The Call To Differentiate Your Hedge Fund

Post on: 16 Март, 2015 No Comment

Apr 1 2013 | 6:15am ET

By Bruce Frumerman

CEO, Frumerman & Nemeth Inc.

Have you taken notice of what SEI reports in 6 Ways Hedge Funds Need To Adapt Now . which addresses what it takes to succeed in the hedge fund business today? This sixth annual global survey of institutional hedge fund investors, with insights from roundtables with industry experts, reports that the key challenges hedge fund firm owners face today include the need to be able to demonstrate a sustainable edge and a clear value added, and to have business and marketing acumen.

According to Hedge Fund Research (HFR) there are around 7,940 hedge funds and 1,870 funds of hedge funds today. While an average of over 840 funds have closed their doors each year since 2005, based on HFR database information, over 1,000 launched in 2011 and around the same number in 2012. How many of these hedge funds might be your direct or indirect competitors?

SEI notes that seven out of ten institutional investors responding to its survey complained that “there are too many look-alike strategies in the hedge fund industry today.” Investors are not just looking for absolute returns, but for “differentiated alpha sources” that can produce non-correlated returns.

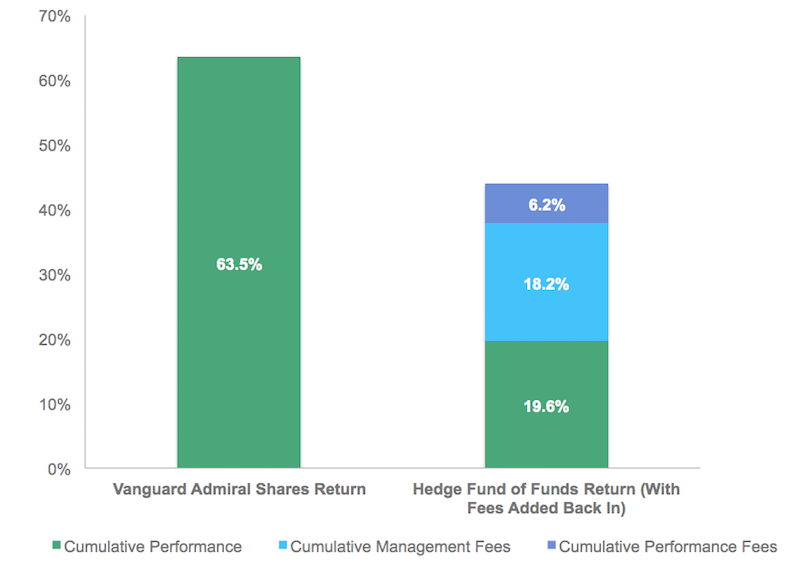

But, it is not enough for hedge funds to distinguish themselves in terms of their pedigree, talent, strategies, and performance, SEI observes. They need to “clearly articulate their investment process, and explain what makes their results repeatable (not to mention worth the fees they are asking).”

“Articulating a fund’s investment process and what makes the results repeatable is job one for fund managers,” SEI counsels. The company tells hedge fund firm owners that they need to communicate a story that is simultaneously concise, compelling and detailed in order to define who they are to prospects and those who influence them.

Which hedge funds are bound to fail to attract assets? Those with no idea of how to get their message across, the SEI report says. These firms “just use the same mumbled jargon and rarely convey what is actually happening,” one industry expert observed. Your hedge fund firm is not guilty of this, right? The marketers that do not put their investment process story in writing and convince others that their process makes sense will not grow assets, the panelist went on to comment.

What was mentioned as being the single greatest feat for hedge funds? “Explaining simply just what it is you do.” SEI found those it surveyed emphasizing how important it is for hedge fund firm owners to spend the time and resources needed to make complex processes clear and simple.

