The Most Liquid Futures Contracts Are Your Best Bet

Post on: 22 Май, 2015 No Comment

Contracts Put You in.

the Drivers Seat

In this page, we’ll talk about the most liquid futures contracts and markets in the following order:

- The most Liquid Futures Contracts — Overview

- Futures Liquidity — Defined

- Defining Futures Open Interest

- Futures Open interest and Volume — Using them together

You’ll get a better handle on the importance of liquidity in futures trading, and the related concepts of volume and open interest, how they work together, and how you can use them to enhance your commodity trading.

The Most Liquid Futures Contracts

An Overview

The most liquid futures contracts and markets are those with which, and within which, you can enter and exit a trade almost immediately.

Some of the main advantages of trading in highly liquid futures markets are:

- exceptionally rapid fills of your entry and exit orders

- extremely advantageous entry and exit price points

The main benefit of course is extracting optimum profit potential should the trade move in your favor.

In these highly liquid futures markets, there are a very large number contracts being continuously traded, providing willing buyers and sellers to enter into a trade with your desired long or short position.

The Most Liquid Futures Contracts

Just What is Liquidity?

There are a couple of related definitions. Overall, a high level of trading and open interest characterizes liquidity.

It is basically your ability to take an asset and quickly converting it into cash. or in our case, buying or sellinga specific commodity futures (or options) contract in the market, with little to no affect on your desired contract entry or exit price.

High liquidity allows for little to no affect on the desired entry price point into, or desired exit price point from a futures contract and market.

Whereas a commodity affected by low liquidity or trading activity can mean slow order fills and/or less desirable order entry and exit price points.

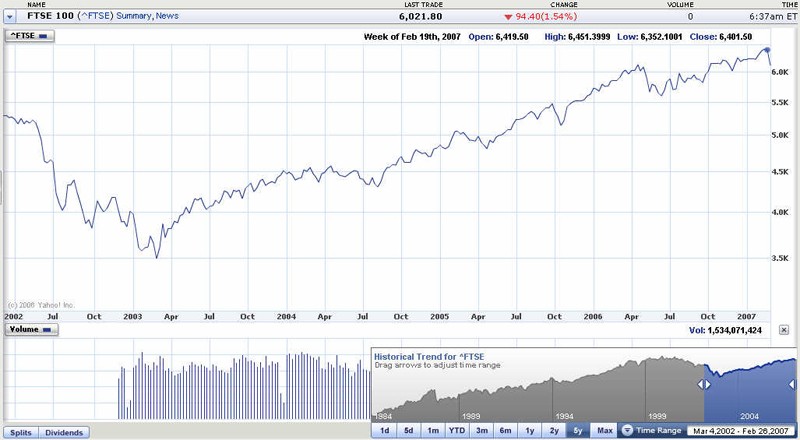

Some of the other most recognizable and most liquid futures contracts and markets include:

- S&P 500

- Treasury Bonds

- Eurodollar

Other highly liquid commodity markets are:

- Crude Oil

- Gold

- Corn

The Financial commodities and futures markets deal with the ultimate commodity — money.

And because financial markets are central to everything that goes on around the world. it’s no surprise that these commodities are among the most liquid futures contracts, and are among the most heavily traded markets.

The Most Liquid Market

The single most liquid futures market in the world is the FOREX — Foreign Exchange — or more precisely, the Foreign Exchange Currency market.

More business is transacted daily in FOREX than in all other worldwide financial markets combined. Billions, Trillions of dollars worth.

It’s just mammoth. And it keeps increasing.

It truly gives you the opportunity to trade the most liquid futures contracts on the planet.

With that sort of futures market liquidity, and with effective, around the clock 24 hour trading, executing a FOREX buy or sell order is almost instantaneous, if not so.

But don’t jump into FOREX right away. you need to educate yourself on that market very well to improve your odds of success there.

Keep in mind that in the financial and FOREX markets in particular, you’ll be going up against some of the most educated, brilliant, and well funded minds/firms in the trading universe. You really want to know your stuff before venturing into trading in these deep waters.

To succeed futures trading, it isn’t necessary to trade the MOST liquid futures contracts.

Just ensure the futures contract, month and market you are considering has sufficient liquidity so as not to negatively impact your futures trading strategy.

If in doubt, your broker, qualified financial advisor or CTA can assist you with questions on this aspect.

Trading Volume Defined

In futures trading, volume is the number of contracts traded in a particular commodity future during a specified period of time (daily, weekly, etc.).

A contract is made up of one buyer and one seller.

A commodities’ daily volume comes out the next trading day. So a particular day’s exact volume is always a day behind. However commodity volumes are also reported throughout the trading day.

Although fluctuating until trading is complete for that day, volume estimates during the day give traders a reasonably tool and ideas how it’s operating during the trading day with respect to a specific futures contract.

Volume helps gives futures traders a window into the relative liquidity of a commodity in question.

As futures trading is dynamic, changing all the time, so is trading volume.

One example of this is as futures contracts move closer to the FND (first notification day) on a front month contract. volumes tend to drop with traders exiting their positions and/or re-entering again in further out contracts. which tends to increase volumes in those further out months.

What is Futures Open Interest ?

Another tool related to both liquidity and volume — and worth incorporating into your trading analysis — is data provided by Open Interest.

As noted elsewhere, a futures trade requires both a buyer and a seller.

No trade occurs with just one or the other.

Futures Open Interest measures the total number of Open, or active futures contracts — — — buyers AND sellers — — — in a commodity market.

This includes all contracts in a specific commodity that have been traded (bought or sold), but not yet expired or terminated.

An increase in Open Interest means new buyers and/or sellers of new, open futures contracts are entering the market.

How Futures Open Interest

and Volume. Work Together

When evaluating a commodity futures open interest and trading volume, . (and/or using these indicatorsto help gauge a futures market liquidity). there are some good guidelines worth following.

Put this info into your overall trading analysis and decision making process to help you make better, more informed and hopefully more profitable commodity trades.

- Falling trading volume and falling open interest :

This tends to signal a market where the number of traders wishing to exit their positions is greater than the number traders willing to accommodate them and offset their positions.

- Falling volume and RISING futures open interest :

This tends to signal traders coming slowly coming into a market and establishing a position.

- RISING volume and falling futures open interest :

This tends to suggest traders are liquidating their positions.

- RISING trading volume and RISING open interest :

When both these indicators are on the upswing, it tends to confirm a trend, with more traders and moreopen contracts coming into a commodity market.

Hopefully this section helped you to gain a better understanding of some the most liquid futures contracts and markets, the value of liquidity when futures trading, the importance of using both trading volume and open interest in assessing a futures’ market liquidity. and as an extra tool in your futures trading analysis.

Return to Home Page from Most Liquid Futures Contracts page

FUTURES TRADING and FOREX TRADING DISCLAIMER:

Trading in Futures, Index Futures and Options of Futures involves

substantial risk, may result in serious financial loss, and is not

suitable for everyone.

As with Future Trading, trading Foreign Exchange instruments carries

the same substantial risk of financial loss, and is not suitable for many

members of the public.

In trading any of the above mentioned financial instruments, only risk capital should be used.

The information on this website is provided purely for informational

purposes only.

You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

Futures-Trading-Mentor.com expressly disclaims all liability for the use or

interpretation by others of information contained in this site.

Decisions based on the information contained in this site are the sole responsibility of the visitor, and in exchange for using this site, the visitor agrees to hold Futures-Trading-Mentor.com harmless against any claims for damages arising from any decisions that the visitor makes based on such information.

While the information on this website is believed to be accurate at the time it is posted, we cannot give any assurances that the information is accurate, complete or current at all times.