The History of ExchangeTraded Funds

Post on: 3 Апрель, 2015 No Comment

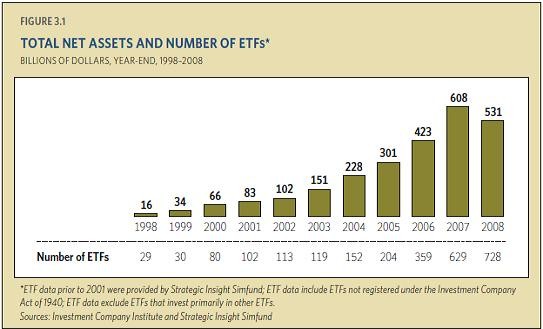

In 1992, the American Stock Exchange (Amex) made use of the Securities and Exchange Commissions (SEC) SuperTrust Order to request use of the first authorized stand-alone index based exchange-traded fund (ETF). That petition was approved by the SEC and it paved the way for the release of the S&P Depository Receipts Trust Series 1, or SDPRs. In time, they quickly gained acceptance in the marketplace and became the first commercially successful ETF.

The first U.S. listed ETF was the SPDRs (Ticker: SPY) which launched on the Amex in 1993. The fund is benchmarked to the Standard & Poors 500 Index. Later on, ETFs based upon widely followed benchmarks like the NASDAQ-100 (Ticker: QQQQ), Dow Jones Industrial Average (Ticker: DIA) and others would follow.

Key Legal Structures

Traditional bond and equity ETFs are generally organized as open-end funds or unit investment trusts (UITs).

Investment products that track commodities, currencies, or other specialized strategies are typically registered as grantor trusts, exchange-traded notes, or partnerships. Although some of these structures share similar characteristics to traditional ETFs, they are not necessarily registered or taxed the same.

As the ETF universe evolves, the variety of product structures will likely follow suit.

Heres a brief summarization of related legal structures.

Open-end index fund

The majority of ETFs follow the open-end structure because it allows the greatest flexibility. Dividends in these types of funds are immediately reinvested and paid to shareholders on a monthly or quarterly basis. This ETF design is also permitted to use derivatives, portfolio optimization, and lend securities. Open-end funds are registered under the Investment Company Act of 1940. ETF families that have this legal structure include iShares, Select Sector SPDRs, PowerShares, Vanguard, and WisdomTree.

Unit Investment Trust (UITs)

The oldest and best known ETFs including the BLDRs, Diamonds, SPDRs, and PowerShares QQQ Trust are organized as UITs. This type of legal structure does not reinvest dividends in the fund, but instead holds dividends until theyre paid to shareholders quarterly or annually. These mechanics cause a situation known as dividend drag. UITs must fully replicate the indexes they track and receiving income from loaned securities is not permitted. Unlike open-end funds, UITs have expiration dates which can range from a period of years to decades. Most expirations are continuously rolled or extended. UITs are registered under the Investment Company Act of 1940.

Grantor Trust

This type of legal structure distributes dividends directly to shareholders and allows them to retain their voting rights on the underlying securities within the trust. The original securities in a grantor trust remain fixed and arent rebalanced. Grantor trusts are registered under the Securities Act of 1933. The streetTRACKS Gold Shares, iShares Silver Trust, Merrill Lynchs HOLDRs and CurrencyShares follow this format.

Exchange-traded Notes (ETNs)

ETNs are registered as debt instruments that pay a return linked to the performance of a single security or index. The operating structure of ETNs is particularly suited for specialized asset classes such as commodities and emerging markets. Under the current tax law, commodity and equity ETNs are taxed as prepaid contracts. This means investors incur tax consequences only upon the sale, redemption, or maturity of their note. ETNs are registered under the Securities Act of 1933.

In December 2007, the U.S. Internal Revenue Service issued an adverse tax ruling on currency linked ETNs. The rule stated that any financial instrument linked to a single currency regardless of whether the instrument is privately offered, publicly offered or traded on an exchange should be treated like debt for federal tax purposes. This means that any interest is taxable to investors, even though the interest is reinvested and not paid out until the holder sells any such financial instrument, including an ETN, or the contract, matures. It also means that gain or loss on sale or redemption will generally be ordinary, and investors will not be able to elect capital gain treatment. The IRS is expected to rule on the tax treatment of ETNs linked to commodities and stocks.

Partnerships

Some index linked products that resemble ETFs are actually operated as master limited partnerships (MLPs). Unit holders are required to report their share of the MLPs income, gains, losses and deductions on their federal income tax returns even if cash distributions are not made.