In this competitive environment where investors are conducting more in depth due diligence into a hedge fund’s strategy and taking into account the personality of the manager responsible for executing it, effective marketing is a must. Many of the top investors on Wall Street attribute their asset and client growth not to their investment results, but to effective marketing, SEI reports. The idea that “perception is reality” is never more relevant than in the hedge fund industry, they say. Yet, while the importance of differentiating is easy to understand, it’s increasingly hard to do, the study admits.

One of SEI’s concluding takeaways for hedge fund firm owners is that “To increase their chances of success, firms should consider outsourcing anything that isn’t core or they can’t do well themselves, as long as it doesn’t undercut their own value-added.”

Tackling Job Number One For Hedge Fund Marketing

So, the marketplace agrees that what will differentiate you from the competition is how well your firm articulates how it invests and what makes performance results repeatable. Your story of how — your investment beliefs and the process you use to assemble and manage your basket of holdings — is the subjective part of what you have to get people to understand and buy into.

You need to be able to communicate this both verbally and in writing. And you need to reduce the odds of having a prospect mess up retelling your hedge fund’s story to an investment committee colleague or a client on whose behalf he makes investment allocation recommendations.

Prospects rarely become investors after just one meeting. The due diligence process of prospective investors and their advisors can take months. A significant time lapse can occur between when your hedge fund first sits down with one of the decision makers, or gatekeepers, and when she gets around to preparing to discuss your fund with others on the investment committee. Not only are you required to tell an effective story, it is equally important to have that content stay once you have left.

Hedge fund managers need to remember that an investment committee that is considering a handful of finalists is not debating which has the better Sortino Ratio, they’re discussing which fund has the clearest investment process and value proposition that they can understand, buy into and be able to discuss, if need be, with the constituents they invest for and report to.

My communications marketing firm regularly sees evidence of this. As a hedge fund manager who had great performance was recently told by a prospective institutional investor, his investment committee spends a lot of time trying to understand how and why their investment managers make money. Unless we can understand the philosophy and process, there is no way for us to be confident it can be repeated in the future, the hedge fund firm owner was told.

At too many hedge fund firms the owners never put the full detail of their hedge funds’ investment process stories in print. Verbal elaboration at an initial sales meeting to explain what your flip chart bullet points were meant to convey is not going to be remembered four or fourteen months down the road when a family office, institutional investor or wealth management firm may be getting around to discussing your fund and a few others with similar performance and risk characteristics. This often results in coming across as a commodity-like investment choice rather than a differentiated hedge fund with a value-added portfolio management approach.

Hedge fund marketing materials should make it easy for investors to conduct their due diligence. Too often they do not. While the pitchbook is the right tool for communicating data-based information (charts, graphs and numbers) it is the wrong leave-behind marketing tool for delivering a compelling and detailed explanation of investment process, which is text based content. An additional marketing collateral sales tool is required.

If you were on the fence before as to whether your hedge fund needed to spend the time and effort to put the full detail of explanation of its investment beliefs and investment process story into print, and then actively communicate that content throughout the selling cycle, SEI’s 2013 global survey of institutional hedge fund investors has now answered that question for you.

Bruce Frumerman is founder and CEO of Frumerman & Nemeth Inc.. a communications and sales marketing consultancy that helps financial services firms create brand identities for their organizations and develop and implement effective new marketing strategies and programs. The firm was named 2013 U.S. Marketing Firm Of The Year for Hedge Funds by Acquisition International Magazine’s International Hedge Fund Awards. Founded in 1987 pre-Crash, Frumerman & Nemeth’s work has helped money management clients attract over $7 billion in new assets, yet they are not third-party marketers. Bruce has over 30 years of experience in helping money managers to develop buyer-focused positioning strategies to differentiate them from their competitors; create more cogent and compelling sales presentations and marketing materials to better tell their story; and use media relations marketing and industry conference speaking opportunities to help establish a branded identity for their organization by generating third-party endorsement for the expertise of their people, the value of their services and the quality of their products. He has authored many articles on the topic of marketing hedge funds and is a frequent speaker on the subject at industry conferences.

Bruce Frumerman