The causes and effects of a strong dollar

Post on: 7 Июль, 2015 No Comment

30th December 2014

The US dollar climbed significantly against a range of currencies during 2014, and this trend looks set to continue into next year.

Strong economic performance has underpinned the currencys rise. In December, the US Bureau of Labor Statistics revealed that total nonfarm payroll employment increased by 321,000 during November, and the unemployment rate was unchanged at 5.8 per cent.

According to the US Department of Commerces Bureau of Economic Analysis, real gross domestic product rose at an annual rate of five per cent in the third quarter of 2014 — up from 4.6 per cent during the previous three months.

Causes of the rising dollar

This trend comes in stark contrast to the performance of other major economies. China, Japan and the Eurozone have all displayed weaker growth and shown signs of relative stagnation, as Dr David Kelly, chief global strategist at JP Morgan Funds, recently pointed out in Barrons. Capital inflows mean fast-growing economies tend to have rising currencies.

Many analysts expect the Federal Reserve to raise interest rates during 2015, unlike the Bank of Japan or the European Central Bank. Investors like to hold their assets in whatever currency pays the highest short-term rates, so it makes sense to buy dollars now to take advantage of the expected appreciation.

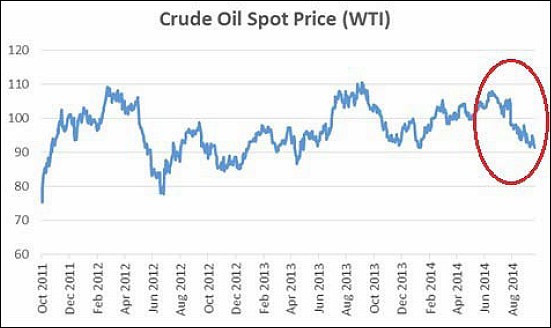

The US dollar is also benefiting from the shale oil revolution, which has significantly narrowed the countrys trade deficit. In 2005, 60 per cent of petroleum products were imported, but this figure is expected to be just 21 per cent next year.

Impact on the global economy

According to Dr Kelly, one of the most obvious consequences of a rising dollar is a negative impact on international investment returns.

Another problem is the effect on American firms with large foreign operations. In 2012, of the S&P 500 companies that provided details on foreign sales, almost 47 per cent of total sales came from abroad.

For these businesses, a strong US currency cuts the dollar value of international revenues and represents a drag on earnings.

Nevertheless, solid GDP growth combined with only slowly rising interest rates and wage growth should deliver mid-single-digit profit gains for the rest of this year and next.

Inflation in the US is likely to be held in check by the stronger dollar, as it reduces import prices. With the lower price of oil leading to cheaper fuel, this is expected to deliver a significant boost to the disposable income of the average American household.

As a result of this lower inflation pressure, the Federal Reserve may be inclined to raise interest rates more slowly than it would otherwise have done.

With a higher dollar, demand is effectively transferred from the US economy to other economies around the world.

Unemployment in the US has been falling sharply and there is little remaining capacity in the countrys economy to absorb extra demand without generating inflation.

This is positive news for the global economy, which is expected to become more balanced. Europe, Japan and emerging markets currently require a boost to their exports, and this is likely to be delivered by a stronger dollar.

Investment decisions should always be made with an eye to the future and it is, as always, very difficult to forecast the direction of the dollar from here, Dr Kelly stated.

However, the rise in the dollar so far in 2014 will have impacts well into 2015, and those impacts should be generally positive for the global economy and risk assets in both the US and around the world.

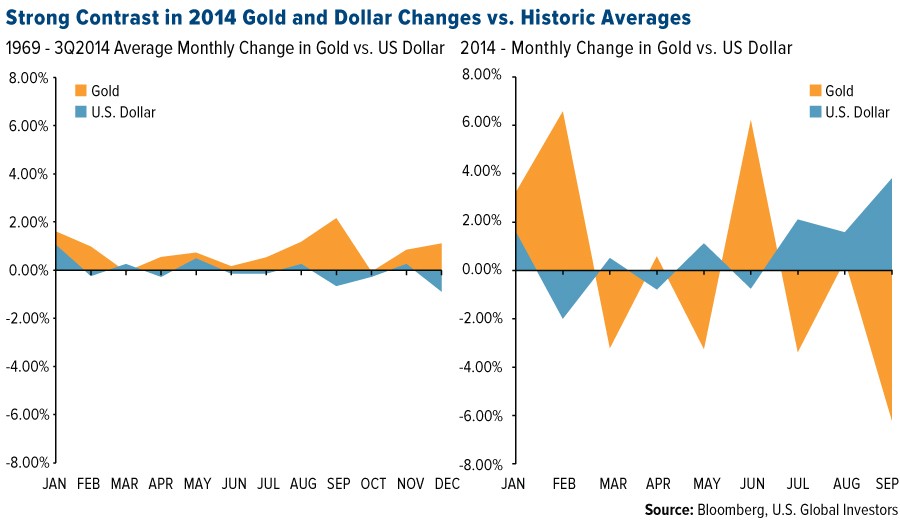

Gold prices are likely to decline, as demand for the safe-haven asset is weakened by the stronger dollar. Bloomberg recently reported that holdings in exchange-traded funds backed by bullion fell 0.6 per cent, extending a drop to the lowest since 2009.

Gold slipped on dollar strength combined with upbeat economic activity at the end of the year, and some gold bulls are giving up on their positions, said Phil Streible, a senior market strategist at RJO Futures in Chicago. Gold prices are going to go a lot lower in 2015, especially once the first rate increase occurs.

Contracts for Difference (CFDs) and margined FX are leveraged products which carry a high degree of risk to your capital. Prices may move rapidly against you and may result in you losing more than your initial deposit. CFDs and FX may not be suitable for all investors and you should fully understand the risks involved before opening an account. Please read the Risk Warning notice on our website .