The Golden Truth The Precious Metals Sector

Post on: 2 Июнь, 2015 No Comment

Wednesday, June 26, 2013

The Precious Metals Sector

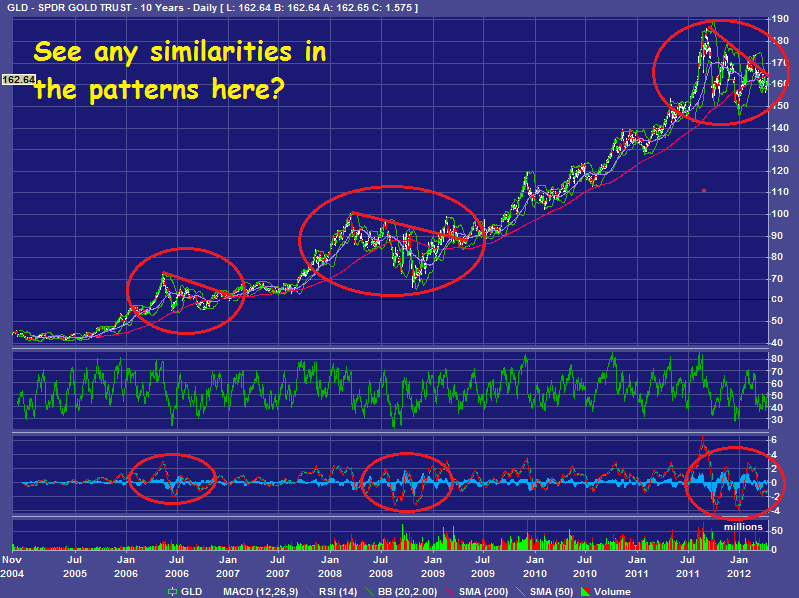

It might help to put what’s going on right now into context. The entire sector is in a massive price correction that is almost a mirror image of the one in 2008. The percentage drops for gold, silver and the HUI top to bottom are almost identical to the percentage drop of each in 2008.

Whether or not this is the bottom is anyone’s best guess. But when this sector turns around, all hell will break loose on the upside. The BIG difference between now and 2008 is that now, individuals are buying aggressively physical gold and silver bullion coins on every price drop. Back then all individual/retail buyers of gold/silver disappeared for quite some time. An even bigger difference is that China is now buying an amount of gold that is equal to the global monthly mining output. Back then China was not really a factor. When this turns, the physical shortages that are developing and will become apparent will shock most people.

What makes this whole a ordeal a complete joke is that the reason given for gold’s demise is the end of QE. Well, how come the stock market keeps going higher? QE has created an absolute monster of a bubble in the stock and housing markets. It will end badly.

My colleague, who has about 35 years of experience in the financial markets, commented earlier today that you can smell desperation in these markets — desperation to beat down the metals and desperation to prop up stocks.. He is correct. One big problem for them is that Treasury bond market is leaking uncontrollably. Bernanke — in a comment that absolutely floored me but received almost no acknowledgement from the spin-meisters on financial tv — admitted that he’s puzzled by the higher interest rates since QE3 commenced. Puzzled? Hmmm — that’s not a good admission for this hubristic little troll who crawled out of Princeton’s ivory tower to re-write the laws of economics.

They’re desperate alright. This is a mirror of 2008, only the hidden catastrophe coming at us in the global financial system is going to be far worse than what hit in 2008. China’s financial system is insolvent and Italy is on the verge of a complete derivatives-fueled financial nuclear melt-down. Comically — yes it’s funny — the U.S. Too Big To Fail banks are exposed to both of those situations via off-balance-sheet derivatives. They may be short Italy and China via off-balance-sheet OTC derivatives, but try collecting when the other side defaults. AIG/Goldman x 10.

Please read the following commentary from Patrick Heller. I don’t often read his commentary because it reiterates a lot of what I already know. But this particular commentary from him does the best job I’ve seen of summing up the current situation with the precious metals sector: Gold Drop: An Opportunity?

Unfortunately, this cartoon embodies everything about our current state of affairs in this country vs. what it used to be like:

(sourced from jsmineset.com, click on chart to enlarge)