The Simple Effective Approach to Investing (Part 3) Determine Your Asset Allocation Mom and Dad

Post on: 22 Июнь, 2015 No Comment

Posted May 22, 2013

This is part of a four-part series on investing basics. You can follow along with the entire series here:

In the last two weeks, weve looked at where investment returns actually come from as well as the relationship between investment risk and return. From those two topics, weve now built the understanding that your individual investment returns will be driven first by overall market returns and second by your asset allocation. With these tenets in mind, we have concluded that your personal investment strategy should essentially be determined as follows:

1. Determine the amount of market exposure you would like to have with your investments.

2. Obtain that market exposure by finding investments that mimic the markets as closely as possible.

3. Do this at the lowest possible cost.

Today well to talk about a very basic but effective way to think about Step 1, determining determining your asset allocation.

There is no perfect asset allocation

Lets get this out of the way from the start. There is no such thing as a perfect asset allocation. There just is no right answer. No matter how much time you devote to the topic, no matter how many research papers you read and economic forecasts you evaluate, it is impossible to pick the single right set of investments. I have no intention of misleading you to believe it can be done.

The reality is that there are guidelines to follow and there are certainly poor practices to avoid. But there is a very wide range of good enough asset allocation decisions. Rather than obsessing over finding the perfect plan, you should really only try to keep two things in mind when making these decisions:

Make sure your plan is good enough. In other words, make sure it follows the general guidelines of good investment policy, which are essentially the three points at the top of this post.

Pick a plan that you feel good about. Beyond Step 1, its really as subjective as that. The best plan for you is one that meets Step 1 and is something you can stick with for the long haul. Staying consistent with a good plan through the ups and downs is really what will eventually determine your long-term success.

The rest of this post will give you some ways to think about approaching both of these topics.

Determine your time horizon

Your time horizon is just the amount of time between today and the day on which you will need the money thats being invested. In this post Im really just focusing on asset allocation for time horizons greater than 10 years or so, which for most people is primarily only their retirement investments. If you have a goal that is less than 10 years away, and you really need to have a specific dollar amount on that date, then you will want a much more conservative allocation and may decide not to invest in stocks at all. The uncertainty of stock returns over such a short time frame is likely not worth the potentially higher returns..

One important thing to keep in mind with retirement investing is that your time horizon is not defined by the day on which you will retire. You will likely live for many years after that, so your time horizon should likely be at least 30 years past your retirement date.

Choose your stock-bond split

As I mentioned in last weeks post about risk and return, the single biggest asset allocation decision you will make is your split between stocks and bonds. This is so because the majority of your returns, both good and bad, will be driven by the stock markets.

The balance to strike here is allocating enough of your money to stocks that you benefit from the higher long-term returns, without over-allocating to the extent that you will pull out when the market drops. The goal is to be consistent, so theres no point in over-extending yourself now at the risk of reacting negatively later.

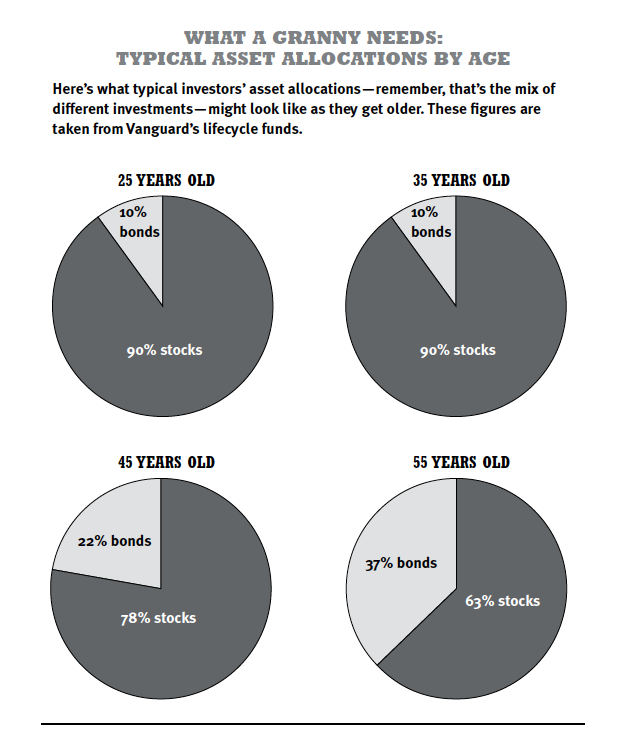

The traditional advice is to allocate more to stocks when youre younger and gradually decrease that allocation as you age. The logic there is that younger people have more time to weather the ups and downs of the stock market.

Thats a fine strategy and will work well if applied consistently, but another approach to consider is one put forth by investment manager Rick Ferri that he calls the flight path approach to age-based asset allocation. The strategy here is to start off with a relatively moderate stock allocation, say 40-50%. You then increase that percentage over the years as you experience the ups and downs of the market, but only if you truly feel that you can handle the higher level of risk. The thinking is that this gives you an opportunity to truly evaluate your own risk tolerance, rather than taking on too much risk at the start and then being scared off at the first market downturn.

