This $4 Gold Stock Will at Least Triple John Doody

Post on: 5 Июнь, 2015 No Comment

Welcome! If you are new to Stock Gumshoe, grab a free membership here and join us to get our free newsletter alerts with new teaser answers and debunkings. Thanks!

The folks at Stansberry & Associates have apparently made a deal with John Doody, who has for many years written a well-respected stock advisory service on gold miners. Theyve apparently gotten him to agree to a trial period for new subscribers and reduce his price a little bit I imagine that hes probably going to get a lot of new subscribes out of this marketing push, which apparently comes with a deadline of 4pm today for the Stansberry deal. Who knows, maybe this will be the beginning of a beautiful Stansberry/Doody friendship and well start seeing Gold Stock Analyst teaser ads everywhere we turn.

Im never one to tell you not to to take a free trial of something, and Ive found John Doodys stuff interesting (if sometimes overwhelmingly complex) when Ive had a chance to take a quick look at it (I dont subscribe, of course, but he makes occasional sample issues available, and talks to the press with some frequency).

But I know lots of you dont want to subscribe to newsletters or couldnt justify $495 to find out about some more gold mining stocks and the letter from S&A tells us that Doody is recommending one top buy right now so can the mighty Gumshoe figure out what that might be?

Lets see

To give you a little context, John Doodys newsletter (Gold Stock Analyst) publishes analysis, sometimes very technical analysis, of gold (and sometimes silver) mining companies, and, as the ad letter describes, it publishes a top ten list of mining stocks each month that essentially gets tracked like any newsletter portfolio or mutual fund.

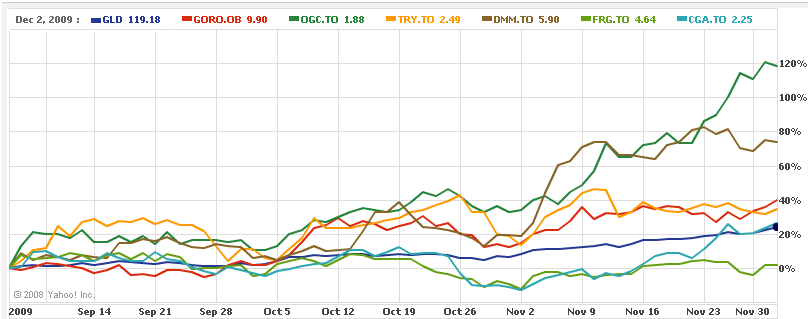

The Stansberry ad tells us that the Top Ten list from Doody has returned 390% since the beginning of the decade (2000, I assume). Thats obviously pretty good, and broadly in line with the fact that people generally tell us that gold mining stocks tend to go up at two or three time the rate of gold prices (ie, if gold goes up 1%, mining stocks go up 2-3% the same happens on the downside, not surprisingly). Gold since 2000 has gone up something like 200% or so from about $300 an ounce. And after a quick glance at the records of most of the precious metals mutual funds, that reported return from Doody certainly outpaces most of them, though of course its also a significantly more concentrated portfolio than most.

Doodys methodology currently tells us that gold miners are currently trading as if gold was priced at about $715 an ounce, so with the current $900 or so per ounce price perhaps theres some cushion in the prices, too well see.

But the tease, of course, is that theres a $4 gold stock that is at the top of his list right now. So what is it?

Well, to get to that we first have to go through a bit of teasing about something called a 43-101 Feasibility Document. This time around they didnt make up a number, at least, this is real National Instrument 43-101 is a Canadian guideline for the disclosure of technical information about mining projects, so youll often see comments about reserves, or official resource reports or updated economic production models, note that they are NI 43-101 compliant or some such language. I dont know much about this, but the rules were put into place to make sure that companies didnt flat-out lie about their geological results and their reserves (after a big scandal involving Bre-X back in the mid-1990s).

If youd like to get an idea of what 43-101s look like, the term is just used as shorthand for technical report filings that Canadian mining companies make with Sedar (their version of Edgar, a public filings database for publicly traded companies). You can search for any company name and restrict your search to just their 43-101 technical documents if you like. They are not magic, of course, and the fact that a filing is a 43-101 does not mean its a good or promising filing, just that its an official and verified mineral resource or similar report. Sedar.com is where you start if you want to search for company filings.

So when you talk about a companys 43-101 feasibility documents youre probably talking about a companys announcements of a discovery, or follow-up announcements about mine exploration and reserves calculations. There may well be a particular kind of 43-101 filing that matters to him, but if so its beyond my ken.

