The Economic Crisis of 1893

Post on: 6 Апрель, 2015 No Comment

The Economic Crisis of 1893

The Panic of 1893 sparked a stock market crash that turned into the worst depression in American history up to that time. There were several causes for this panic, some of which are similar to the causes of America’s economic problems today.

Reading Railroad | Image Credit: Flickr.com

The financial panic began when the Reading Railroad declared bankruptcy. Soon afterwards, Industrial Black Friday hit, and 24 businesses failed per day in May alone. The crisis sparked a four-year depression in which 15,000 companies and 600 banks closed, and over $1 billion worth of bonds were defaulted. The national unemployment rate approached 20 percent.

Just as questionable lending practices and overinvestment in housing created a financial bubble that burst into crisis this past decade, the same practices in railroads created a bubble that inevitably burst in 1893. Added to the panic was the contentious debate over the value of gold and silver in the U.S. monetary system.

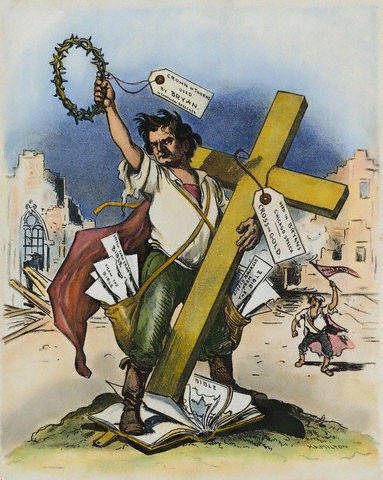

Gold versus Silver

The top economic issue of the time involved whether to coin silver along with gold in the U.S. currency system. Prior to the 1890s, gold backed the U.S. dollar, so the dollar’s value was directly related to the value of gold. Farmers and laborers opposed the gold standard because they believed it constricted the money supply and made money scarce for them. Miners opposed the system because silver mining was booming in the West.

From this, the Sherman Silver Purchase Act became law in 1890. This required the federal government to adopt a bimetallic monetary system in which the U.S. dollar would be related to either gold or silver. The law fixed the value of silver at 16 ounces to one ounce of gold. But as silver mining expanded, the silver supply increased. This meant the silver ratio should have been much higherperhaps 20 or 25 ounces to one gold ouncebut it was not.

As the silver supply increased, people began exchanging their silver for gold, which was more traditional, stable, and valuable. This decreased the U.S. Treasury’s gold supply, and since gold was the basis of U.S. international credit, the nation’s credit rating suffered. This was very similar to the downgrading of U.S. credit in 2011while the downgrade in 1893 was partly due to coining silver, the 2011 downgrade was partly due to the excessive printing of paper money.

The credit downgrading of the early 1890s damaged business confidence, which in turn devalued the U.S. currency system.

Railroad Overexpansion

Railroad construction had been the lifeblood of the U.S. economy since the end of the Civil War. Individuals, speculators, and banks invested heavily in railroads, with many of them investing beyond their means in the hopes that the payoff would cover the debts. Like the housing crisis of the early 2000s, too many people borrowed too much and expanded too fast using credit rather than tangible capital.

Eventually supply outweighed demand, and the market could no longer sustain such a high volume of railroad construction on borrowed money. Moreover, many railroads were financed through either questionable means or through the federal government (i.e. taxpayers), just as the housing market is primarily financed through the government (i.e. Fannie Mae and Freddie Mac) today.

Even worse, the overabundance of silver led to the closure of several western silver mines. These closures forced western railroads serving the mining towns to close. When the railroad bubble burst, economic chaos ensued, much like the bursting of the housing bubble in the 2000s.

Prominent railroads declared bankruptcy, including the Northern Pacific, the Union Pacific, the Reading, and the Erie. With less railroad construction came less need for steel manufacturing, and 32 steel companies closed their factories. Construction and manufacturing ground to a halt, and the depression arrived in full force in June 1893.

Who’s To Blame?

Like today, analysts blamed various sources. Gold supporters blamed the Silver Purchase Act for draining gold out of the Treasury and discouraging foreign investment. Silver supporters blamed the same act for not going far enough to save debt-ridden farmers with cheap silver. Samuel Gompers, head of the American Federation of Labor, blamed the greed of the capitalist class for overextending the railroads. Still others blamed certain classes, races, religions, or another dark, mysterious conspiracy.

Like the corporate bailouts today, New York banks loaned investors $6 million to halt the financial panic. And like today, this only delayed the inevitable crash. People rushed to withdraw their bank deposits, causing bank runs. Investors with high-interest bonds frantically tried to sell, causing a selling panic and making the bonds almost worthless. The price of silver plummeted.

