The Optimal Extraction of Exhaustible Resources

Post on: 9 Июнь, 2015 No Comment

/media/images/epp_logo.gif /%

The Optimal Extraction of Exhaustible Resources

Conventional theory can’t explain historic commodity price fluctuations, but modified models may provide better guidance

Executive summary

Policymakers concerned about rapid swings in commodity prices seek economic guidance about causal factors and future trends, but standard modelsbased on Harold Hotellings classic 1931 theoryare unable to explain actual data on price variability for a wide range of commodities. In this paper, we review this Hotelling puzzle and suggest modifications to current theory that may improve explanations of commodity price changes and provide better policy advice.

Introduction

The prices of exhaustible resourcesoil, natural gas, copper, coal, etc.have varied dramatically in recent years, concerning policymakers, businesspeople and economists alike. Oil prices, for example, rose sharply in the 2000s and then fell abruptly in 2008 with the onset of the Great Recession. Prices rose again with recovery, but are now trending down as new sources are tapped.

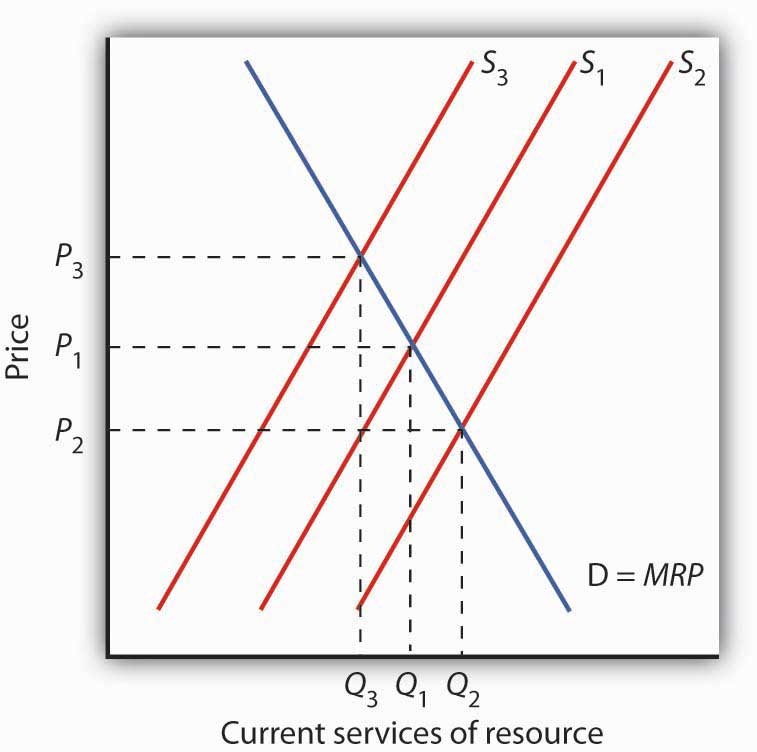

How do such fluctuations affect inflation, and how should policy respond? More fundamentally, what makes prices of commodities like this fluctuate so much? The usual analysis with a simple supply-and-demand diagram is inadequate for answering this question. What, after all, is the supply curve for a resource whose quantity is fixed and is brought to market simply by pulling it out of the ground?

In 1931, Harold Hotelling proposed an answer. 1 His remarkably simple theory has become the benchmark for research on the price of an exhaustible resource. In this paper, however, we examine the historical record on such commodity prices and find that Hotellings theory fails to account for actual price trends. We briefly discuss possible ways to resolve this failure, which we call the Hotelling puzzle .

Hotellings theory begins with the fundamental trade-off that the owner of the resource, say, oil, faces. The owner can leave the oil in the ground indefinitely or extract and sell it right away and then purchase a financial asset with the proceeds. In other words, the owner can keep the oil as a physical asset or turn it into a financial asset.

Suppose the price of one barrel of oil is currently $100. If the oil is extracted and sold right away, the owner will have gained, at the end of the year, $100 (per barrel) plus the interest earned on the $100. By contrast, if the oil is left in the ground, the owner will get the price that is expected to prevail next year. Which action will yield the most profit? The answer, Hotelling would argue, lies in the current interest rate and the expected commodity price. On the one hand, suppose the current interest rate is 5 percent and the oil price expected next year is $110 per barrel. Then, clearly, the owner will hold the oil underground until next year. On the other hand, with the same interest rate, if the price expected to prevail next year is $100, the owner will extract the oil this year.

