The P E ratio

Post on: 16 Март, 2015 No Comment

The most basic, yet useful ratio for beginner investors.

@Moneyweb  | 10 January 2008

The beginning of a new year is an opportune time to get back to basics. Also, being out of touch with the market after a refreshing break, revisiting some old friends is a good way to get back into the swing of things. So I decided to take out my latest financial weekly and breeze through the shares listed on the back pages and take a look at their respective P/E ratios. And it reminded me just how important the simple P/E ratio is

The P/E ratio (price:earnings ratio) is probably the most quoted valuation tool that is used by both professional fund managers and common folk when making relative valuations of shares. The P/E ratio is simply the share price divided by the earnings per share. or just the market capitalisation divided by total earnings .

Although the P/E ratio is the ratio usually quoted in the press, I prefer to use its inverse, the earnings yield ratio, as it is easier to understand. The earnings yield is simply earnings per share divided by share price (note the inverse of P/E). Therefore a P/E ratio of 12 would give an earnings yield of 8.3%. The earnings yield is the historical earnings you would get on your investment, and since you are a shareholder in the company, you are entitled to these historical earnings (in the form of dividends).

So one can compare the earnings yield, of say 7%, to the interest rate one would receive on a fixed deposit at the bank. An intelligent statement at the moment would be I can get 10% on a fixed deposit at my local Nedbank branch, so why would I risk my life savings on the stock market when I am only getting 7% odd on my investment on the JSE?

That is an excellent point. The risk-free rate in South Africa is currently around 11% at the moment, so investors willing to invest in the stock market will want a return in excess of 11% to make it worthwhile. So therefore investors must be expecting future earnings to grow at a relatively high rate in order to justify current share prices.

And that high earnings growth potential is what makes South African shares a worthwhile investment. Future corporate earnings are expected to grow as South Africa is one of the leading emerging markets in the world. The growing black middle-class, the pre-2010 construction boom and the high demand for resources from China and India will further increase international investor sentiment towards South Africa, and thereby maintaining robust growth.

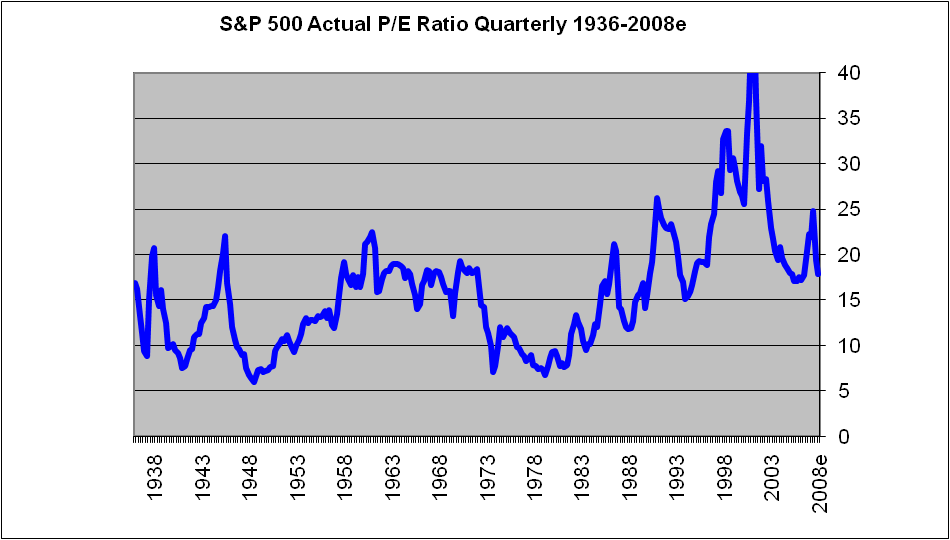

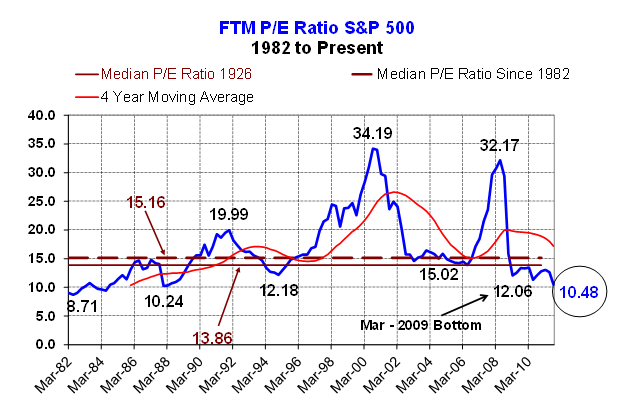

A share with a high P/E ratio is indicative of a company which expects future earnings to grow at a relatively high rate, or that the share is overvalued. Conversely, a share with a low P/E ratio would indicate the opposite. So when you see a share that is trading on a very high P/E ratio, the expected future earnings growth of the company has already been discounted into the share price. (Please dont be fooled by the current dot.con bubble happening on the JSE at the moment.)

The P/E ratio is also an excellent ratio to compare different companies, industries and stock markets. It is an unwritten rule that investing in low P/E ratio shares will outperform the market in the long-term. At the top of a bull market and the possible onset of a bear market this rule is as important as ever.

The P/E ratio is far too a simplistic valuation method to be solely relied upon. The earnings in the denominator are based on accounting rules which can easily be smoothed by creative accountants and/or manipulated by fraudulent ones. Another factor to consider is the financial leverage of a company which could slur its historical earnings, and hence its P/E ratio. In addition, different companies have different accounting policies so reported earnings are often hard to compare.

But for beginners to investing, there is no better place to start than the P/E ratio. If you invest in a portfolio of mid to large cap shares on P/E ratios of sub-10 (e.g Investec, PSG, Northam, Foschini, ABSA. Steinhoff and Imperial), you can be sure to beat the market, if not in the short-term, than certainly in the long-term.