The mutual fund route to international investing

Post on: 24 Апрель, 2015 No Comment

The international investing theme is as much about finding new investment opportunities as it is about diversifying your portfolio. But you have to choose your international fund with care.

Shanthi Venkataraman

The world is our oyster. Or, in fund manager-speak, The world is our investment universe! Thats the message Indian mutual funds are trying to convey through the spate of global or international fund offers that hit the market in the last year. With the limits for overseas investing by mutual funds having been relaxed considerably since the last Budget, the market has witnessed more than a dozen new fund offers dedicated to international investing, with a few more in the pipeline.

With all these high-decibel launches, most mutual fund investors would be familiar with the argument for investing overseas by now. The need for diversification, the promise of a wider investment universe with India accounting for barely 3 per cent of world market capitalisation the opportunity to invest in themes that are under-represented in India and, significantly, the fact that several markets besides India have delivered spectacular returns in recent years.

Differentiated menu

While the case for international investing may be familiar and simple; the funds on offer are not. In fact, unlike earlier themes, such as infrastructure or multi-cap or small-cap funds, that have tended to spur a host of me-too fund launches, offerings within the international investing theme are now quite differentiated. Good news for investors, who can be selective in choosing funds that suit their diversification needs and risk profile.

Within this group, there are the truly global funds (not restricted to any region) such as Birla Sun Life International Equity Fund, DWS Global Thematic Offshore fund and Principal Global Opportunities, which invest across markets, stocks and sectors. Their proposition is that one region or market cannot continually outperform and that it is possible to find top performing stocks even in low-return markets.

For investors with a strong home bias, there are funds that invest in regions closer to our borders, such as the ICICI Prudential Indo-Asia Fund or Franklin Templetons latest offering, Franklin Asian Equity Fund. Fidelity International Opportunities has a go-anywhere mandate, but focuses on the Asia Pacific region excluding Japan. The ABN AMRO China-India fund takes a more regional approach by focussing on the two Asian tigers alone.

Funds such as Kotak Global Emerging Market and Sundaram Global Advantage widen their investment universe to include emerging markets across Asia, Eastern Europe and Latin America. It is not too hard to sell the growth story of emerging markets to Indian investors, seeing the kind of returns some of these markets have generated over the last four years.

These markets have historically low correlation (that is, their stock markets dont often move in tandem) though they have become increasingly connected in recent years.

Asian funds seek to capitalise on the same features that make India an attractive investment opportunity; fast-growing economies, strong domestic drivers in the form of infrastructure and consumer spending and, in most cases, nascent stock markets.

In fact, with heightened infrastructure spending being a dominant theme across growing economies, funds such as Tata Indo-Global Infrastructure fund and Kotak Indo World Infrastructure fund seek to invest in a combination of Indian and global infrastructure companies.

Unique options

The international investing theme is, however, as much about finding new investment opportunities as it is about diversifying your portfolio. Funds focussed on Asia allow the advantage of complementing ones portfolio with stocks of hardware exporters, consumer electronics makers, travel companies or online portals and other consumption plays, for which there are few listed options in India.

Similarly, emerging market funds that invest in countries such as Brazil and Russia offer exposures to mining, precious metals, oil, natural resources and other commodity stocks that are not so plentiful in India. Recent fund launches have gone beyond narrowing in on regions alone and offer exposures to new asset classes. The option to invest in exchange traded funds (ETFs, capped at $50 million per fund) and real estate investment trusts (REITs) listed overseas has also prompted some unique fund launches. Sundaram BNP Paribas Global Advantage, in addition to investing in emerging markets, also has the mandate to take a small exposure to ETFs tracking commodities and global REITs.

ING Vysya Mutual Fund recently opened the ING Global Real Estate Fund, which invests in real estate investment trusts and global real estate stocks. The fund seeks to provide higher returns than Indian fixed income, but with lower volatility than Indian equity. DSP Merrill Lynch World Gold Fund invests in stocks of gold mining companies. When gold prices rise, the profits of gold companies increase more than proportionately, thanks to the leverage effect. Therefore, stocks of gold companies can outperform gold prices by a significant margin.