The Hotelling insight is that the forces of competition between owners will ensure that the price expected to prevail next year is equal to todays price plus the interest earnings. In our simple example, if the price expected to prevail next year is $110, and with a 5 percent interest rate, then the price today will end up being $105.

The logic behind this simple and ingenious result is straightforward and draws from the profit-maximizing behavior of the owner described above extended to include many resource owners. Consider the scenario in which the price expected to prevail next year is $110. Then, more owners will choose to keep the resource underground, which will cut todays supplies and raise todays price. Owners will continue to do this until this years price rises from $100 to about $105, so that if the oil is extracted this year, the owner will get $105 plus the 5 percent interest at years end.

The Hotelling result is intuitive and well-known to economists. In addition, it has a clear and strong implication for prices of these resources over time. When all prices and interest rates are adjusted for inflation, and as long as these real interest rates tend to be positive (and setting aside extraction costs, for the moment), the price of an exhaustible resource should rise over time at roughly the same pace as interest rates. The wide fluctuation in commodity prices experienced in recent years therefore appears to be inconsistent with Hotellings theory.

To examine this implication over a longer period and to understand if recent commodity price trends are simply an anomaly to the standard Hotelling-theory price trend, we examine data on the prices of 11 exhaustible resources for which we have a long historical record. 2

The accompanying table displays the average annual growth rates of the prices (logged and adjusted for inflation) of these exhaustible resources. The simplest version of Hotellings theorymore sophisticated versions will be discussed belowsuggests that exhaustible resource prices should grow at the real (adjusted for inflation) interest rate. The price of risk-free U.S. Treasury securities averaged 1.14 percent in the 20th century (annualized and inflation-adjusted); therefore, if this simple version of the theory is valid, these 11 prices should have grown at approximately that rate. (There are, of course, many other measures of the real interest rate, with higher-risk securities invariably generating higher average returns.)

%img src=/

/media/images/pubs/eppapers/14-5/epp_dec2014_commodity_table.gif?la=en /%

The table shows that the prices of all our exhaustible resources have actually risen at a rate far lower than that on U.S. Treasuries. Prices on commodities for which we have the longest continuous data record (lead, coal and gold) rose at an annual average rate of 0.07, 0.13 and 0.16 percent, respectively, since 1650. Not one of the 11 commodities examined rose at a rate comparable to U.S. Treasury securities. (Tin is the closest, at 0.71.) Clearly, this simple version of Hotellings theory does not explain commodity price trends.

Expanding the theory

What could be wrong with the theory? An immediate reaction might be that it should be modified to include fluctuations in demand. For example, many think that commodity prices rose in the 2000s because of surging Chinese demand. Yet there seems to be no room for demand in the theory. The remarkable feature of the simple version of Hotellings model is the implication that prices should rise at about the real interest rate independently of demand considerations.

If demand considerations cannot play a role, perhaps extraction costs could. Thus far, we have omitted this possibly important factor in our simple version of Hotellings theory. Indeed, Hotelling did include such costs in his analysis. Suppose that, in a more sophisticated version of Hotellings theory, it is costly to extract resources and that the per-unit costs of doing so depend neither on the amount currently extracted nor on the quantity of stock remaining in the ground.

Redoing the earlier analysis but this time including extraction costs, we find that the per-unit profit on resources should indeed rise at the real interest rate. This result from the more sophisticated version of the theory is sometimes referred to as the Hotelling principle. (An even more refined version of this principle is that the value of the resources left in the ground must rise over time.) The theory can then be reconciled with the observed lack of trend in prices if the per-unit extraction cost falls rapidly enough.

So, how rapidly must extraction costs fall for the theory to be consistent with the data? To simplify the analysis, we assume that the interest rate on risk-free securities is constant, and we consider two values for the interest rate, 1 percent and 4 percent per year. For ease of presentation, we give results for two commodity indexes rather than the 11 commodities individually.

Our basic index is a weighted average of the individual prices where weights are computed using the average shares in overall production for the commodities during 1987-2010. Then, to ensure that our results are not overly influenced by oil and coal, which account for 64 percent and 20 percent, respectively, of overall commodity production, our second index omits these two.

