The Cyclical Bull Is On Its Last Legs

Post on: 23 Апрель, 2015 No Comment

Even though the market has been in a 5-year cyclical bull market, the benefit of doubt still lies with the long-term structural bear camp due to the following chart.

S&P 500 Index Adjusted for Inflation (1999 – Present)

Adjusted for inflation, the S&P 500 is still lower than it was in 2000. This is very important because true bull markets are those that make investors money in both real (inflation adjusted) and nominal terms. The chart below shows what a long-term bull market should look like.

BULL MARKET- S&P 500 Index Adjusted for Inflation (1982 – 2000)

If stocks are unable to protect one’s purchasing power, then they are generally not worth the risks (especially if valuations are high). During a true structural bull market, stocks successively climb to a higher inflation adjusted plateau during each cycle, as was the case between 1982 and 2000. The ability to consistently compound wealth above the level of inflation is one of the keys to successful long-term investing. Even though the S&P 500 is 25% above its 2000 level in nominal terms, on a real basis, the index is still 10% below the 2000 peak. This is not the stuff that legendary bull markets are made of.

If we dig a little deeper into the recent inflation adjusted S&P 500 chart, we observe that the current 5 ¼ year old cyclical bull market that began in March of 2009 is exhibiting similar characteristics to the terminal stage of the bull cycles that ended in 2000 and 2007.

S&P 500 Index Adjusted for Inflation (1999 – Present)

With RSI Momentum

In the final stages of the last two cyclical bull markets, we saw monthly momentum stall out about a year before the final top was in. To be exact, stocks climbed higher for 15 months after momentum peaked in 1999 and they rallied for another 10 months after momentum stalled out in early 2007. Once again, we are seeing this same late cycle action as momentum began to stall out in May of last year and the market has continued to rally for 14 months. This points to the current bull cycle (that began in 2009) being on its last legs after an impressive 198% move.

Unlike the S&P 500, gold has done a very good job of staying ahead of inflation since the turn of the millennium. As mentioned, the ability to consistently compound wealth above the level of inflation is one of the keys to successful long-term investing. Having a portion of wealth in gold during periods when stocks are unable to keep ahead of inflation is a prudent diversification strategy. In direct contrast to the S&P 500, gold is ahead of its 2000 level in both nominal (+425%) and real terms (+250%). These superior return numbers even take into account the cyclical downturn that gold has been in during the past three years. Again, these real and nominal gains are the definition of a true structural bull market (like the S&P 500 was in from 1982 – 2000).

You don’t have to be a gold fanatic to realize the value of gold to a portfolio when it is in a bull market and the S&P 500 is in a structural bear market (as defined by the ability to get to new inflation adjusted highs during each successive cycle). We are now seeing the opposite situation in the gold inflation adjusted chart (shown below) that we are observing in the S&P 500 inflation adjusted chart. Specifically, gold has been trading down to sideways for the past twelve months, while its momentum has bottomed at a washed out level and is now trending higher. This is a nice set-up that points to the gold downturn being close to major pivot point. In contrast to the S&P 500, gold appears to be completing a cyclical bear market within the confines of a structural bull market.

Gold Price Adjusted for Inflation (1999 – Present)

Despite the frustration of seeing gold and gold mining assets decline during much of this final phase of US stock market euphoria, the asset class is actually setting up to do just what it is designed to do. Namely, preserve purchasing power for investors in a counter-cyclical manner and help keep their portfolios ahead of inflation when US stocks are not doing that job for them over long stretches. When the S&P 500 adjusted for inflation since 2000 chart (first chart on page one) is coupled with a valuation analysis, it becomes clear to us that gold still offers some major diversification benefits in the years ahead. Said another way, gold’s upward trending inflation-adjusted structural bull market will not be over until US stocks are able to keep ahead of inflation on a sustained basis. This is where valuations come into the picture.

In order to believe that US stocks are about to shatter the ceiling of the 2000 inflation adjusted highs and start a new secular bull market one must believe that equity valuations are compelling. As we illustrate in our concluding remarks below that just isn’t the case. In fact, we have rarely seen this deadly combo of multi-decade inflation adjusted stagnation and record high valuations. Usually by this stage of the bull market cycle, either valuations are still attractive for long-term investors and/or stocks have begun to exhibit a new cycle of inflation adjusted highs. At the moment, we have neither of these conditions present. Being stuck in a late stage cyclical bull market, in conjunction with a bigger picture inflation adjusted bear market and wildly high valuations, is a recipe for big disappointment in the years ahead.

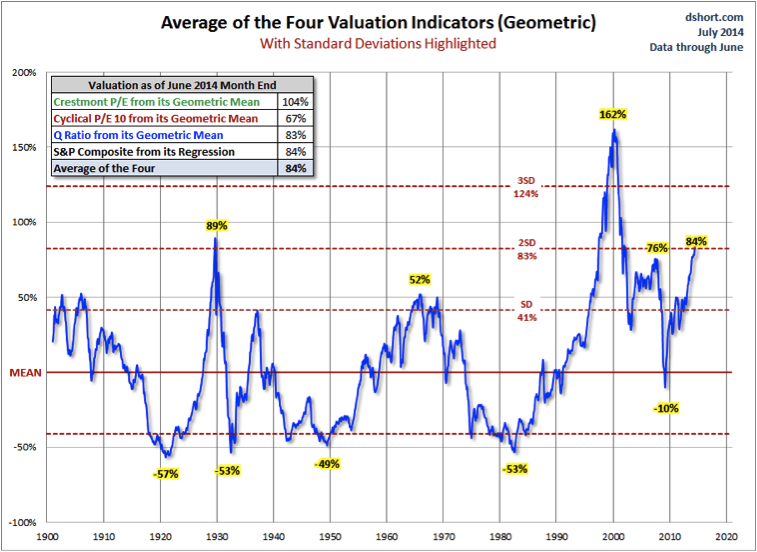

We will tie this all together with a quote from renowned hedge fund manager Stanley Druckenmiller; “Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction.” We don’t know when or from where that catalyst will emerge, but when it does, history tells us we have a LONG way to fall. In over 100 years of stock market history, we have only observed two periods with valuations as extended as they are at present: 1929 and 1999! Once the “catalyst” entered the picture to change the market momentum, stocks lost over 50% of their value, while the most overvalued sectors lost over 80% when all was said and done. It is for these reasons that we are proceeding with such caution even if there may be a few more percentage points of upside before the next bear market arrives.

US Stock Market Long-term Valuation Study

The above chart from Doug Short is one we have used before. It is a blended average of four classic valuation metrics. After June’s gains, the US stock market is now 84% (or two standard deviations) above its 114-year long-term mean. Again, this is not a market timing mechanism, but rather a gauge on how much downside risk exists once the party ends.