The Sharpe Ratio_1

Post on: 30 Апрель, 2015 No Comment

Most investors understand that the stock market is a balancing act between returns won and risks taken. This balancing act means that a gold stock with, say, 50% upside may not be as attractive as a medical stock with only 20% upside. This apparent contradiction is due to the gold stock having significantly more risk attached to it than the relatively defensive medical stock.

But what if the gold stock offered 100% upside? Or the medical stock only offered 10% upside?

Have a read through Wikipedias Sharpe Ratio entry here and, perhaps, refresh yourself on what standard deviation is here.

In a nutshell, the Sharpe Ratio is the ratio of expected return in excess of the risk-free rate over the standard deviation (or price risk) of the same shares share price. Or, put differently, the Share Ratio shows you how many units of real return you are buying for each unit of risk taken on.

How do you calculate the Sharpe Ratio for JSE shares?

Well, without getting to technical, you can do it the following way:

- Find the risk-free rate in South Africa. In South Africa, this is normally the South African Reserve Banks TBills or, next best estimate, the South African Governments 10 year bond rate. Some of this information is publicly accessible on the SARB website .

- Estimate the expected return of the share you are analysing. This is utilising fundamentals, valuations and dont forget about future dividends. It is an industry norm to calculate a shares value a year in advance. This is called the Target Price (TP) and is often referred to as the twelve month target price (12m TP). The 12m TP plus 12m expected dividends less the current share price will give you an idea of the expected return of a share. Express this as a percentage return.

- Calculate the excess return. This is simply #2 less #1 and shows you the excess returns one can expect over and above the risk-free rate. I.e. the returns that are rewarding investors for taking on an asset that is not risk-free.

- Calculate a shares risk. Risk is defined as the volatility of returns. In a very basic sense, the volatility of a shares share price is its risk; the more volatile the share price, the riskier the share. Thus, to estimate the risk of a share, calculate its share prices standard deviation. Excel has a very good and quick formula for calculating this (see here for a free tutorial ) and if you download the share price history for as long a period as possible, then it becomes quite easy to calculate the standard deviation of that share.

- Calculate the Share Ratio. This is simply #3 divided by #4.

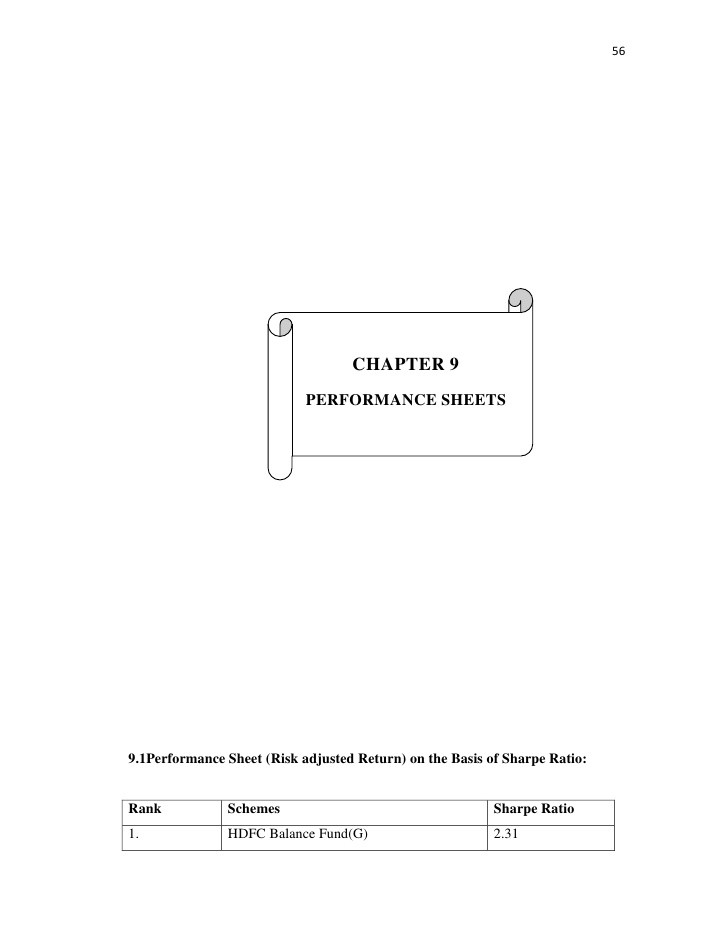

Finally, one needs to interpret the Sharpe Ratio. Very basically, if the Sharpe Ratio is greater 1.0, then you for every 1 unit of risk you are getting more than 1 unit of returns. This is generally a good deal, but it also may not be the best deal For example, per our calculations, Afrimat (AFT) currently has a Sharpe Ratio of c.3.1, but Clover (CLR) has a Sharpe Ratio in excess of 7.8!

Still, nothing should be viewed in isolation and what I find the Sharpe Ratio most useful for is in comparing investments across a wide investable universe. For example, across the JSE small caps sector. You can ranks shares by their Sharpe Ratios and it allows you to invest in only those with the highest, hence you are taking on minimal risk for maximum (potential) return. Hence, in the above return, it is probably wise to give Clover a higher weighting in your portfolio than Afrimat, given its lower risk profile for each unit of potential return.