The one reason why gold s selloff doesn t matter

Post on: 5 Сентябрь, 2015 No Comment

Share on Facebook Twitter

April 15, 2013

Sydney, Australia

Somewhere, Paul Krugman is smiling.

The Nobel Prize winning economist, whose brilliant ideas include:

- spending your way out of recession

- borrowing your way out of debt

- conjuring unprecedented amounts of currency out of thin air without consequence

- staging a false flag alien invasion of planet Earth

is perhaps most famous in certain circles for calling gold a barbarous relic . He also recently suggested that Europes failing euro monetary union is the modern day equivalent of the gold standard. Im told he was completely sober when he said this.

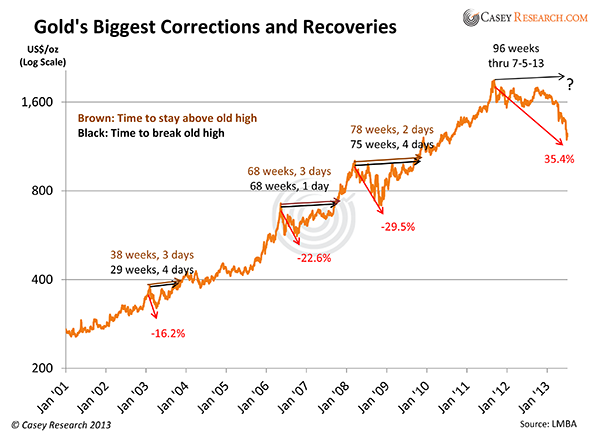

Of course, Krugman is smiling right now because he thinks that hes been proven right. Golds massive sell-off over the last few days has shaved over $200 from the metals nominal price a steep move any way you look at it.

And as Krugman has been saying, gold is not a safe investment. But thats because he fails to understand the fundamental premise of gold.

Gold is, in fact, a terrible investment. Its an even worse speculation. But lets look at what those actually mean

When you invest, you risk a portion of your savings, typically for several years, hoping for a nominal gain when denominated in paper currency. You buy for $1,000 and you sell for $2,000.

Speculating involves taking much higher risk, often for shorter periods of time with a smaller percentage of your portfolio, hoping for outsized nominal gains when denominated in paper currency. You buy for $100 and you sell for $2,000. But you could easily lose everything.

Well, gold makes for a really bad speculation. Like almost any real asset, it cant really go to zero. Its physical. Its real. Its always going to be worth something. And for physical gold, theres very little leverage available.

Gold makes for a bad investment too because in either case, the price of gold tends to rise and fall over the long-term with inflation and inflation expectations. If its leading (or keeping pace with) inflation, then you cant expect much of an inflation-adjusted return.

But these reasons for buying gold miss the point.

Gold is a proxy against the financial system. Its a way to withdraw savings from a corrupt fiat currency and hold something that cannot be conjured out of thin air by a tiny banking elite. We dont buy gold hoping to sell it down the road for even more paper currency.

This is the same reason why Im buying so much agricultural property in South America its controlled by nature, not by men. Plus, I get paid huge dividends by way of organic fruit.

If you look at the fundamentals briefly, gold had a major sell-off this morning in part because the Chinese reported poor economic data. In addition there was Fridays pitiful consumer numbers in the Land of the Free.

Yet with

poor economic data still abounding from the US to China

massive, debilitating debt still accumulating

Europe still completely bust..

Japan promising unprecedented money printing in an era already marked by unprecedented money printing

what will the general trend be? Will central bankers around the world continue printing money?

It certainly seems likely. If they stop printing, interest rates surge and nearly every government in the developed word will go bankrupt. Thats a big incentive to bankers.

With this in mind, while the gold correction probably has quite some time to play out, the long-term trend is obvious.

Our goal is simple: To help you achieve personal liberty and financial prosperity no matter what happens.

If you liked this post, please click the box below. You can watch a compelling video youll find very interesting.

Will you be prepared when everything we take for granted changes overnight?

Just think about this for a couple of minutes. What if the U.S. Dollar wasnt the worlds reserve currency? Ponder that what if

Empires Rise, they peak, they decline, they collapse, this is the cycle of history.

This historical pattern has formed and is already underway in many parts of the world, including the United States.

Dont be one of the millions of people who gets their savings, retirement, and investments wiped out.

Click the button below to watch the video.

Click Here to Watch the Video