The Best Index Funds

Post on: 8 Июль, 2015 No Comment

The How, Why and Where of Index Funds and Strategies

Learn the basics of index funds and become a better investor. Getty Images

Which are the best index funds and what do you analyze to choose them? Why are index funds better than actively-managed funds? Are passive mutual funds better than ETFs?

Even if you are not a beginner, the path to the best index funds begins with the basics. An index, with regard to investing, is a statistical sampling of securities that represent a defined segment of the market. For example the S&P 500 Index. is a sampling of approximately 500 large-capitalization (aka large-cap) stocks.

There are thousands of large-cap stocks in the universe of investments but the statistical sampling will accurately reflect the price movement of the overall market. Similar to the statistical sampling in polling, it would be difficult and counter-productive to attempt polling the entire segment of a population or, in the case of indexing, to capture an entire segment of a market. Therefore a statistical sampling of only certain securities within a market segment—an index—can accurately represent the entire segment without including all securities within the segment.

So once the index is formed, mutual fund portfolios can be built and made available to investors.

There are three primary reasons that investors may want to use index funds for their own investment strategies: 1) passive management, 2) low expenses, and 3) broad diversification.

- Passive Management: Index funds are said to be passively-managed because the manager of an index fund is seeking only to buy and hold securities that represent the given index for purposes of matching the performance of the index, not to beat it. In summary, the reason passive management is good for the investor is captured in the saying, If you can’t beat ‘em, join ‘em.

- Low Expenses: The index fund manager is not actively researching securities and they are not placing many trades. This translates into low costs, which are a large advantage for index funds because the cost savings translate to higher returns for the investor. For this reason, look for the index funds with the lowest expense ratios .

- Broad Diversification: An investor can capture the returns of a large segment of the market in one index fund. Index funds often invest in hundreds or even thousands of holdings; whereas actively-managed funds sometimes invest in less than 50 holdings. Generally, funds with higher amounts of holdings have lower relative market risk than those with fewer holdings; and index funds typically offer exposure to more securities than their actively-managed counterparts.

Best Mutual Fund Companies for Index Funds and No-Loads

If you want or need to keep your funds at one mutual funds company, there three best are Vanguard, Fidelity and T. Rowe Price:

- Vanguard Investments. Home of the Bogleheads, Vanguard is among the best and favorite of mutual fund companies for the do-it-yourself crowd. Founder Jack C. Jack Bogle formed the company around his idea that low-cost index funds can provide superior returns for the long-term investor. Bogle taught that the combination of higher relative costs and the tendency for human error erodes returns for actively-managed funds over time. Therefore, it is the common sense approach of low costs and the removal of emotional barriers that makes index funds the best vehicles for investors, especially for those with long-term time horizons (greater than 10 years).

Vanguard also offers Exchange Traded Funds (ETFs). which have not been completely embraced by Bogle, who has labelled ETFs as a trend potentially dangerous to the average investor.

Fidelity Investments. Better known for their actively-managed funds and as a provider of retirement services and products, such as 401(k) plans and IRAs, for businesses and individuals, Fidelity is probably Vanguard’s biggest rival with a large selection of low-cost index funds.

T. Rowe Price. Named for its founder, Thomas Rowe Price, Jr, the investment firm founded in 1937 offers mutual funds, retirement plans and separate account management for individuals. Today, T. Rowe Price is a favorite among the do-it-yourself crowd for the investment firm’s broad selection of quality no-load mutual funds .

The best index funds have a few primary things in common. They keep costs low, they do a good job of matching the index securities (called tracking error), and they use proper weighting methods.

For example, one reason Vanguard has some of the lowest expense ratios for their index funds is because they do very little advertising and they are owned by their shareholders. If an index fund has an expense ratio of 0.12 but a comparable fund has an expense ratio of 0.22, the lower cost index fund has an immediate advantage of 0.10. This only amounts to only 10 cents savings for every $100 invested but every penny counts, especially in the long run, for indexing.

As for matching holdings, there is a science involved with getting just the right exposure to each holding, which can be in the hundreds or thousands, depending upon the index.

To create an index fund, the management team will have to decide how much (the number of shares) of each holding on the list to purchase. The idea is to match the percentage weighting of the index itself. Indexes that rank the holdings so that the larger components are given larger percentage weights are called capitalization-weighted indexes (aka cap-weighted or market cap weighted indexes). The S&P 500 is an example of a cap-weighted index. Most index funds will mirror the cap-weighted index by buying shares of holdings to make the stocks with the largest capitalization the largest holding by percentage in the index fund. For example, if XYZ Corporation stock has the largest market capitalization, XYZ Corporation stock will represent the largest percentage of the index fund.

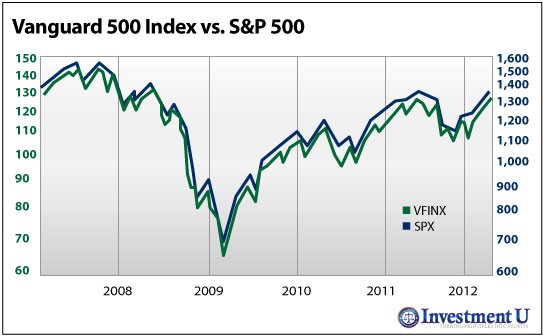

- Vanguard 500 Index (VFINX): More than 35 years ago, Vanguard founder John Bogle observed that the majority of stock investors were unable to outperform the S&P 500 Index consistently over long periods of time. His idea was to simply match the holdings of the index and keep costs low. Simplicity and frugality two of the greatest tenets of successful investing and Vanguard has these virtues mastered.

