The Age Of Deleveraging Commenced Today

Post on: 22 Апрель, 2015 No Comment

The Age Of Deleveraging Commenced Today

Financial market report for May 4, 2010

1) … The Age of Deleveraging commenced as inflation destruction and exhaustion of quantitative easing continued to take stocks, ACWI, commodities, DJP, Major world currencies, DBV. emerging market currencies, CEW. and commodity currencies, CCX, as well as Junk Bonds, JNK, lower again today. The Euro, FXE. rose to a new rally high at 147.73 as did the Swiss Franc, FXF at 114.96. The Yen, FXY, rose to 122.57. This Finviz database repor t of FXA, FXE, FXM, FXC, ICN, FXB, FXS, SZR, FXF, CYB, BZF, XRU, FXY, BNZ, DBV, CEW, CCX, UUP, shows competitive currency devaluation is underway, which is confirmed by the currency yield curve, RZV:RZG. falling lower.

Competitive currency devaluation commenced this week as the US Dollar, $USD closed at a 40 year low according to Economic Policy Journal. The low interest rates of the US Central Bank have destroyed the US dollar, resulting in monetization of debt, which has created an investment demand for gold, GLD, while destroying the value of US Treasuries, as seen in the chart of the Flattner ETF, FLAT, TLT, and GLD.

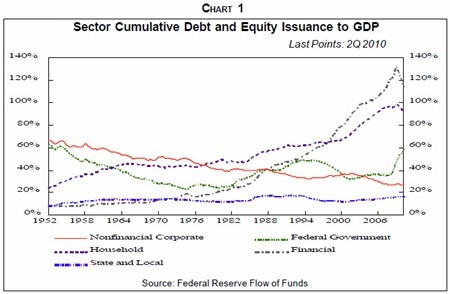

John Mauldin writes “I have written repeatedly about the Endgame in the weekly letter, as well as in a New York Times best-seller on the same topic. By Endgame I mean the period of time in which many of the developed economies of the world will either willingly deleverage or be forced to do so. This age of deleveraging will produce a fundamentally different economic environment .”

Yes, this week, the world has passed from the Age of Leverage and into the Age of Deleveraging as the seigniorage of neoliberalism failed with the exhaustion of quantitative easing.

Beginning with the announcement of QE 1, roughly two years ago, investors favored distressed securities, like those taken in by the US Federal Reserve, which are traded by FAGIX, the Emerging Market Countries, EEM, Leveraged Buyout Indebted Companies, PSP. Junk Bonds, JNK, and Emerging Markets Bonds, EMB. as is seen in the chart of FAGIX, EEM, PSP, JNK, and EMB .

The weekly chart of distressed investment mutual fund FAGIX, FAGIX Weekly. shows a growth from the beginning of QE 2 to the end of earnings seasons in May 2011 of 4.5 to 9.95. It has been the moneyness of distressed investments held by the US Federal Reserve that has underwritten the global stock market, VT, recovery.

Two mid cap stocks exemplify the stock wealth that has come via quantitative easing are Herbalife, HLF. and Harley Davidson, HOG. as is seen in the Yahoo Finance chart of HLF, HOG, VCR and SPY .

Beginning with the formal announcement of QE 2 in early November 2011, a dollar liquidity trade and the seigniorage of the Apple Ecosystem, FONE. boosted the US Shares, VTI. especially the most discretionary stocks, VCR. But these two seigniors have now lost their moneyness, as they have succumb to quantitative exhaustion easing.

Anticipation of Quantitative Easing 2 was quite inflationary in the Asia Tigers and also the South East Asia countries, and Turkey, TUR. Ben Bernanke’s investment cool aid gushed into these countries and inflated stock values.

The countries that saw hot money flows and inflation that came with QE 2, are either now, or have been seeing, a fast loss of value that comes with an exhaustion of QE 2. Taiwan and South Korea have the name Asia Tiger for a reason. Deleveraging in underway in South Korea, EWY. and South Korea Small Caps, SKOR. Now South Korea, EWY. and the emerging market countries are experiencing the exhaustion of quantitative easing and the pain of inflated commodity, DJP, prices. Asia’s two technology leaders, the electronics leader South Korea, and the semiconductor leader Taiwan Semiconductor, TSM. are now participating in the quantitative easing exhaustion that the Philippines, EPHE. has been experiencing.

Beginning nine months ago, the announcement of the EFSF monetary authority, a US Dollar liquidity trade, and the seigniorage of the Apple Ecosystem, gave moneyness to leveraged buyout companies, PSP. consumer discretionary service companies, IYC. and small cap US stocks, like the Russell 2000, IWO. as emerging market bonds, EMB. But now emerging market countries, EEM, and the Brics, EEB, are leading the deleveraging wave down. Ben Bernanke in printing money to purchase US Sovereign debt, first destabilized emerging market bonds, EMB. and some stocks such as shipping, SEA. and airlines, FAA, and is now snuffing out the inflation driven value of stocks world wide as in the chart of FAGIX, EEM, PSP, JNK, EMB, IWO, IYC.

This week, the week ending May 6, 2011, is marking an ending of earnings season, and the moneyness of the US Central Bank, as Junk Bonds, JNK, turned lower from 40.66, and as US Government Bonds, TLT. is completing a temporary rally in the 94. 50 to 95.75 area. And bonds, BND. completing a temporary rally in the 81.0 area. The end of credit as it has traditionally been known, will commence very soon..

US Stocks relative to the US 10 Year Note, VTI:TLT. reflects that the US stocks have maxed out on the US seigniorage provided by US Central Bank. Deleveraging from a failure of US Central Bank seigniorage, as well as failure of Portugal and other European Nation seigniorage is likely to start a wave of disinvestment from stocks globally. Thus in May 2011, we are going to see falling world government bonds, BWX. falling interntional corporate bonds, PICB. and falling stock value, ACWI .

Dow Theory communicates that a bear market is underway as both Transports, IYT, and Industrials, IYJ, have now turned lower. The mother of all bear markets has commenced, and no central bank has the ability to prevent it. The world has entered into Kondratieff Winter. The coming Age of Deleveraging will be characterised by the inability to profitably use traditional carry trade lending to invest long the markets. This is seen in the Optimized Carry ETN, ICI, having entered an Elliott Wave 3 of 3 Decline this week.

VTI;TLT

Both stocks, VT, and bonds, BND, will be falling lower in value; and the dynamo is mostly going to be exhaustion of quantitative easing and failure of debt sovereignty, that is debt seigniorage, as bond vigilantes call interest rates higher globally, which will be seen in world government bonds, BWX, falling lower. Then the currency traders are likely to heavily call commodity currencies, CCX. the major currencies, DBV. like the Euro, FXE. and the emerging market currencies, CEW. lower. Both the interest rate on the 10 Year US Goverment Note, $TNX. and the 30 Year US Government Bond, $TYX. are bottoming out, meaning that both TLT and EDV and ZROZ are now peaking out.

The neoliberal Milton Friedman Free To Choose floating currency regime has died with the end of earnings season in May 2011, and with the exhaustion of quantitative easing.

2) … The BRICS and the sectors that are the most sensitive to global growth were hit the hardest today.

Small Cap Energy, PSCE, -3.3

Energy, XLE, -1.5 and Dow Energy Services, IEZ, -1.7 and Energy Services, OIH, -1.2

Metal Manufacturing, XME, -2.3 and Steel, SLX, -1.7

India, INDY, 1.2, India Small Cap, SCIN, -2.7

Hard Asset Producers, HAP, -1.6

Russia, RSX, -2.2 and Russia Small Caps, RSXJ, -2.5

South Korea, EWY, -1.8

Shanghai, CAF, -1.0, and China, YAO, -1.3 and China Small Cap, HAO, -1.9

Design Build, PKB, -2.0

Aluminum Producers, ALUM, -1.8 and Coal, KOL, -1.7 and copper miners, COPX, -1.6

Agriculture, MOO, -1.5

Wood and Paper, WOOD, -1.5

Emerging Market Financials, EFN, -1.7 and Financials, XLF, -0.8

The Morgan Stanley Cyclicals Index, $CYC, fell 0.9%

Market leader Exxon Mobil, XOM, fell lower.again today

Bloomberg reports Chinas Stocks Fall Most in Two Months on Critical Inflation. China’s stocks fell the most in two months after the government said taming inflation is “critical,” signaling to investors that more policy tightening measures may be ahead even as economic growth slows.

3) … Commodity ETFs falling lower today included US Commodities, USCI, Base Metals, DBB. Oil, USO, Brent OIl, BNO, Petroleum, DBC, Timber, CUT. Gasoline, UGA, and Natural Gas, GAZ

Natural Gas, UNG

4) … In today’s news

Jeff Macke Breakoutcrew Yahoo in article Corporations Rush to Hedge U.S. Dollar, relates Wolfgang Koester is on the front lines of corporate Americas efforts to lessen our collapsing currencys impact on the bottom line. The CEO of FiREapps helps hedge currency risk for U.S.-domiciled heavyweights such as Nike, (NKE ), and Accenture, (ACN ), and he says demand for his services is rocketing as more companies become concerned about a weak greenback.

Why would a company need currency hedging? For one thing, in a multinational world, companies such as Nike and McDonalds, (MCD ), get a majority of their revenues from countries other than the United States. That means the earnings generated from those foreign revenues, likely the majority of their earnings, need to be calculated and converted into U.S. dollars, both for the sake of financial reporting and in financial reality (at least in theory) if and when the money is brought back to the States. Whether or not these companies hit their plans and estimates is often a function of what happened to the dollar during that period. If youre doing a fantastic job making shoes or burgers, youd rather not have your quarterly destiny tied to what Ben Bernanke does.

Compared to just two years ago, the U.S. dollar is down more than 20% vs. the Canadian loonie and over 30% against the Aussie dollar, to name just two of the many countries in which your buying power has collapsed. That said, dollar neglect typically leads to higher corporate earnings, unless it weakens the buying power of U.S.-based companies going to foreign lands to buy raw materials. In this case, an offset needs to be created for a one-time charge statement.

Lets just say plenty of organizations are looking to get rid of the currency headache by outsourcing it to guys like Koester. The questions for investors are: Which companies are doing their hedging well, does this lead to higher stock prices and what does the hedging say about the direction of the dollar going forward?

Not shockingly, Koester says his clients are doing well in terms of hedging, citing Agilent (A ) and Google (GOOG ) as two examples. On the other hand, he says Alcoa (AA ) in particular is an apathetic hedger, leading to unpredictable earnings. Off camera he also mentions Phillip Morris International (PM ), which derives all of its earnings from overseas (after a split from Altria) and hedges not at all. Whether or not it matters to investors is generally a function of the current trend.

Does the market simply look past currency impact on quarterly earnings when pricing a stock? From market experience, a company worried about hedging is less focused on actual operations. Whats more, just like individual traders, corporations tend to get swept away in frenzied moves from exogenous factors such as dropping dollars and rising input costs. Consider the airline industrys rush into jet fuel hedging near the heights of crudes rise. Those who had experience in the game, like Southwest (LUV ), prospered. Those who didnt, like AMR (AMR ), took substantial one-time charges.

Ultimately, how the stocks performed was more a function of operational execution and the fact that the airline industry is the land that love forgot.

A dollar rally seems wildly implausible in an environment of unprecedented stimulus programs.

Of course, the reversal of well-established trends always seems unlikely. If past is prelude, and it generally is, ramping demand for dollar hedging suggests a bottom in the dollar may be at hand. The end of sharp moves always comes when no one expects it. Even if dollar impact is largely not a factor in stock prices, the dollar drop is behind, or at least correlated with, moves higher in gold, crude, silver and nearly any other asset you could buy overseas. Whether we like it or not, most Americans portfolios are heavily impacted by the dollar.

You dont have to believe or, for that matter, understand a rally in the dollar, but itll pay off to get n touch with your inner Wolfgang Koester and start thinking of ways to lessen the impact a reversal could have on your portfolio.

Open Europe reports The Express reports that a number of public buildings around Britain are being ordered to fly the EU flag to celebrate Europe Day next Monday. The article notes that, in order to avoid fines from the Commission, the EU flag must fly for a week and officials are expected to provide prove that the rules are being observed.

Bloomberg reports Geithner extends debt-ceiling deadline to Aug. 2. (Does he have the legal authority to do so?)

I agree with Martin Wolf who writes in the Financial Times that the eurozone faces a choice between permanent pro-cyclical adjustments, a break-up; or closer union, that is deeper integration. He predicts they will choose the latter, but it is a political choice.

I envision that a strong European Leader such as Tony Blair will arise to lead a new European Empire, a revived Roman Empire, so as to speak. This Chancellor will be recognized as The Sovereign; he will be accompanied by a world class banker, such as Mario Draghi, who will be recognized as the Seignior, as he will provide a new seigniorage to replace the failed Seigniorage of Neoliberalism.

Keywords,

Age of Deleveraging, Dow Theory, Neoliberalism, The Seignior, The Sovereign, Tony Blair, Mario Draghi, Quantitative Easing Exhaustion, Seigniorage, Morgan Stanley Cyclical Index. Failure of Seigniorage, European Economic Governance, Kondratieff Winter, Kondratievv Winter, End of Credit, Inflation Destruction, Milton Friedman, Carry Trade Investing, Competitive Currency Devaluation, Debt Monetization, Monetization of Debt