The All Weather Portfolio How Ray Dalio s Strategy Works

Post on: 6 Апрель, 2015 No Comment

The All Weather Portfolio is an investment philosophy developed by Ray Dalio and the name of fund offered by his hedge fund Bridgewater, one of the largest hedge funds in the world. However, you will also see detailed “all weather” portfolios on many investing sites. These portfolios don’t mimic the “all weather” fund offered by Bridgewater, whose exact investments remain secret, but invest based on the “all weather” philosophy.

What’s unique about the All Weather investing philosophy?

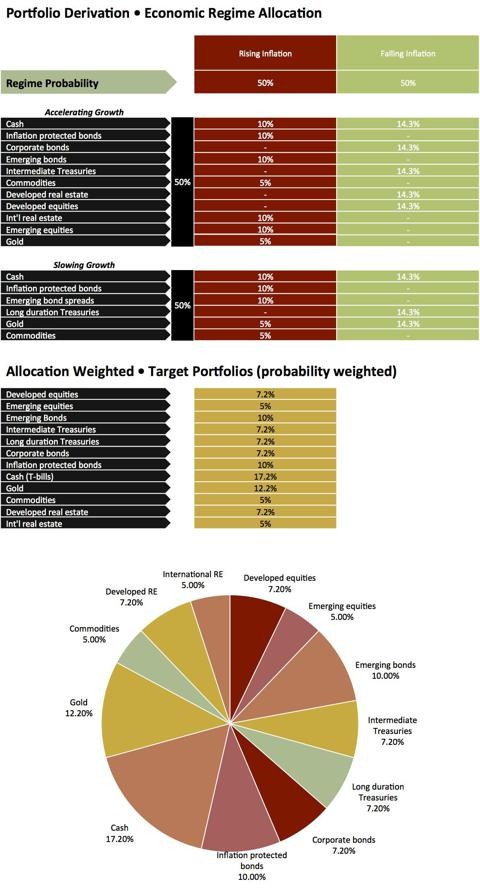

- The fundamental idea is that the future is impossible to predict. The future will fall into two of the four basic economic scenarios: rising growth, falling growth, rising inflation. falling inflation. Different types of assets do well in each of these scenarios. The all weather portfolio contemplates allocating a quarter of a portfolio’s risk (which is different than assets) to each of these scenarios.

The all weather portfolio is not about generating the highest possible returns. Instead its about creating a portfolio which has a similar risk profile to cash but, generates a return that is much higher than cash. The fundamental idea is that over time most investments have a return that is higher than cash. However, returns for specific investments or types of assets are very volatile.

The all weather portfolio seeks to reduce the volatility of investing in assets other than cash, by holding assets that naturally move in the opposite direction. The part of the portfolio which is geared towards profiting from rising inflation expectations will move in the opposite direction of the part of portfolio which is geared towards profiting from falling inflation expectations.

What type of assets belong in each part of the portfolio?

Falling Growth Expectations

Rising Inflation Expectations

- TIPS / Inflation Linked Bonds Commodities Emerging Market Bonds

Falling Inflation Expectations

- Stocks Treasuries

How well does the all weather strategy work?

In 2001, Bridgewater Associates launched the All Weather fund. According the Wall Street Journal article Money Magic: Bonds That Act Like Stocks. the fund has average a return of 10% for the last 10 years.

However, the key question is not the returns but, does it deliver on its promise of low volatility. As the fund’s performance data is not public, we need to rely on the Wall Street Journal article which states that during 2008 the fund was down 20%. Obviously, a cash-only portfolio would have no losses, but no upside potential as well.

Compared to the average all stock portfolio which was down -38.5% in 2008, the all weather portfolio’s losses were minor. The all weather portfolio barely beat a 60/40 portfolio of stocks and bonds which lost -21.1% during 2008. There are environments such as the high inflation and falling economic growth of late 1970s in which one would expect that all weather portfolio to outperform the 60/40.

Replicating the All Weather Portfolio

Bridgewater’s legendary All Weather Fund has been closed to new investors since 2006, when the fund grew to almost $50 billion in assets. Even if the fund wasn’t closed, the minimum investment would probably be around $250 million, making investing in it out of reach for most investors. However, the founder of Bridgewater, Ray Dalio has shared the investment philosophy behind the fund .

There have been several attempts to build portfolios based on the all weather philosophy. While I believe these attempts provide a better and more diversified portfolio than the traditional mix of stocks and bonds, I don’t believe that these attempts at cloning the All Weather Fund exactly replicate the original

Why are they ignoring Ray Dalio?

As we discuss above Ray Dalio advises investors to prepare for four different market scenarios:

- Rising economic growth Falling economic growth Falling inflation Rising inflation

Under each scenario, he suggests broad categories of assets to invest in. However, he doesn’t say investors should dedicate an equal amount of assets to each scenario, or evenly divide funds among the assets he suggests. Instead, he proposes that one should take an equal amount of risk for each category.

Unfortunately, most All Weather clone portfolios follow the following asset allocation model. Graphic from CSSA

Graphic from CSSA

This model is derived from taking the four scenarios and evenly allocating funds to each asset within the category. The method of allocation is arbitrary and does not take into account that different assets have different levels of risk (volatility). For example, stocks may be 3 times as risky as investing in treasury bonds. The method of allocation described above treats treasury bonds and stocks as having the same level of risk. As a result, the portion of portfolio which is dedicated to rising growth which includes stocks may contribute more to the performance of the portfolio than the part focused on falling growth which has treasury bonds but not stocks.

Why don’t All Weather clones make this adjustment for risk?

Not to be flip but, Ray Dalio hasn’t made public how this process works for the All Weather Fund. If everything about the All Weather fund was public, there would be no reason for institutional investors to pay an estimated half a percent a year to invest. Lacking a clear methodology for incorporating the relative riskiness of different assets the All Weather Clone portfolios decided to use arbitrary allocations.

There is another issue with the clone portfolios. Ray Dalio doesn’t provide much granularity in terms of the asset he invests in. Even when dealing with an asset as vanilla as treasury bonds, there is a big difference between buying those with a short-term versus long-term maturity. Those creating a clone portfolio have to guess what to put into the portfolio.

Are the All Weather Clone Portfolios any good?

Yes, I particularly like the one constructed by Scott’s Investments using eight low cost ETFs: VTI (stocks market), DBC (commodities), GLD (gold), HYG (high-yield bonds), TIP (ironically, it holds TIPS), EMB (emerging market bonds), AGG (investment grade bond market). For exact allocations between the different ETFs, please visit Scott’s Investments .

Scott back-tested the performance of this portfolio from 2005 to 2012. The portfolio had about 3% better return and half the volatility of a “balanced” portfolio which contained 60% stocks and 40% bonds.

Learn how to generate more income from your portfolio.