- Fidelity Spartan 500 Index (FUSEX). Fidelity’s size, experience with indexing and desire to compete with Vanguard combine to make their index fund offerings second only to Vanguard’s. Often the index funds between the two giant rivals are indistinguishable in terms of expenses and performance. Ultimately, the competition creates higher quality funds for the investor.

- Schwab S&P 500 Index(SWPPX). Charles Schwab has made a conscious effort to provide more than just discount brokerage service to investors: They have dipped deeply into the index fund markets of Vanguard and Fidelity. Their index funds are usually a bit higher in expense ratio than their larger competitors but if you are already a Schwab investor, you may as well save the transaction fee for using out-of-network funds and use the Schwab index funds.

A total stock market index fund is a mutual fund that invests in a basket of stocks that will closely mirror the stock holdings and performance of a particular benchmark, such as The Wilshire 5000 or The Russell 3000. The holdings include most of the domestic US stock holdings traded on stock exchanges, which is why the total market name is usually included in the fund name. Like S&P 500 Index Funds, the Wilshire 5000 is market-cap weighted, which means that larger companies (those with larger capitalization) will represent a larger portion (be among the top holdings) by percentage than the smaller companies.

- Vanguard Total Stock Market Index (VTSMX). Vanguard is the original indexer and VTSMX is among the first index funds to capture the total market. With an expense ratio of 0.18%, VTSMX makes a solid core holding for any mutual fund portfolio.

- Schwab Total Stock Market Index (SWTSX) : With an expense ratio of 0.11%, it’s tough to beat SWTSX unless you qualify to get lower expense ratios with one of Vanguard’s Admiral Shares funds.

- iShares Russell 3000 Index Fund (IWV) : This is an ETF that works well for those investors who like to the ability to trade intra-day like stocks or if they are able to trade certain ETFs with no transaction fees (some mutual fund companies charge fees for trading certain index funds). IWV has an expense ratio of 0.20%.

Best Total Bond Market Index Funds

The total bond market index usually refers to index mutual funds or Exchange Traded Funds (ETFs) that invest in the Barclay’s Aggregate Bond Index. also known as the BarCap Aggregate, which is a broad bond index covering most U.S. traded bonds and some foreign bonds traded in the U.S.

Investors can capture the performance of the overall bond market by investing in an index mutual fund or ETF that seeks to replicate the performance of the index. Fund examples include iShares Barclays Capital Aggregate Bond Index (AGG ) and Vanguard Total Bond Market Index Fund (VBMFX ).

Index Mutual Funds vs ETFs

When you hear the term index fund, the reference is generally to mutual funds. But ETFs also offer their own benefits. As with many investment securities, there are strengths, weaknesses and best use strategies for each.

The index funds vs ETF debate is not really an either/or question. Investors are wise to consider both. Fees and expenses are the enemy of the index investor. Therefore the first consideration when choosing between the two is the expense ratio. Secondly, there may be some investment types that one fund may have an advantage over the other. For example, an investor wanting to buy an index that closely mirrors the price movement of gold, will likely achieve their goal best by using the ETF called SPDR Gold Shares (GLD) .

While past performance is no guarantee of future results, historic returns can reveal an index fund or ETF’s ability to closely track the underlying index and thus provide the investor greater potential returns in the future. For example the index fund, Vanguard Total Bond Market Index Inv (VBMFX) has historically outperformed iShares Core Total US Bond Market Index ETF (AGG), although VBMFX has an expense ratio of 0.20% and AGG’s is 0.08% and both track the same index, the same index.

ETFs typically have lower expense ratios than index funds. This can in theory provide a slight edge in returns over index funds for the investor. However ETFs can have higher trading costs. For example, let’s say you have a brokerage account at Vanguard Investments. If you want to trade an ETF, you will pay a trading fee of around $7.00, whereas a Vanguard index fund tracking the same index can have no transaction fee or commission.

Index funds are mutual funds and ETFs are traded like stocks. What does this mean? For example, let’s say you want to buy or sell a mutual fund. The price at which you buy or sell isn’t really a price; it’s the Net Asset Value (NAV) of the underlying securities; and you will trade at the fund’s NAV at end of the trading day. Therefore, if stock prices rise or fall during the day, you have no control over the timing of execution of the trade. For better or worse, you get what you get at the end of the day.

In contrast, ETFs trade intra-day. This can be an advantage if you are able to take advantage of price movements that occur during the day. The key word here is IF. For example, if you believe the market is moving higher during the day and you want to take advantage of that trend, you can buy an ETF early in the trading day and capture it’s positive movement. On some days the market can move higher or lower by as much as 1.00% or more. This presents both risk and opportunity, depending upon your accuracy in predicting the trend.

Part of the trade-able aspect of ETFs is what is called the spread, which is the difference between the bid and ask price of a security. However, to put it simply, the biggest risk here is with ETFs that are not widely traded, where spreads can be wider and not favorable for individual investors. Therefore look for broadly traded index ETFs, such as iShares Core S&P 500 Index (IVV) and beware of niche areas such as narrowly traded sector funds and country funds.

Final Tip for Buying Index Funds: If you are fortunate enough to have high balances in your investment accounts, you may qualify for other share classes that have even lower expense ratios than those funds listed here. For example Vanguard has another share class, called Admiral Shares that provide lower expense ratios. The Vanguard 500 Index Admiral (VFIAX) has an expense ratio of only 0.06, whereas VFINX has an expense ratio of 0.17%.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.