Mode of investing

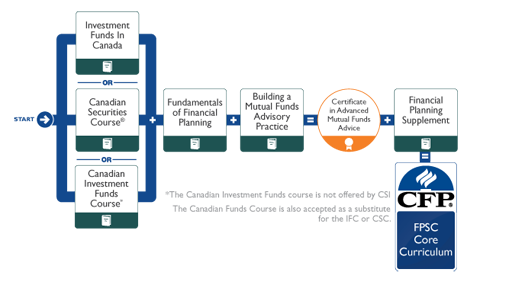

How do local mutual funds manage to invest overseas and across asset classes? Do they really have the resources and the expertise? Most funds that have an international backing, such as Franklin Templeton, Fidelity International or DSP Merill Lynch, have access to research from their international fund management teams or re-direct investments into an existing overseas fund.

For instance, Templeton India Equity Income, a fund that invests in value stocks with a bias towards emerging markets, is managed by Dr Mark Mobius, Managing Director of Templeton Asset Management and Lead Portfolio Manager of Templeton Emerging Markets Fund. DSPML World Gold Fund simply invests in Merill Lynch International Investments World Gold Fund, which in turn invests in gold mining companies. Sundaram BNP Paribas Global Advantage, on the other hand, adopts a fund-of-funds approach to investing. FundQuest International, a unit of BNP Paribas Asset management, specialises in multi-manager and multi-asset class products. FundQuest chooses international funds to take exposure to different markets.

Diversifying the portfolio

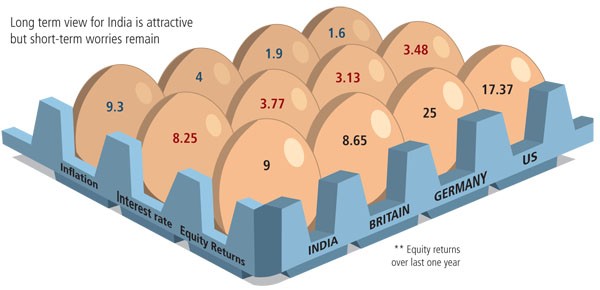

How have the international funds launched so far fared? Not too well, when compared with the Indian market. However, it is too early to comment meaningfully on performance; most funds have been launched in the last few months, which has been an exceptional period for Indian equities. In any case, you need to view these funds from a long-term perspective; they could cushion your portfolio at times when India-specific factors dampen domestic equities.

Also, as each fund has a different proposition, it is best to compare each fund to its benchmark rather than with the category average. While most of these ideas do make for appealing investment options, they do have some limitations. Most of these funds invest at least 65 per cent of their assets in Indian equities to qualify as an equity fund under Indian tax laws, and get the related tax benefits. Only a handful of them offer a complete exposure to global markets. This limits the diversification benefits, especially if you are going to invest a small portion of your portfolio in such a fund.

How to choose

If you wish to adequately diversify your portfolio:

Go for completely global funds to maximise the diversification to your portfolio. Do not avoid 100 per cent global funds just to enjoy the tax benefits of Indian equity funds. These are, in any case, restricted to dividend payouts and do not impact capital gains.

Considering the variety on offer, you can afford to add more than one international fund to complement your Indian portfolio. For instance, one that offers exposure to an exciting region and another to an emerging asset class. Restrict such funds to 5-10 per cent of your portfolio, as your core portfolio needs to be in investments you can track easily.

Invest according to your risk appetite. Other emerging markets offer wider investment opportunities but are as susceptible to global meltdowns as Indian stocks.

Invest in themes where there is a dearth of investment options in India, such as commodities, real estate, natural resources, energy, bullion, and so on. Such funds would add greater value to your portfolio, both from a diversification and a returns perspective.

Stay invested in international funds for at least a three-year period. The diversification benefits play out only over the long term.

Finally, a caveat. Overseas investing does carry currency risks. The rupee movement has been sharpest against the dollar, so far. But any further strengthening in the rupee against Asian and other currencies could dilute the returns from these funds.

(This article was published in the Business Line print edition dated December 9, 2007)