The Mantra on Wall Street Is ‘Don’t Fight the Fed’ but Do You Know What the Fed Is Doing And Where

Post on: 16 Март, 2015 No Comment

The main mantra on Wall Street is ‘Don’t Fight the Fed’ . implying that if monetary policy is geared towards easing – lowering of interest rates then riskier markets are the game in town, and if monetary policy is geared towards tightening – rising interest rates – then volatile markets are to be avoided. But do we know what the Fed is up to?

I. DOW, S&P 500, QE, and Tapering

Both the DOW and S&P 500 are sitting at all-time highs. Since bottoming out in early March 2009 (DOW . S&P 500 ). the DOW is up approximately 150% and the S&P 500 approximately 180%. Astronomical returns no matter what period you compare this to.

It’s no secret that the only reason the markets have been soaring is because of unlimited quantitative easing [QE], i.e. stimulus, stimulus, and indefinite-stimulus “fundamentally a regressive redistribution program that has been boosting wealth for those already engaged in the financial sector or those who already own homes, but passing little along to the rest of the economy.”

By December 2012, funds were being pumped into the markets to the tune of $85 billion a month a last resort, desperate measure that the FOMC began so that their ‘growth’ targets could be met. This was tapered down to $65 billion a month in June 2013, which resulted in a major sell off in the markets “the stock markets dropped approximately 4.3% over the three trading days” prompting the Fed to “hold off on scaling back its bond-buying program”, underscoring the fact that the Fed still has Wall Street’s back and is still in the business of transferring wealth from Main Street to Wall Street .

After the initial shock that ‘free’ money was going to be less readily available subsided and the markets stabilized, the tapering continued ; “after three additional reductions, the program currently stands at $45 billion per month. Fed Chairman Janet Yellen expects the program to wind down steadily through 2014 and conclude by year-end, assuming the economy remains healthy.”

“The FOMC will likely continue to taper the pace of its asset purchases by a further $10 billion — split equally between Treasuries and mortgage-backed securities — as hinted at in Chairman Bernanke’s press conference following the December meeting. While the Committee has taken pains to note that the path of asset purchases is not on a preset course, a substantial change in the outlook would likely be required for the Fed to either pause or accelerate the gradual pace of tapering started at the last meeting. We think this relatively high bar has not been met, some weaker recent data notwithstanding. Based on a roughly $10 billion per meeting tapering schedule, the last QE3 purchases should occur in October 2014.”

II. The Fed and Belgium

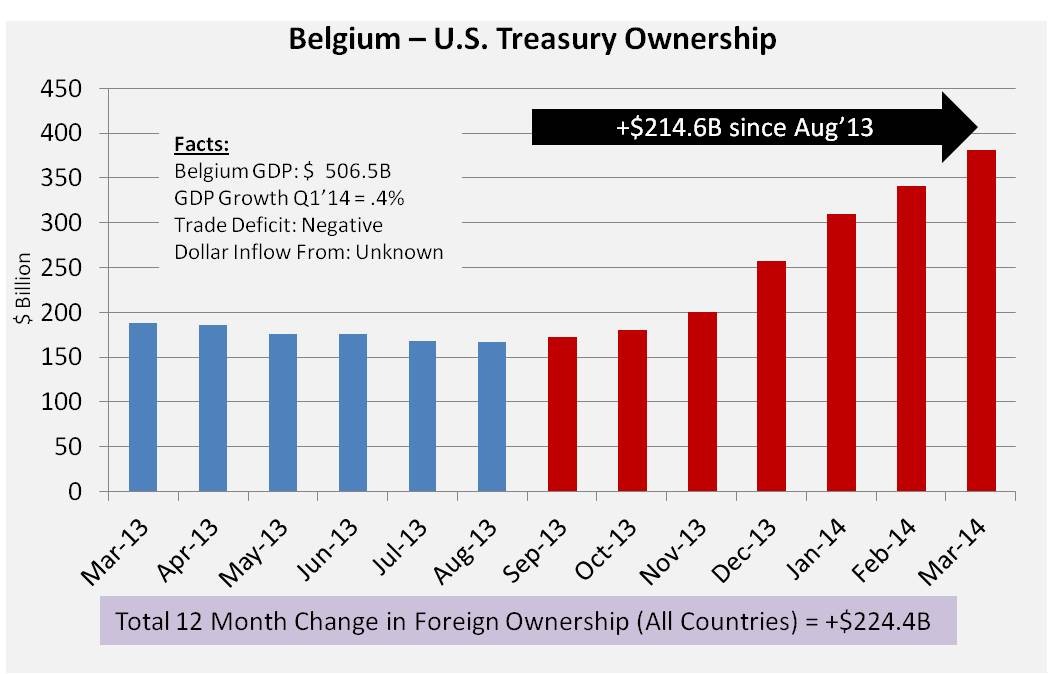

But all is not as it appears. According to Paul Craig Roberts and Dave Kranzler, “The Fed Is The Great Deceiver” it has not been tapering, but pumping more funds into the markets than ever before.