Figure 1 displays both indexes computed without extraction costs (the simple version of Hotellings theory). Both indexes indicate, again, that the data contradict the theory. The basic index displays no significant growth (0.19 percent per year). The second index has a negative trend (-1.18 percent per year). That is to say, commodity prices (excluding oil and coal) do not rise at all. let alone at the real interest rate.

%img src=/

/media/images/pubs/eppapers/14-5/epp_dec2014_commodity_fig1.gif?la=en /%

For the theorys more sophisticated versionincluding extraction costswe assume that costs including extraction are 90 percent of the initial price. Figure 2 displays our results under this assumption for the basic 11 commodity price index, without extraction costs, and with extraction costs and the two interest rates (1 percent and 4 percent). Our results for the price index excluding oil and coal (not displayed) are similar.

%img src=/

/media/images/pubs/eppapers/14-5/epp_dec2014_commodity_fig2.gif?la=en /%

For both interest rates and both indexes, this more sophisticated version of the theory implies that extraction costs fall so fast that they quickly turn negative! Obviously, actual extraction costs cannot be negative. Therefore, it appears that even when we allow for extraction costs, we are still left with a Hotelling puzzle. His landmark theory is not consistent with actual data.

Further refinements of the analysis do no better. When we repeat the exercise using the simple theory (excluding extraction costs) with an expanded set of commoditiesbeyond the 11 for which we have long historical sampleswe again find that average prices fall over time, at an annual rate of -2.92 percent since 1964. If we include extraction costs and use the expanded commodity set, the results are slightly different. While the 1 percent interest rate results still require negative extraction costs, a 4 percent interest rate maintains positive extraction costs. Unfortunately, closer analysis of these results has found that they too are inconsistent with the Hotelling principle. 3 The puzzle persists.

Conclusion

Policymakers are troubled by large price fluctuations in commodity markets in recent decades. For example, monetary policymakers are concerned about dramatic variations in the prices of energy-related commodities and how they impact the inflation rate. (Indeed, such trends in the 1970s led to the creation of the core inflation index, which excludes volatile price components such as energy.) In our view, devising appropriate policy responses to such fluctuations requires an economic theory that is consistent with the data.

Unfortunately, current theory fails in this regard. This paper has shown that existing models suggest that the payoff from leaving exhaustible resources in the ground is on average lower than the payoff from extracting all resources immediately and investing the proceeds in financial assetsin obvious contradiction of reality and of Hotellings 1931 theory (the basis of current models) developed to explain price trends for such commodities. We refer to this failure as the Hotelling puzzle.

Simply stated, the mystery is this: Why dont owners of exhaustible resources extract resources at a much more rapid rate than they actually do, as theory suggests they should to maximize revenue? The answer, of course, must lie in a failure of one or several of the theorys assumptions, and we suspect that specification of extraction costs is at the root of the problem. If we assume that costs are related both to the rate at which the resource is extracted and to the size of the existing stock of resources, then it may be possible to reconcile the data with a more sophisticated version of Hotellings theory. We are exploring this idea in ongoing research.

Endnotes

1 See Hotelling (1931).

2 For details about these data, see Harvey et al. (2010). The data were kindly provided to us by the authors. The prices in our table have been deflated by an aggregate price index in Harvey et al (2010). The 11 commodities used in our analysis are aluminum, coal, copper, gold, lead, nickel, oil, iron, silver, tin and zinc.

3 A number of studies show that the data are inconsistent with the more sophisticated version. As Krautkraemer (1998) writes: Empirical tests of the dynamic behavior of in situ value have generally failed to support the Hotelling implication that in situ value increases at the rate of interest (p. 2079).

References

Hotelling, Harold. 1931. The economics of exhaustible resources. Journal of Political Economy 39 (2), 137-75.

Harvey, David I. Neil M. Kellard, Jakob B. Madsen and Mark E. Wohar. 2010. The Prebisch-Singer hypothesis: Four centuries of evidence. Review of Economics and Statistics 92 (2), 367-77.

Krautkraemer, Jeffrey A. 1998. Nonrenewable resource scarcity. Journal of Economic Literature 36 (4), 2065-2107.