However you want to approach it, remember the rule of thumb discussed last week that in any given year you should be comfortable losing half of the value of your stock allocation due to a down market. So if 60% of your money is in stocks, it wont be unreasonable for you to lose 30% of your money in a given year. This broad rule of thumb can help you pick an overall stock-bond split that feels comfortable.

Diversify within stocks

Diversification is an investors best friend. It is the single method by which you can decrease your investment risk without decreasing your expected returns. Based on that single fact, you would be crazy not to take advantage of it.

Diversifying simply means that you want to own many different types of investments. Its the difference between owning a single stock vs. the entire stock market. With a single stock, you have all of your risk concentrated in one place. When you own the market, your risk is spread out and actually decreased because while a single company can go bankrupt, its not likely that all companies will.

There are many different ways you can carve up the stock market into different sectors. There are big stocks and small stocks. Growth and value. Utility and technology. Domestic and international. Developed and emerging. The list goes on and on.

A lot of people like to slice and dice their portfolio, choosing different funds or different stocks to represent each different part of the stock market. That approach to diversification can certainly work, but in my view its unnecessarily complicated.

Remember from Part 1 that most of your returns are derived from the overall markets. With that in mind, I believe that the default as you start out should be a total market approach. Find one fund that represents the entire US stock market. Find another fund that represents the entire international stock market. Start with a 50-50 split between the two and adjust as you see fit. So if youve decided that your overall stock-bond split is 60-40, then the 60% you have in stocks would be split 50-50. In the end, 30% of your money would be in US stocks and 30% would be in international stocks.

This approach will get you adequate diversification and it will expose you to all sectors and sizes of the stock market. Its as complex as you need to make it in order to take advantage of the major benefits of stock market investing.

Diversify within bonds

Within your bond portion, there are two basic routes you could take. The first one is a total market approach, like what I described with stocks. You can find a total market bond fund and put your entire bond allocation there. You could use an international bond fund as well for a little extra diversification. This total market approach is simple and effective and should probably be the default as your start out.

A slightly different approach, and the one I personally use, is to look at the purpose of your bond allocation as a counterweight to your stock allocation, not as a real source of return itself. This approach is advocated by Yales legendary endowment manager David Swensen in his book Unconventional Success (affiliate link), which happens to be my all-time favorite book on investing.

The logic here is that your stock allocation will drive your returns, while the bond portion is simply meant to provide some downside protection during the periods when stocks go bad. To make this work, you want to choose bonds that are as far on the opposite end of the risk spectrum from stocks as possible. In practice, this means that you would avoid corporate bonds, which are issued by the same companies whose stocks you already own. Instead, you would purchase only US Treasury bonds, which are as close to a guaranteed investment as you can get and are most likely to perform well when stocks are suffering. You can look at 2008 for the most recent example of this phenomenon in full effect.

If youre going this route, it likely makes sense to choose an index fund that either tracks the entire US Treasury market or one that has an intermediate term (meaning an average maturity of 5-7 years). Either way you will be approximating the entire US Treasury market, which is essentially taking a total market approach for this specific sector.

Sticking with one US Treasury fund is certainly good enough, but you might choose to add a little bit of diversification with a TIPS fund. TIPS are US Treasury bonds that have a special inflation protection mechanism built in. They will pay a lower interest rate to start, but if there is unexpected inflation they will pay more. This can add a nice little bit of extra protection without adding too much complexity to your portfolio.

Adding alternative investments

If youve followed the advice above, you will have at most four funds making up your entire investment portfolio. You will have a reasonable split between stocks and bonds and you will be well diversified within each. If you can implement a plan like this and stay consistent with it, thats really as far as you need to go to have success with investing.

But people like to tinker, and there are many other types of investments you can add to spice up your portfolio. There is real estate. There are commodities like gold and oil. There are hedge funds and private equity firms. There are stamp collections. The opportunities are endless.

I will say that none of these other types of investments are necessary, but if youre going to get into them you should keep a few things in mind:

1. What kind of return can you realistically expect? Some of these alternative investments (like gold) dont actually have any expected return above inflation.

2. What is the real risk involved? All investments have risk. Understand this risk thoroughly before getting involved.

3. How will the addition of this investment affect your overall portfolio? When stocks are up, how will the investment behave? What about when stocks are down? Do you like that kind of interaction? Is it helpful?

4. Do you really understand the investment enough to stick with it through the tough times? If not, its likely to do more harm than good.

Summary

Your asset allocation, how your money is portioned among different types of assets, is the most important investment decision you will make. Within this, the simple split between stocks and bonds will have the biggest influence on your returns. Beyond that, there are some simple ways to diversify that will decrease risk without sacrificing returns and without adding too much complexity.

If youre starting out, keep things as simple as possible by following the guidelines above. Find a good enough strategy that feels good to you and stick with it.

Next week well talk about some simple ways to actually implement your chosen asset allocation strategy.