The One Stock I Would Build A Retirement Portfolio Upon At Any Age AT&T Inc (NYSE T)

Post on: 16 Март, 2015 No Comment

Summary

- There are times when it does not matter what age you are when you begin a retirement portfolio, you need to start with at least ONE stock.

- A dividend aristocrat with nearly a 6% yield is a great start for just about everyone.

- Higher yields and income right now, and more every year after that.

Many of my newest subscribers have asked me if I were to build a retirement portfolio from scratch, right now, which stock would I buy. As far as I am concerned, the answer is quite simple: AT&T (NYSE:T ).

Why T?

Let me see if I can make this as simple as possible to understand without getting too technical about the company itself.

- The current dividend yield is about 5.65%.

- The price-to-book value is an extremely low for a stock of this kind at 1.88.

- The share price is way too cheap ($33.63 as of this writing) for what the company offers, and is more than 15% off of its 52-week highs, and not that far from its 52-week low of about $32.00.

- The company is nearing the completion of DIRECTV (NASDAQ:DTV ) which will be accretive virtually immediately.

- T will own National Football League TV rights which has been extended by the NFL to DTV.

We are pleased to continue our partnership with DirecTV, said NFL Commissioner Roger Goodell. DirecTV and NFL Sunday Ticket have served our fans well for 20 years and continue to complement our broadcast television packages. We also appreciate DirecTV’s commitment to NFL Network, which it has carried since the channel launched in 2003.

As far as I am concerned, this one product alone, owned by AT&T for all of its customers, should regenerate internal as well as external growth at higher margins than cell phones!

Let’s not forget that football fanatics also are fantasy football league managers, and the new agreement will also have a dedicated channel just for fantasy football fanatics. or the FFFs as I call myself (yes, I came in second in my league this year. I missed by an extra point to win it all!)

The dedicated fantasy channel offers added value to the complete NFL TV package and reaches wide demographics of viewers. Why? Well, by the nature of fantasy football, the viewer needs to see multiple games at the same time to watch his team, and ONLY AT&T will have that.

According to the Fantasy Sports Trade Association, there are now 33 million people playing fantasy football each year. They also include an estimated 6.4 million women.

Guess what, it has been estimated that the fantasy football market is worth $70 billion all by itself! Think of the ways that T could generate revenue from having the whole ball of wax!

- Paid or free fantasy play for AT&T subscribers to the NFL package.

- Dedicated apps for mobile devices that link the channel up to tablets and cell phones either free with a subscription or a fee for non-subscribers.

- The potential to stream the NFL channels on AT&T devices as either added value for proprietary content, or a fee-based subscription for stand-alone access.

I can think of plenty more marketing initiatives that T will be able to do, but I believe you are getting the picture here. I am not suggesting that T will grow revenue by all of the estimated $70 billion, but even 5% of the market is $3.5 billion. out of virtually nowhere, right to the top and bottom line, with gross margins that will more than likely be in line if not better than anything else T has to offer (currently at nearly 59% by the way).

$3.5 billion x 59% = $2.065 billion in gross profit.

There is no other telecom company that will have this, so this deal all by itself will separate T from the pack, and quicker than a pick-pocket in Times Square on New Year’s Eve.

It STILL Is All About Income Anyway

Like I said, investors at any age, a portfolio can be built with AT&T as the one core stock for reliable income. The company is a dividend aristocrat with a current dividend of $1.88/share. If ALL you have at this very second is $33,630 and want the least amount of risk to generate the most amount of income at whatever age you are, T is just about as good as it gets for an equity (which always has risk involved, and do not forget that).

1,000 shares of T x $1.88/per share = $1,880 annual income.

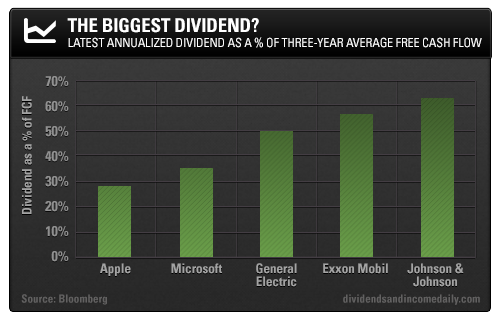

I cannot think of any security that pays nearly 6%, and has increased its dividend for 31 consecutive years, can you?

I think the above chart is pretty cool. The 30-year Treasury rate is LESS than 1/2 the dividend yield of T. On top of that, the Treasury does not increase its income given to you, ever. T has increased its dividend (income for us) greater than inflation for 31 straight years.

The Bottom Line

Where would you like to start a dividend income portfolio for retirement? Treasury? Annuities? Or shares of AT&T?

Have I mentioned that internal and external growth could return to T as well? That could mean capital appreciation of about 15% if it just returns to its 52-week highs.

Disclaimer: The opinions of the author are not recommendations to either buy or sell any security. Please remember to do your own research prior to making any investment decision.

Disclosure: The author is long T. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.