The Quantity Theory Of Mone

Post on: 16 Август, 2015 No Comment

4. A reasonable interpretation of the quantity theory makes it a statement of the effect of a change in a single factor. The objections to the quantity theory assume that it is a statement of what occurs under all conditions, instead of what it is, an index to the working of one condition at a time. The foregoing objections need but to be further analyzed to show that in each of them it is not merely the quantity of money, but a number of other factors that differ in each of the propositions. We may note briefly in turn the defects in the arguments of the preceding paragraph.

Not a per capita rule.

First, the quantity theory does not remotely imply that prices in different countries differ at a given moment according to the per capita money. In the case of the United States and Mexico not only the amount of exchange per capita but the method of exchange, and the rapidity of the circulation of money differ quite as much, doubtless, as does the per capita circulation. The quantity theory would lead any fairly careful student to a conclusion the exact opposite of that which its critics have twisted from it.

Recognizes the growth of trade.

Second, the quantity theory does not imply that during a period of years when a country is changing in a multitude of ways, as in population, methods of industry, modes of exchange and transportation, and in wealth and income. the prices will vary directly either as the absolute or per capita amount of money does. In the light of the quantity theory the inquirer must be led to just the opposite of the ridiculous conclusion imputed to it.

Recognizes use of credit .

Third, the theory does not overlook the effect of an increased use of credit, for it fully implies that any such a change, by economizing the use of money, would enable the same amount of money to support a higher scale of prices.

Not confined to primary money.

Fourth, the theory does not overlook the variety of forms, and is not true merely of primary money. However great this variety, the money demand of individuals and of communities still represents a pretty definite ratio of the value of exchanges effected. If the primary money alone were doubled in quantity, while the various forms of substitute money (smaller coins, bank-notes, government notes, etc.) remained unchanged, the quantity of money as a whole would not be doubled, and according to the theory, prices would not be expected to double. Indeed, in such a case, the method of exchange would be very greatly altered, and the case is fully covered by the statement of the theory.

Fifth, despite the number of changing factors affecting the methods of exchange, the method of business, etc. the quantity theory is a rule usable at any moment. These various factors change slowly, and the quantity theory answers the question, What change occurs in prices as a result of an increase or decrease of the money in a given community at a given moment? Like the law of gravitation, the law of projectiles, and the statement of the chemical reaction to be expected when adding some substance to a given compound, the theory must be interpreted with practical limitations. When the quantity theory is thus stated and understood, its negation is unthinkable, as is evidenced by the involuntary use made of it constantly by every one of its few critics in explaining the simplest monetary phenomena.

Is a practical rule.

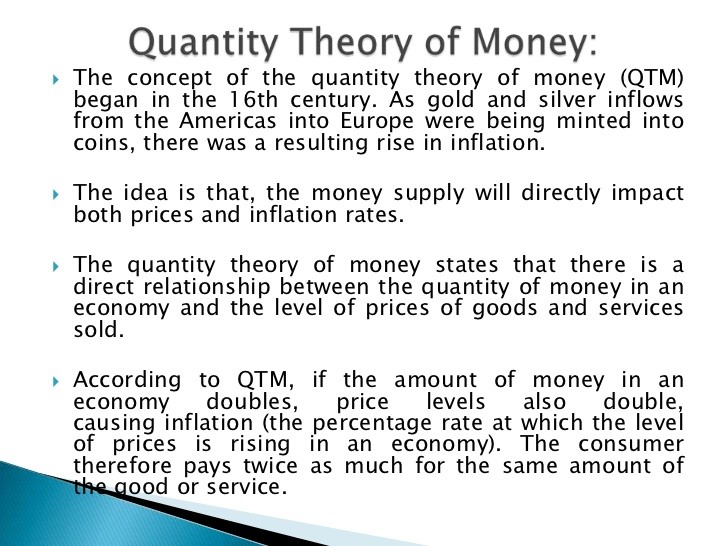

5. The quantity theory makes intelligible the great and rapid changes in price that have followed sudden changes in the money supply. Inductive demonstration of broadly stated economic principles is difficult, but in no other economic problem is laboratory experiment so nearly possible as in that of money. Many inflations and contractions of the circulating medium have occurred, now in a single country, again in the entire world, and the local or general results have served to exemplify richly the working of the quantity principle. With the scanty yield of silver- and gold-mines in the Middle Ages, prices were low. After the discovery of America, especially in the sixteenth century, quantities of silver flowed into Europe. The great rise of prices that occurred was explained by the keenest thinkers of that day along the essential lines of the quantity theory, though there were many monetary fallacies current at the time. The experience in England during the Napoleonic wars, when the money of England was inflated and prices rose above those of the Continent, led to the modern formulation of the theory by Ricardo and others. The discovery of gold in California and Australia, in 1848-50, increased the gold supply marvel-ously, and gold prices rose throughout the world. Between 1870 and 1890 the production of gold fell off greatly while its use as money increased and prices fell. A great increase of gold production has occurred in the period since 1890. In part the rising prices from 1897 to 1902 are explicable as the periodic upswing of confidence and credit, but in part doubtless they are due to the stimulus of increasing gold supplies. These are but a few of many instances in monetary history which, taken together, make an argument of probability in favor of the quantity theory so strong as to constitute practically its inductive proof.

Practical application of the quantity theory.

Recent price changes.

Questions On Chapter 45. Use, Coinage, And Value Of Money

1. If gold were to become as plentiful as iron, would it be worth more or less than iron?

2. Some say Providence has indicated gold and silver as the materials for money. How has this been done?

3. Why does nearly all the gold produced in California leave the state? What keeps any of it there?

4. Who makes coins? Would jewelers make better ones?

5. When gold comes out of the mine is the gain to the community greater or less than when the same value of grain is harvested?

6. Does gold cost the day-laborer as much in California as in New York?

7. What are the principal things besides money uses that cause a demand for gold and silver?

8. The mint price of an ounce of gold,.900 fine, is alike at San Francisco and Philadelphia, $18,604. Why is gold ever shipped from California to New York?

9. Give examples of things that increase the demand for money.

10. Note any habits of friends that result in their carrying more or less money than others of the same income.

11. What determines the amount of money needed by different persons, towns, states, and nations?

12. When goods are exchanged for money or money for goods, what is the gain?

13. On an isolated island would it make any difference as to the value of money if there were but one gold-mine or several competing ones, supposing that the output were the same?