How does that play into this investment thesis? Apparently, Doody has identified a pattern whereby companies that discover gold see a huge boost in their share price, but then the shares tail off for a long period of time (many years, usually) as those early investors lose interest. After all, after discovering a gold deposit it can take years and years and years before they actually fully evaluate the reserves, and even longer before theyre ready to begin even the first stages of mining. So at some point in there Doody has identified a trigger where he believes the stock should shoot up.

As the ad puts it:

In other words, to successfully pick the right gold stocks you must have PROOF that the company will actually produce and sell gold.

And thats where the timing indicator comes in

In the world of mining stocks, the key to making a lot of money is to wait for a series of events that begin with something known as 43-101 Feasibility Documents.

On average, it takes about 1 to 5 years after a big gold discovery to reach this critical stage.

Without getting into too many technical details, I can tell you that 43-101 papers start the clock on a phase that is vital to any mining company making a serious fortune.

Simply put, these government-authorized documents provide independently vetted proof that a company can build an economically viable mine and actually begin producing gold.

.

Typically, just weeks after this obscure set of documents is released, the stock takes off in anticipation of gold production.

This is exactly where his favorite $4 gold stock falls right now.

Here are the clues we get about which trigger company hes got at the top of his list now, according to the ad:

Its a $4 gold stock.

This tiny miner operates in the U.S. and in Mexico, where it has 100% ownership of a 5 million-ounce gold deposit.

As usual, when the company announced its discovery in 2002-2003, a lot of speculators jumped in expecting the tiny stock to skyrocket.

Doody and the Stansberry folks think this one could triple in the next six months so what is it?

Well, this is not at all certain, but my best guess on this one is

Minefinders Corp (MFN, or MFL in Toronto)

This is a small mining company whose primary asset is 100% ownership of a new mine in Mexico, the Dolores project in Chihuahua. The price is in the $4 range ($4.55 as I type this). And I dont know how it matches up with the companys actual reports, but Doody has publicy said that they have nearly 5 million ounces of potential reserves, and should produce 185,000 ounces of gold this year and that its potentially a double or triple from here. The initial discovery also coincides reasonably well with that 2002-2003 time period clue.

So its a decent match, but still a guess on this one not enough clues to be really certain. And as I think Ive said several times before, Im certainly no expert on analyzing the reserves and reporting of mining companies, so Im not going to provide any brilliant insight for you here (and yes, I hear you in the back saying what else is new!).

As to the 43-101 business, they had some delays getting the mine up and running, but they did pour their first gold late last year so they are officially a producing gold miner and they have filed reserve updates in the last year and operational updates in the last few months, though they havent produced very much gold yet [**that’s a correction — I originally implied that they had filed reserve updates recently, the last official 43-101 was in March of ’08 and recent updates have been about production and operations, not reserves].

That appears to be Doodys focus, buying companies that are either already producers, or that have filed promising 43-101 technical paperwork on reserves, etc. Minefinders certainly matches this. If youd like to read a good interview with him, click here he talks about Minefinders and a few other specific companies, and generally expounds on his assertion that 2009 will be a huge year for gold miners (and that theyll be among the few successful and profitable companies around).

Minefinders has actually gotten a fair amount of attention lately, thanks to that first pour of gold, so you can also see some other recent articles if you want more info heres one from the Motley Fool. and another from Mining Weekly. There was also an interesting Dow Jones article earlier last month about Minefinders and a couple of the other big juniors in Mexico and possible consolidation in the industry.

So should you jump on board and take a trial with his Gold Stock Analyst newsletter? Or should you buy Minefinders or any of the other promising young gold miners that typically catch his interest? I cant decide that for you, but let us know what you think. Do keep in mind that Doody typically recommends that everyone who owns gold miners should buy at least a half dozen of them for reasonable diversification, so its always reasonable to consider funds and ETFs if youre not willing to pace bets on just one or two miners.

So there you go, yet another gold teasers and with the steady drumbeat of fear and future inflation talk and devaluing currencies, I wouldnt be surprised to see many more. Stay tuned, and shout out your comments below if youve got any feeling on gold, gold miners, John Doody, or, really, whatever else tickles your fancy. Have a great week!

I confess to being an addict.

I check my net worth, my spending and saving progress, and my portfolio (combined from several different brokerage accounts) using Personal Capital at least once a week, sometimes every day. after all, it’s free and brilliantly organized.

Personal Capital has great tools for tracking spending (they can cut your spending by 15%), but what I love most is their automated financial dashboard — it will look at all your assets and debts, tally up your asset allocation, project where you’ll be at retirement, and suggest ways to manage risk or improve returns. It’s free, I think their free tools are great, and I think it’s worth checking out — you can do so here.