Things You Must Know About Investing in GoldKiplinger

Post on: 25 Апрель, 2015 No Comment

Use the shiny metal as a hedge against financial catastrophe.

Thinkstock

1. Solid gold is not always solid. The price of bullion peaked in September 2011 at nearly $1,900 an ounce and has fluctuated since between $1,500 and $1,800. But a slew of worries—most having to do with the prospect of a global economic slowdown—sent prices falling in mid April to just below $1,400 an ounce. The price of an ounce of gold recovered to about $1,470 in early May. But many analysts still predict that the price will fall to $1,200 to $1,300 by year-end. Among the factors that could continue to weigh down gold: a strong dollar, a surging stock market and tepid economic growth around the world.

See Also: Our Quiz on Understanding Gold

2. Defense, defense. Think of gold as a hedge against unexpected, catastrophic financial events. For example, the credit downgrade of U.S. debt and worry about a Greek default fueled a 44% rally in gold prices in the first nine months of 2011. Gold also worked well as a hedge against inflation during the 1970s; the price of the metal rose to a high of about $600 an ounce in 1980, from $35 in early 1970. And some experts, including John Hathaway, co-manager of Tocqueville Gold Fund (symbol TGLDX ), say that gold is a good defense during times of deflation (falling prices).

3. A little bit goes a long way. “Gold does nothing. It earns nothing; it doesn’t pay a dividend,” says Dan Denbow, co-manager of USAA Precious Metals and Minerals Fund (USAGX ). Even so, many experts say a small exposure to gold—from 1% to 5% of your portfolio—can be a good long-term portfolio diversifier whether prices move up or down. That’s because gold tends to move out of sync with stocks and bonds.

4. You could start your own treasure chest. Consider buying the actual metal in one-ounce coins, such as American Eagles, says Alec Young, global equity strategist at S&P Capital IQ. “Buy through a reputable dealer, one that’s been around for 30 years and that’s listed with the Better Business Bureau,” he says. You’ll pay a premium when you buy and sell the pieces. But Young says you shouldn’t pay more than a 5% to 6% premium to spot-gold prices when you buy, and you should accept no more than a 1% to 2% discount to spot prices when you sell. Store the coins in a safe-deposit box at the bank. “You don’t need to buy a home safe, and you don’t need to buy insurance,” says Young.

Advertisement

5. Or invest in an exchange-traded fund. Many so-called gold bugs have chosen to buy shares in an ETF, such as iShares Gold Trust (IAU ), which tracks the price of gold by buying bullion. Note that the IRS considers gold a collectible, like a piece of art or a baseball card, and gives it special tax treatment. When you sell your shares, your gains will be taxed at your ordinary income rate, up to a maximum of 28%, if you’ve held the shares for more than a year. If you sell your shares within a year of buying them, your profits will be taxed as ordinary income, up to 39.6%.

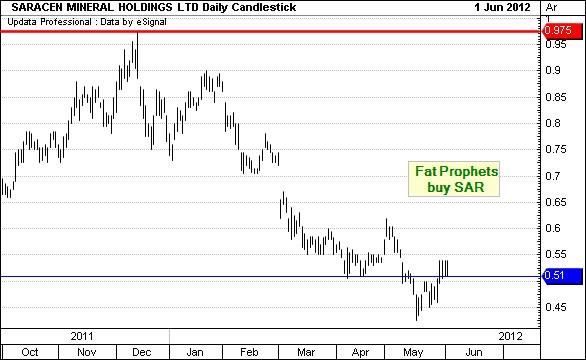

6. Gold stocks are riskier. Prices of gold stocks are often more volatile than the price of the metal itself. For example, over the first four months of the year, the price of bullion declined 16%; by contrast, an index of the biggest U.S. gold mining stocks plunged 36%.