The Beginner s Guide To Financial Markets Commodities

Post on: 25 Июль, 2015 No Comment

Sculpture of a LIFFE trader

In the latest of our series on London’s financial markets, we look at the commodity market and its history in the capital.

Whats a commodity?

What have lean hogs, wheat, oil and sugar got in common? They are all physical products which are bought and sold on commodities exchanges in the form of three-month contracts, the prices of which directly affect the cost of a loaf of bread in the supermarket, a jar of coffee or the petrol you put in your car.

Probably one of the most publicised is oil you will often hear news reports on the price of a barrel of oil. One contract equals 1,000 barrels and each tick (price change) equals $10. The price of oil can affect lots of other things, for example, in our previous installment on the equity markets we explained how the price of oil can affect the price of airline shares.

There are two types of commodities: hard and soft. Hard commodities are natural resources that are mined or extracted (gold, rubber, oil), and soft commodities are agricultural products or livestock (wheat, coffee, sugar).

Despite the high profile of petrol and food prices, the commodity market is probably one of the least well-known.

Buying and Selling

In days of yore, if one wanted to buy a cow, one could simply pop down to the nearest cattle market, purchase said animal, then lead it back to ones field. Nowadays, buying and selling of commodities happens on exchanges where the contracts are traded. The actual trading can happen in a couple of different ways usually spot or future:

Spot a transaction where delivery of the commodity takes place pretty much immediately. So you buy your cow and take ownership of it there and then.

Future where the two parties agree to buy or sell a cow at a price that they set on that day (called the strike price), but delivery of the cow and payment occurs at a future date.

The majority of trading in commodities is electronic, but like many exchanges it used to be open-outcry, which is where the traders shout at each other and use hand signals to communicate. Want to see what an open-outcry trading floor is like? This very short video is from the London International Financial Futures Exchange (LIFFE) floor around 1993. And that was probably on a quiet day.

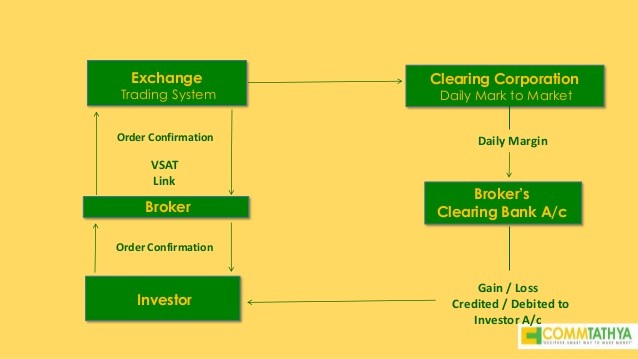

The role of the exchange in all this is to act as an intermediary between buyer and seller. Each party puts an agreed amount of money into an account to reduce the risk of either side defaulting on the contract this is called the margin.

As in all financial markets, the price of the commodity will change on a daily basis, so each day the exchange will draw money out of one partys margin account and put it into the others so that each party has a daily loss or profit that reflects the market price. If the margin account goes below a certain value, then a margin call is made and the account owner must put more money into the account.

For anyone whos seen Rogue Trader, the film about Barings Bank trader Nick Leeson, and how he came catastrophically unstuck, the term margin call may be familiar. In Leesons case, hed accumulated a loss of $1.4 billion from trading futures that he hid from his employers. The exchange then made a margin call on the hidden losses, which Barings was unable to meet. This resulted in the collapse of Britain’s oldest merchant bank and the Queens personal bank.

Ive got a lorry full of pork bellies downstairs, can you sign for it?

This is probably the worst possible thing a commodities trader could hear, apart from Youre fired. The City is full of anecdotes about someone who knows someone else who forgot to sell a commodity future contract and ended up with a lorry full of corn outside their office. In reality it doesnt happen unless the party buying the contract is a manufacturer or someone who actually wants to take delivery (that usually happens in the spot market). All commodity futures have a delivery date, as theyre obviously physical products, but actual delivery only happens on about 2% of contracts. Many safeguards are in place to prevent inadvertent deliveries, not least because the office fridge couldnt cope with that volume of meat.

