Technical Trading Systems RSI Rollercoaster

Post on: 30 Апрель, 2015 No Comment

Pages

RSI Rollercoaster

Introduction

This system was developed by Kathy Lien and Boris Schlossberg and first published in their book High Probability Trading Setups for the Currency Market E-Book (2006).

Here is a link to the system as published on Investopedia:

The system as published on Investopedia (see link above) is identical to the system as published in the book.

There is little point in my detailing the system again here myself.

Personal observations and recommendations

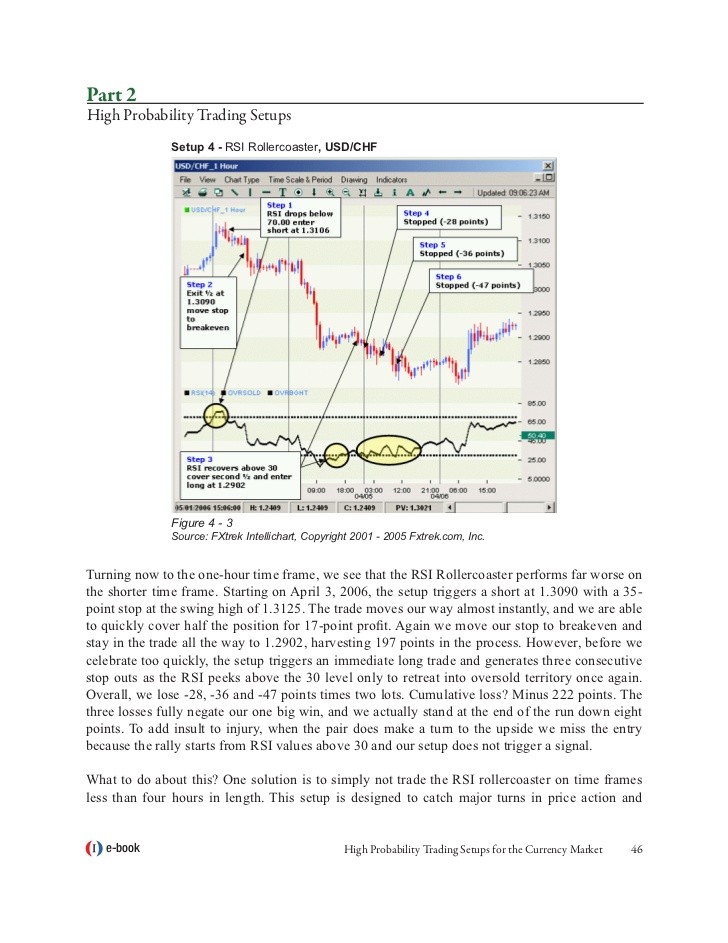

I recommend that you trade the system exclusively on the daily timeframes although the authors do give examples of trades on the one hour timeframes. I have found the signals to be unreliable on the one hour timeframes and even although you will probably breakeven more often than not you’re wasting valuable time even although you’re not losing money.

As always: I do not recommend trading forex pairs (with any system). Trade equities (preferably the major indices and ETF’s) and commodities.

The system is based on Wilder’s RSI which employed smoothing as per Wilder’s method Removing Wilder’s smoothing or using a standard exponential moving average in the calculation of RSI results in many more signals being generated by the system. Many more whipsaws or breakeven trades are the result however. One could also analyse historical data for a particular instrument to determine where most turning points for that particular instrument occur i.e. it may be that for a particular instrument the turning points occur at different RSI thresholds e.g. 65/35.

With this system each trade consists of two separate positions and the potential loss if stopped out on BOTH of these positions must be taken into account when calculating risk and therefore position size.

The developers suggest moving your stop on the remaining position to breakeven once your first target has been reached the theory being that SOME profit is better than NO profit. I have had better results by moving my stop to breakeven on the TRADE once the first target has been reached. If stopped out it means that you breakeven on the TRADE. However: moving your stop to breakeven on the TRADE once your first target has been reached has the effect of giving your trade more room to move and therefore decreases the probability of your being stopped out prematurely and possibly missing out on an extended move.

As noted: there is little point in my detailing the system again here myself. I will, however, provide real trade examples.

Trade examples

Gold (Delta Trading) (for testing) (under construction)