The Best Silver Stocks

Post on: 21 Июль, 2015 No Comment

Comments ( )

If you are just now learning about the lucrative realm of silver investing, you need to read this.

Morgan Stanley recently reported silver and gold are the best commodities for 2013.

Additionally, billionaire Eric Sprott zealously claims silver is the investment of the decade as investment interest for silver inches its way up to historic heights.

He’s not wasting any time. at least 90% of his assets outside of Sprott Inc. shares are in silver and gold.

The Bandwagon Effect

Trust me; you’ll be more than grateful you stumbled upon this page now and are reading this information just in time to find out why you should buy before this silver frenzy catches the attention of millions of investors who haven’t jumped on-board yet; unaware of the critical position silver is in right this very second .

A variety of metals experts have repeatedly indicated that 2013 will be the year for silver, as it’s positioned to become the world’s hottest commodity outshining the precious yellow metal for the first time in history.

An unprecedented crisis in the silver market could easily hand you a long series of double. triple. even quadruple investment gains with silver stocks.

Here’s how.

You probably already know that every commodity fortune ever made was created by an imbalance of supply and demand.

This year, silver is perfectly positioned to outperform gold. For investment purposes this means we’re buying 53 times more silver than gold !

The available silver for investment vs. gold for investment is a ratio of 7:1. But people are buying it 50:1. The investor can’t buy at this rate for long before something big happens.

When the demand for a certain commodity is high and supplies are low, prices skyrocket. And investors holding the commodity in question gain profits.

This is exactly what has happened in the case of many natural resources just in the past decade alone:

Crude oil shot up 620% in 6 years

Gold is now up over 700% since 2001

Uranium spiked 830% in 4 years

Copper increased nearly 530% in 7 years

Palladium more than tripled in 3 years

Platinum prices grew 430% in 6 years

As demand grew and supplies dwindled, the prices for these natural resources ballooned in value. but none of these commodities experienced the supply/demand crisis that silver is currently facing.

Take a moment to chew on this to see why silver is expected to outperform gold amidst this year’s market conditions.

The precious metals market experienced quite an explosive boom right around 1979-1980. Both precious metals experienced all time highs during this time. At that time, you could buy 17 ounces of silver or one ounce of gold for the same price, meaning the silver/gold ratio was set at 17:1. Fast-forward to 2012, and that ratio is approximately 55:1. That leaves plenty of room for silver to surge in its historic relation to gold prices.

Silver Price to Strengthen on Both Investment and Industrial Demand

The Silver Institute reports prices have soared this year due to investment and industrial demand, which will keep silver’s price strong over the remainder of the year. The primary reason for this revolves around the simple fact that it is not easy to substitute any other metal in for practical, industrial uses requiring silver.

In the first ten weeks of this year, silver outperformed gold, platinum, and palladium .

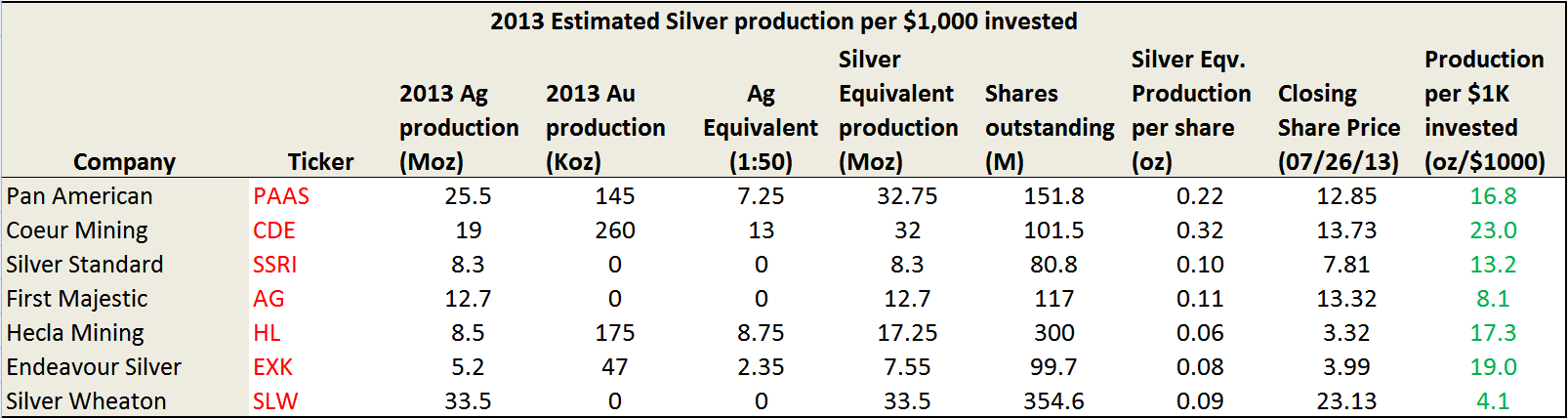

Despite extremely depressed market reports lately, many silver stocks are beating the markets:

Silver Wheaton is the largest precious metals streaming company in the world.

The company has thirteen long-term silver purchase agreements and two long-term precious metal purchase agreements. These agreements allow the company to purchase all or a portion of the silver production at a low fixed cost from high-quality mines located in Mexico. the United States, Greece, Sweden, Peru, Chile, Argentina, and Portugal.

By 2013, annual production is expected to increase significantly to 38 million ounces of silver and 59,000 ounces of gold, for total production of over 40 million silver-equivalent ounces.

Despite slumping prices from March-May, the stock is inching it’s way back up again and will continue a steady incline as investors realize just how poor the state of economy is still in.

Pan American Silver Corp. (NASDAQ: PAAS)

Pan American Silver is the second largest primary silver producer in the world. The company owns and operates eight silver mines and four development projects in Peru, Mexico, Bolivia, and Argentina.

Pan American’s growth strategy is based on the continued increase of low cost silver production through the efficient operation and expansion of its existing mines, an aggressive exploration program, and the acquisition and development of new silver-rich deposits.

It represents a price-trend similar to Silver Wheaton Corp. First quarter sales this year ended at $228.8 million with net earnings of $50.2 million or $0.47 per share during the first three months of 2012. They produced 5.5 million ounces of silver and 19,496 ounces of gold that same period of time.

Fresnillo plc (LSE: FRES)

Fresnillo plc is the third largest silver producer in the world and Mexico’s second largest gold producer. The company operates four producing mines and one development project, all located in Mexico. In total, Fresnillo has mining concessions covering approximately 1.75 million hectares across the country.

One of the main drivers of Fresnillo’s growth is the investment in exploration and the development of projects and prospects with the potential to become low-cost operating mines. The company’s disciplined approach to investment includes the evaluation of economic ore grades, maximum extraction costs, and an established reserve base.

Currently standing as the world’s largest primary silver producer, Fresnillo aims to create maximum value for all stakeholders.

These companies are ideally set for the coming supply crisis within the silver sector.

Use this knowledge to your advantage so you can still buy silver and silver stocks at a bargain before the price jumps dramatically as supply runs dry.

For a more detailed look at why you should invest in silver instead of gold, check out our latest research report before silver disappears from the market completely amidst surging demand.

Related Articles on The Best Silver Stocks

Silver is a popular investment lately amid economic uncertainty and an industrial resurgence. Mining companies allow investors to get in at the source.

As the value of silver continues to rise, investors are turning to silver coins. But there’s also a level of risk to this type of investment.

As demand grows globally for silver, India expects its silver exports to grow as much as 30% throughout 2013.