Today, the Federal Reserve has sought to stabilize the economy by selling bonds and printing paper money. Just as the price of silver plummeted in 1893, the value of the U.S. dollar has plummeted today. In both instances, the value of gold skyrocketed.

Public Reaction

Like today, unemployment soared as a result of the crisis and subsequent depression. Many people could not comprehend such a crash, and, like today, stories of Wall Street greed aligned with political corruption horrified them. Members of Congress were involved in speculation and the allocation of corporate stock. And corporate lobbyists had pushed for tariffs on various imports.

Banks overflowing with paper and silver money offered loans at extremely low interest rates in the hopes of stimulating the economy. But nobody was borrowing because they feared the economic future. This is like today, in which the Federal Reserve has infused banks with paper money and offered low-interest rates to encourage borrowing, but fear of future economic uncertainty has prompted reluctance to borrow.

Most people blamed the coinage of silver for cheapening the monetary system. And since Democrats and Populists were the chief supporters of silver, they lost heavily in the 1894 elections. The Republicans gained more seats in that election than in any other in history. The Republican gain of 2010 came close to matching the 1894 gains, largely due to the same economic issues.

With economic uncertainty came unrest, largely in the form of protests and labor strikes. Jacob Coxey led a march of unemployed men on Washington to demand public works (i.e. pork barrel) projects that would create jobs. The press ridiculed them as radicals who would rather accept handouts than work. A massive strike against the Pullman Railroad Company in 1894 helped lead to the rise of the socialist movement in the U.S.

Government Response

President Grover Cleveland was among the last of the conservative Democrats who supported limited, constitutional government. This included a sound monetary system based on gold. As such, he opposed many in his party by calling for the repeal of the Silver Purchase Act.

Those opposed to repeal argued that coining more silver would provide government relief (i.e. like stimulus today) to the suffering masses. Cleveland countered that returning to the gold standard would be painful but necessary to sustain the free market.

After heated debate, Cleveland persuaded enough members of Congress to pass the Repeal of the Silver Purchase Act in October 1893. This helped boost business confidence and gradually stemmed unemployment. It also reduced runs on exchanging silver for gold, although the exchange was still being conducted at an unsustainable rate.

Bailing Out the Government

Congress had fixed $100 million as the minimum needed in the U.S. Treasury to keep up the gold standard. By 1893, reserves had fallen to $103.5 million and continued falling as more and more people exchanged their paper money, silver certificates, and silver dollars for gold. By January 1894, the Treasury’s gold reserve had fallen to $65 million.

In response, President Cleveland desperately authorized two bond sales that each generated $50 million for the Treasury in 1894. But this was not enough. When a third bond sale became necessary, Cleveland turned to Wall Street for financial help.

J.P. Morgan, the nation’s most powerful banker, agreed to bail out the federal government by loaning the Treasury 3.5 million ounces of gold. This enabled the Treasury to issue two more bond sales, one in 1895 and another in 1896. By the end of February 1896, the Treasury reserve finally climbed over the $100 million mark once more.

The Panic’s Long-Term Effects

Grover Cleveland’s support for the gold standard, coupled with his usage of perceived Wall Street greed to stabilize the gold reserves, doomed his future with the Democratic Party. After Cleveland, no conservative Democrat ever won another presidential election. Campaigning as champions of the workingmen, the Democrats fully embraced the coinage of silver in the 1896 elections. But they lost to William McKinley and the pro-gold Republicans.

Unlike today, the government did not use stimulus to address the crisis, and as a result the depression was over within four years. The repeal of silver purchasing, the gold loan, and the bond sales stabilized the economy, which gradually strengthened. The election of a pro-gold president in 1896, coupled with the discovery of gold in the Klondike in 1897, ended the depression. It also doomed the pro-silver cause.

In 1900, President McKinley signed the Gold Standard Act into law, which forever ended the coinage of silver in the U.S. monetary system. This ended in 1971 when President Richard Nixon took the U.S. off the gold standard. Since then, the currency system has been driven by paper money not backed by any precious metal, which has led to rampant devaluation and inflation.

Perhaps most importantly, the Panic of 1893 and the subsequent depression alienated many people from both the economy and the political process. This loss of confidence in the system led to the rise of Progressivism, which featured the notion that government leaders should handle the nation’s problems without the input of ordinary people. This strayed from the founders’ notion that people must always be involved in the political process to ensure their own liberty, and it has led to even further alienation. That alienation tends to expose itself most vividly in times of economic crisis and uncertainty, much like today.

Sources

- Schweikart, Larry and Allen, Michael, A Patriots History of the United States (New York: Penguin Books, 2004)

- Wallechinsky, David and Wallace, Irving, The Peoples Almanac (New York: Doubleday & Co. 1975)