Who trades commodities and why?

The players in the futures market fall into two categories, hedgers and speculators. The former include farmers, manufacturers, importers and exporters. A hedger buys or sells a commodity to ensure its price in the future and protect against price risks. Speculators simply aim to profit from the price changes that hedgers are trying to protect themselves against.

This is a very good example from Investopedia of why someone would want to use commodities contracts to help their business:

A silversmith must ensure they have a certain amount of silver in six months time for orders received and paid for. The price of silver could go up or down, so the smith needs to hedge, or minimise the risk of this happening.

They would buy a silver contract settlement in six months time at a price of $28 per ounce. At the end of the six months, the price is actually $30 per ounce so the silversmith has benefitted from hedging. If the market had gone down the smith would have been better off without the contract but they have protected themselves from potential price rises in a volatile market.

Londons commodity exchanges and some history

Leadenhall Street is home to the London Metal Exchange (LME). which is the worlds foremost commodity exchange for metals. It handles the highest volume of trades and is one of the few that still has open-outcry rather than solely electronic trading.

The LMEs style of trading is particularly unusual its called the Ring because the traders sit in a circle at fixed points around it. Trading takes place throughout the day with each contract traded in five-minute periods and the resulting price is known as the Ring price. But how did it all start?

Trading of commodities in London originally started in the 16th Century in the Royal Exchange, the home of the Citys financial market, where traders of metal and other commodities met. Although it started out as a domestic market, it quickly expanded to include European merchants. By the 19th Century, there were so many commodities traders that they took a leaf from the book of some of their equities predecessors and branched out into coffee shops.

The Jerusalem Coffee House, off Cornhill, became the new trading floor and it was there where the tradition of the Ring started. A merchant with metal to sell would draw a circle in the sawdust on the floor and shout change at which point all those wishing to trade would gather around the circle and put in their bids.

The industrial revolution was at the heart of a huge demand for commodities. The problem the traders had was that demand made the market more volatile, which meant that prices changed much more quickly. Importing large amounts of metals, which took months to be shipped, dramatically increased the risk for merchants and ship owners. Steam ships and the invention of the telegraph made transport a bit more reliable and improved communications. These advances also allowed merchants to anticipate when a cargo of metal would arrive, sell a contract for delivery on a fixed date, and protect themselves against a fall in price during the voyage.

So how did the traded contracts come to be three months long? Its down to the opening of the Suez Canal in 1869, which meant that the delivery time of tin from Malaya matched the three month delivery time for copper from Chile. The LMEs system of daily trading dates for up to three months forward is still how commodities are traded.

In 1877, London Metals and Mining Company was formed in an office over a hat shop in Lombard Court. Its rapid growth and rebirth as the London Metal Exchange led to several moves before ending up in Leadenhall Street.

The International Petroleum Exchange (IPE)

This was was one of the worlds largest energy exchanges and, like the LME, was open-outcry until 2005. Traders for individual companies were identified by the brightly coloured jackets they wore. Founded in 1980, it traded a range of energy commodities such as gas oil, electricity and Brent crude oil. Those with a good memory may remember a well-publicised incident in 2005 where Greenpeace protesters tried to disrupt trading, only to be met with furious resistance from the IPE traders. The IPE was acquired by Intercontinental Exchange in 2001 and is now known as ICE Futures, where trading is all electronic.

The meaning of LIFFE

In 1996, the London Commodity Exchange (LCE) merged with the London International Financial Futures Exchange (LIFFE) and started trading soft and agricultural commodities as well as financial derivatives well look at derivatives in more detail in a later installment. LIFFE was also open-outcry until 2000 and was eventually acquired by Euronext in 2002.

Last year, the London Metal Exchange achieved a trading volume of $15.4 trillion annually, or $61 billion on an average business day. London recently overtook the US in trading North Sea Brent crude oil with over 715,000 contracts traded per day. London is also one of the main global centres for commodities trading along with New York and Chicago. Thats an awful lot of gold and oil.

Photo by akirbs in the Londonist Flickr pool.