The Best Inflation Hedge Gold versus Stocks

Post on: 2 Июль, 2015 No Comment

Investors can be divided into two groups: one group strongly believes that gold will protect their savings during a period of rapidly increasing inflation; the other group thinks that stocks are a better protection against inflation. Whos right? What is the best hedge against inflation: gold or stocks?

Warren Buffetts Stance: Stocks as Inflation Hedge

Warren Buffett legendary investor and once the richest man in the world belongs to the group that regards stocks as the best possible inflation hedge. His argument: the underlying company should be able to produce something that is able to retain its profitability in inflationary times by raising prices. According to Buffets theory, stock prices should move in line with a severe decline in the purchasing power of a currency.

The inflation of the 70s is perhaps the best real-life example with which we can examine the inflation-protective power of stocks.

The Stagflation of the 70s: Inflation & Stock Prices

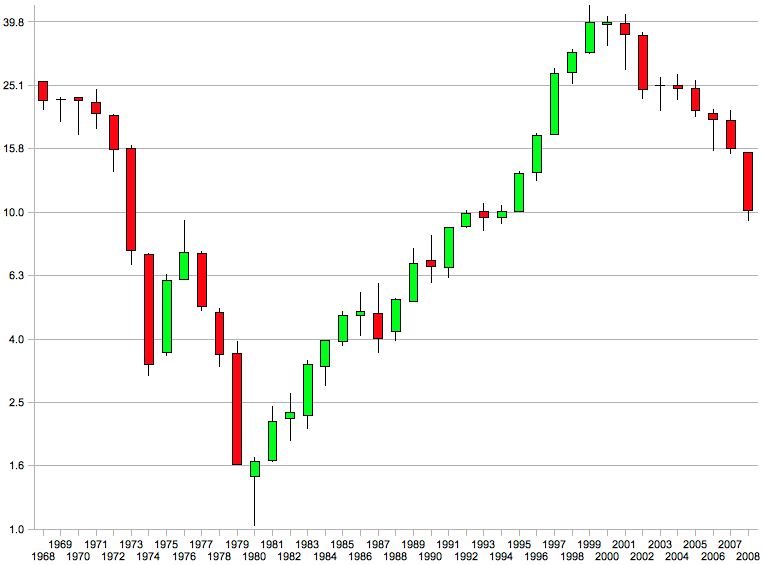

It turns out to be a common misconception that stocks increase in value in times of inflation. From 1970 to the end of 1979 the S&P 500 rose a mere 27%; during the same period consumer prices doubled. The annualized return on the S&P 500 was only 2.4%, whereas the lowest annual increase in consumer prices equalled 3.3% in the 1970s, with spikes in 1974 and 1979 (over 12% price inflation, a 10% purchasing power loss if invested in stocks).

If an investor would have invested $100 in the stock market in 1970, and then waited until 1979, than he would end up with $127 dollars. However, any product that would have cost $1 in 1970, cost $2 in 1979. In brief, a big share of the net worth of a stock investor (in real terms) would have evaporated in the 70s. Even Warren Buffets beloved Coca Cola lost almost 20% of its value between 1970 and 1979.

Best Stock Market of the Year Venezuela: +480%

Another case in point is the stock market in Venezuela, which disproves our thesis. At least, it appears so. The index increased a stunning 480% in 2013, while inflation increased from 30% annually to almost 30% monthly. the best performing stock market of the year, indeed, but only in nominal terms.

The one problem with this reasoning: the increasingly worthless Venezuelan currency ironically called the bolivar fuerte cannot be exchanged for foreign currency due to the foreign exchange controls. The Venezuelan stock market is driven by inflation, but only because of the fact that it goes hand in hand with exchange controls do stock prices increase that much: money cannot leave the country and looks for domestic safe havens.

No Venezuelan Scenario for Western Stock Markets

This, however, does not imply that the same applies to western markets. First, there are no exchange controls in developed markets; nor do they seem likely at the moment. Second, the Venezuelan stock index is no longer an index; the few stocks that remain after rampant socialism, are illiquid to such an extent the stock of the world-famous Santa Teresa rum hasnt been traded for over a year that we cannot consider it a real stock market anymore.

Stocks as Inflation Hedge? Even the Richest Man in the World Commits Mistakes

Buffets theory is wrong for various reasons. A company not only increases its prices during inflation, but also suffers from rising costs. In many cases the costs increase even faster than the ability of the company to raise prices and, as a result, margins come under pressure. Moreover, inflation can actually coincide with economic stagnation and falling production, contrary to the opinion of many economists, as it did in the 70s.

Empirically we see declining stock prices across the board in inflationary times, also because stock prices are bid up to such heights that even with higher inflation stock valuations seem generous. In brief, stocks, above all when they are overvalued (corporate profits tend to rise before consumer prices), do not constitute a good protection against inflation.

Gold as Inflation Hedge: It Depends on the Price

The gold price, as stock prices, reflects future expectations. It prices in expectations. When high inflation is expected, the gold price rises in anticipation of an inflationary event. As such, the gold price actually peaks before the consumer price index (CPI) peaks.

Does this mean that gold is not an inflation hedge? That would be a rather misleading conclusion. It is logical, after all, that the gold price anticipates. not lags behind, inflation estimates. After all, you dont buy fire insurance when your house is already on fire. You buy fire insurance before your house is filled with flames and smoke.

At the moment high inflation seems far-fetched, but that is exactly why it currently pays off to buy precious metals as an insurance against inflation. Right now the insurance premium is affordable. Right now stock prices seem too high and gold prices too low, in anticipation of possible inflation caused by heedless central bank policies. The recent negative real interest rate the interest rate minus price inflation still indicates rising consumer prices in the future.

For the same reason it will be soon too late to include gold as protection against inflation in an investment portfolio inflation has then already hit, the house is already on fire.

Author: Olav Dirkmaat

Olav is a precious metals analyst at GoldRepublic and PhD-candidate in (Austrian) Economics at the Rey Juan Carlos University in Spain. In this column Olav gives his personal view on the subject. The information in this Market Update is not meant as individual investment advice, nor as a recommendation to purchase certain investments. GoldRepublic has taken the greatest of care to ensure the accuracy of the contents of the newsletter, but cannot accept responsibility for any inaccuracies, omissions, or errors. For questions and/or comments you can send Olav an email or call him at +31 (0) 20 794 60 21.