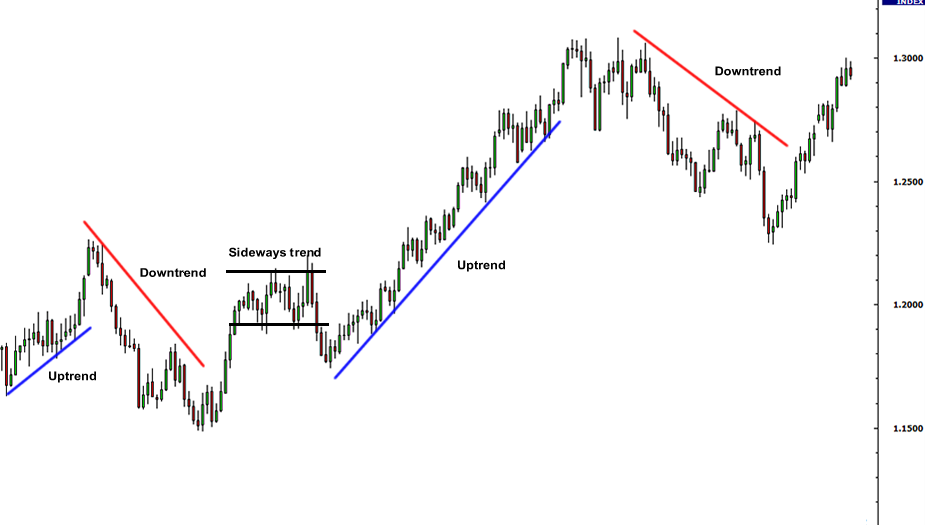

A trend reflects the average rate of change in price over time. Trends exist in all time frames and all markets. Forex Day traders may attempt to establish and take action in the short-term trends to within minutes. Position and swing traders may attempt to establish and take action in the intermediate trends of days or weeks and the long-term investors watch trends that persist for many months or even years.

UP, DOWN or RANGE-BOUND trends can be found in Forex Trading. Some technical strategies try to locate TOPS and BOTTOMS, which are those points where a trend, rally or a decline, ends. Locating a top or a bottom can be especially difficult though a successful trade is often very profitable due to the high level of reward to risk.

However a well-known quote about trends advises, The trend is your friend . For traders, this wisdom teaches that you will have more success taking trading positions in the direction of the prevailing trend within chosen time scales than against it.

Up-Trend Forex Market

The price rallies often with intermediate periods of consolidation or movement against the prevailing trend. In doing so, it draws a series of higher highs and higher lows on the price chart. In an up-trend, there will be a POSITIVE rate of price change over time.

Trends tend to persist over time, therefore a price graph in an up-trend has a high probability of continuing to rise until some change in value or conditions occur and fulfil the possibility of a change in the trend.

Uptrending market example:

EUR/USD Daily Chart. The pair has been in an uptrend since April 2002. Higher highs and higher lows.

Down-Trend Forex Market

The price declines often with intermediate periods of consolidation or movement against the prevailing trend. In doing so, it draws a series of lower highs and lower lows on the price chart. In a down-trend, there will be a NEGATIVE rate of price change over time.

Study the above down-trend chart carefully and try and see what it has in common with the up-trend chart previously shown, other than the obvious we have already discussed.

Range-bound Forex Market

The Price swings back and forth for a prolonged period between easily seen upper and lower limits. There is no apparent direction to the price movement on the chart and there will be LITTLE or NO rate of price change.

Did you study the down-trend chart carefully and did you find anything significant in common with the up-trend chart. If you were sharp enough you may have seen they are one in the same. One chart is just the inverse scale of the other. Hard to see that they are the same chart unless you already knew. The point we are making is that, if you are not sure the market is trending or range-bound then turn the chart upside down and if it looks the same stay away and consider another time scale.

Compare the inverse scale of the range-bound chart and you will think you are looking at the same graph. It may sound silly but if it helps to avoid trading at the wrong time or using the incorrect strategy for prevailing market conditions than it is truly worth its weight in gold.

Inverse Range-bound Forex Market