The S P s Worst Performers Are Bouncing Back

Post on: 13 Апрель, 2015 No Comment

Although we don’t believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes — just in case they’re material to our investing thesis.

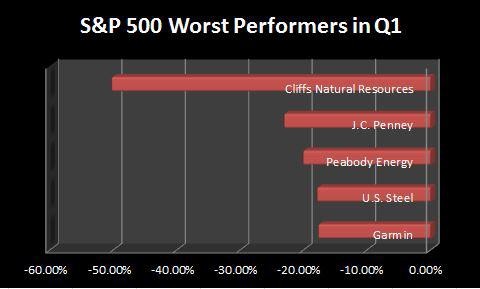

The S&P 500 ( SNPINDEX: ^GSPC ) has pulled back recently from its record-setting performance over the past several months, with a drop of 2% last week. Yet some of the hardest-hit stocks in the market benchmark have actually posted strong gains recently, bouncing back from the beatings they’ve taken earlier in the year. Let’s look at three of these companies and see what’s behind their bounces.

Commodity comeback

All three of these stocks have something in common: they’ve all suffered at the hands of the swoon in commodity prices. For Cliffs Natural Resources ( NYSE: CLF ). poor international demand for steel production has hammered prices of iron ore and metallurgical coal, leading to nearly a 40% drop in the stock so far this year. Similarly, Peabody Energy ( NYSE: BTU ) has had difficulty finding demand for its coal, as relatively cheap natural gas continues to pose competitive pressures on the U.S. coal industry. Peabody’s down 34% so far in 2013. Finally, Newmont Mining ( NYSE: NEM ) has taken a big hit from plunging gold prices, which have suffered at the hands of the Federal Reserve and investor fears that an end to accommodative monetary policy could pull out the rug from underneath gold’s long bull market.

More recently, though, all three of these stocks have put in floors and started rising again. For Peabody, the prospect of being able to export its coal to more energy-hungry areas of the world is particularly inviting given its extensive coal resources in Australia, relatively near the high-demand Asian market. Moreover, even its U.S. resources are well-placed for to meet export demand, and that has sent Peabody shares up 10% in just the past month.

For Newmont, a rebound in gold prices has come at an important time. After bottoming around $1,200, gold topped the $1,375 level on Friday, and while that’s well off its highs from earlier in the year, Newmont has low-enough costs of production to sustain profits at those levels. Silver has been outperforming gold most recently, but gold’s rise was enough to pull Newmont stock up 14% in the past month.

Finally, Cliffs has rebounded more than 31% since mid-July. Encouraging economic data from China have led investors to believe that the worst might be over for the steel industry worldwide, and that in turn could finally put a stop to price declines for Cliffs’ raw materials for steel production. Fits and starts in a bounce in emerging-market growth have tricked investors before, but Cliffs has been hit hard enough that even a bounce of this magnitude doesn’t entirely eliminate the losses that longtime shareholders have suffered.

Of all these markets, gold’s bounce arguably has the most potential to draw in new investors. Read The Motley Fool’s new free report, The Best Way to Play Gold Right Now , and find out what the recent volatility in gold prices means for you and your investing. Click here to read the full report today!

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter: @DanCaplinger. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools don’t all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .