The Role Of Speculators In The Commodity Market Yahoo She Philippines

Post on: 3 Июнь, 2015 No Comment

For the most part, financial market participants have few qualms about the markets when prices are rising. This is because most investors are long in the market and make money when market levels increase. Commodity markets are a bit more complicated because although rising prices means greater profits for the underlying owners of those commodities, for many companies and underlying customers, it means costs have grown more expensive.

Volatility is also a concern in commodities markets because it makes it more difficult for companies and individuals to plan for the future. With wild swings in prices, it can be difficult to budget for production levels or how much discretionary income will be left after it becomes much more expensive to fill the tank and drive to work each day.

Commodities

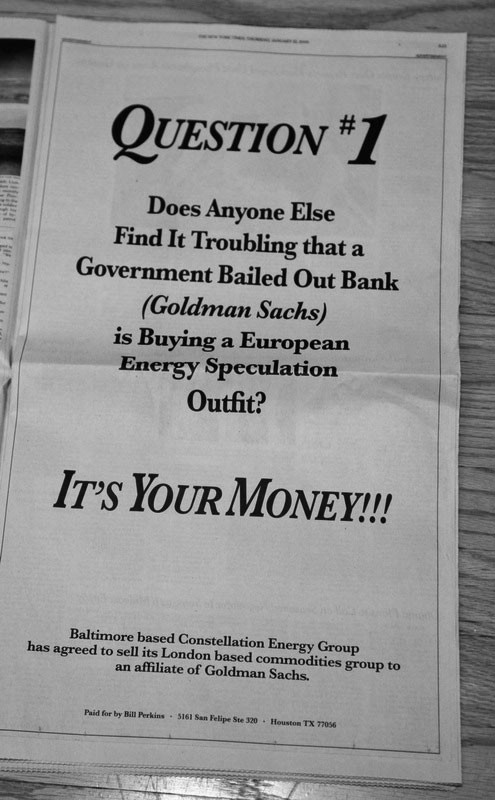

In periods of excessive price swings, individuals, politicians and market regulators start questioning the role of commodities speculators. These participants look to profit from either rising or falling prices through the commodities future markets, where it is possible to invest in a financial asset or index where the price level is determined by an underlying commodity price level. Oil is a major commodity that is traded, as are precious metals including gold, silver and copper, as well as agricultural resources like corn, wheat and even frozen orange juice concentrate.

Regulation

In the United States, the Commodities Futures Trading Commission (CFTC) recently implemented a number of rules to try and regulate the role of speculators in the commodities market. It set limits on the amount of supply that speculators can trade for 28 commodities and related restrictions in an attempt to make commodity price gyrations less volatile and more stable overall.

The underlying assumption with these recent rules and a negative overall attitude toward commodities speculators, is that they are a primary cause to price volatility. However, there is scant evidence to support these views. In fact, restricting the ability of speculators in the marketplace could end up doing more harm than good.

For starters, speculators serve an important role in commodities markets. There are many legitimate purposes for trading in commodities futures or by actually holding physical commodities. Companies do it to hedge against rapid rises and falls in price, and farmers may do it to try and offset swings in the weather or price swings that result in rapid shifts in demand. These market participants need someone to take the offsetting positions to their positions, which is exactly what speculators do. In this respect, they provide the markets with an invaluable service and help encourage liquidity, which serves to encourage the ability to easily make trades with reasonable commissions .

Also, fluctuations in underlying supply and demand have arguably the most impact on commodity prices. The credit crisis caused a rapid plummet in demand for many commodities, including oil and iron ore that goes into steel production. Supporting the use of ethanol as a fuel source has served to stoke demand for corn, and in the process has increased prices. Supply changes can be severe as well. Mother Natures droughts can severely restrict corn, cotton and other related commodity prices. Similarly, wet weather has also destroyed crops, such as what happened several years ago with Australias red grape supplies.

The Bottom Line

Speculators should be watched closely for unethical and even illegal activities. Allegations that certain insiders at MF Global stole client commodity funds to stave off bankruptcy certainly comes to mind as a recent example. But to suggest that they are the primary culprits to overall commodity price volatility is only a speculation, at best.