The Best Way to Invest in Silver (PAAS SLW)

Post on: 1 Июль, 2015 No Comment

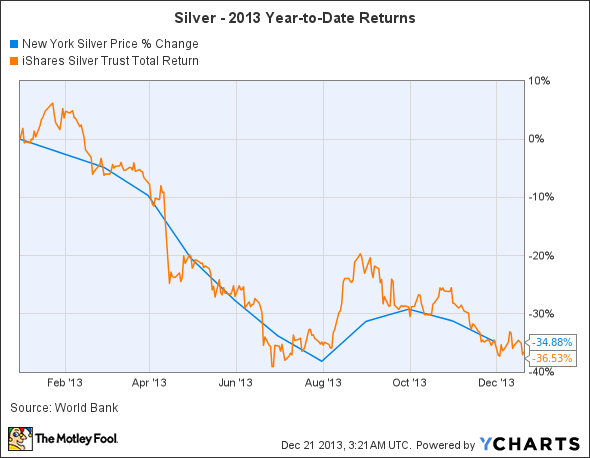

Mining is highly cyclical, with commodity prices rising and falling in long-term trends. For Foolish investors, these cyclical industries allow for classic value investing, with the market offering great companies at deep discounts that can yield market-crushing long-term total returns. This article highlights silver and explains the long-term bullish case for the precious metal. More importantly, it offers a low-risk way for long-term investors to profit immensely should silver prices soar.

Silver has many important uses other than jewelry or a store of value that can justify long-term price appreciation.

- Electronics

- Solar panels

- Nuclear reactors

- Metallurgy

- Chemical production

- Medicine

- Water/food purification

- Engines

Typically, investors who want to invest in silver either purchase coins or invest in silver miners such as Pan American Silver ( NASDAQ: PAAS ). However, silver streamers such as Silver Wheaton ( NYSE: SLW ) are far superior investments to traditional miners or collecting coins.

Pan American Silver: Good as far as silver miners go

As seen in this chart, even adjusting for dividend reinvestment, Pan American Silver has lost investors money over the last 12 years despite silver prices almost tripling. Meanwhile, Silver Wheaton has crushed the market by 222% annually, with 24.4% annual total returns vs the market’s 7.7%. Yet, I call Pan American Silver a good silver miner. I have several good reasons for this.

First, compared to its peers, it has the highest yield at 3.3% vs 1.1% for the industry average. Similarly, its valuation in terms of price/sales (3) and price/book (1.1) compares favorably to the industry average’s 5.1 and 1.7, respectively.

Second, I’m impressed with Pan American Silver’s ability to cut costs while increasing production. Specifically, in the first quarter, it increased production of silver and gold by 5% and 43% while cutting its production costs for those metals by 20% and 27%, respectively.

Finally, Pan American Silver’s Dolores mine expansion project, which will increase silver production by 38% and gold production 33%, along with its 348% increase in silver reserves at its La Calorada mine, might serve as a good growth catalyst should silver prices recover.

However, Pan American Silver, like most silver miners, is terrible when it comes to profitability and operating efficiencies.