Technical Analysis of Forex Prices

Post on: 27 Июнь, 2015 No Comment

Analyze and Understand Patterns and Indicators

In this section we will take a deeper look at the various tools employed by technical analysts in predicting the direction of the trend, and for deciding on entry or exit points. We will first study the main categories of forex technical analysis. and then examine some of the most popular indicators used in this type of analysis, in order to help you decide on the best tools for your approach.

Neither a great understanding of the markets, nor exceptional skills in mathematics is a necessity for being a successful technical analyst. Since the tools have been refined through decades of trial and error, we have all the principles laid out for us by the past wizards of this trade. Many scenarios have been examined, countless situations have been explored with technical tools, and what is more, with the backtesting capability of today’s software, the ways in which our technical schemes can be employed are practically limitless. With all this automation, the knowledge and experience that is readily available for students of technical analysis, all that is needed is patience and hard work.

Forex Price Action — Reading the Language of the Market

June 12, 2013 at 11:15 AM 1 Comment

Most of this text is fairly straightforward. The terms and descriptions that we use are often self-evident, and we hope that even someone with no experience of trading will be able to grasp the essence of the discussion with a. Read More

The Pin Bar: One of the Most Powerful Price Patterns in Forex Trading

June 12, 2013 at 11:10 AM 1 Comment

Are you tired of trying to be a scalper and continually getting scalped by the market? Perhaps the quick action of the 1-Minute and 5-Minute charts is a bit too much. In fact, trading those lower timeframes can be very. Read More

Forex Candlestick Charts

Japanese candlestick charts have provided traders with a unique insight into the future direction of markets since their invention by a Japanese trader in the mid 1700s. Read More

Forex Indicators: Can Universal Forces of Nature Guide me?

April 15, 2013 at 10:12 AM

Forex indicators, one day you swear by them, and the next day you swear at them! Can’t seem to live without them, but you can’t kill them either! How could we trade foreign exchange without technical analysis? Indicators can be. Read More

Price Charting Technical Analysis Literature

April 15, 2013 at 8:52 AM

Many forex traders new to the market find themselves intrigued by the more sophisticated ways of interpreting price charts used in advanced technical analysis. Read More

Seminal Technical Analysis Literature

April 15, 2013 at 8:42 AM

Many of the inventors of popular technical indicators have written books about how to use their indicators or analysis methods properly when trading. Read More

A Few General Principles on Technical Analysis

April 15, 2013 at 7:59 AM

Traders new to forex might be mystified as to why technical analysis can provide such excellent market calls, perhaps even initially considering it another fortune telling hoax like reading tea leaves. Read More

The Effective Use of Technical Indicators

April 15, 2013 at 7:32 AM

Technical traders often compute and plot mathematical quantities based on market observables like price and volume in order to indicate the past or present state of the market. Read More

The Generality of Charting Techniques

April 15, 2013 at 5:36 AM

Although forex charts seem especially popular at present, traders in all financial markets use charts. In fact, many of the techniques used by forex traders in charting exchange rates were originally developed by technical analysts operating in the stock and. Read More

Technical Versus Fundamental Analysis

April 15, 2013 at 5:25 AM

Like other financial markets, the forex market has two primary methods of performing market research that traders can then use to base their trading decisions on. These are: Read More

Basic Technical Analysis Trading Manuals

April 15, 2013 at 5:16 AM

Many forex traders prefer to base their short term trading decisions on technical analysis factors rather than on fundamentals in order to obtain greater objectivity in their trading plans. Read More

Useful Software for Technical Traders

April 15, 2013 at 5:07 AM

Forex traders who base their trade plans on technical analysis often require support from specialized technical analysis software programs. Some more sophisticated forex technical analysis software packages also offer a number of different types of functionality to their users. Read More

Market Strength: How to Gauge the Power of a Market Movement

April 15, 2013 at 4:50 AM

The basic profit in forex, as in any liquid, market-based investment, is knowledge. If you can accurately predict where the market is going and do so consistently, you’ll be a very rich person. Read More

Essential Forex Chart Types

April 15, 2013 at 4:43 AM

Price charts have been used by technical analysts operating in a variety of financial and commodity markets for many years. In the forex market, traders will typically plot the exchange rate of a particular currency pair as it evolves over time. Read More

Multiple Time Frame Analysis

April 15, 2013 at 4:41 AM

When trading forex using technical analysis, many traders will consult charts that cover several different time frames in order to refine their analysis. Furthermore, many technical analysts provide different forecasts for a particular currency pair that depends on what time. Read More

Forex Technical Analysis Trading Tools

April 12, 2013 at 10:10 AM

A particularly popular method of trading forex involves using technical analysis to generate buy and sell signals. Read More

Identifying Point and Figure Chart Patterns

April 12, 2013 at 9:27 AM

Interest has recently resurfaced among technical analysts and forex traders in using a traditional form of price analysis that has been around since the 19th century in the form of Point and Figure charts. Read More

Fibonacci Retracements and Projections

April 12, 2013 at 9:19 AM

Many forex traders have learned to use Fibonacci retracements and projections when trading. Nevertheless, not all of them realize that they are using an element of Elliott Wave Theory in the process of doing so. Read More

The Bullish Kicking Candlestick Chart Pattern

April 12, 2013 at 9:01 AM

When Candlestick charts are interpreted correctly by a skilled technical analyst, they can clearly indicate potential market reversals to a forex trader. This can give the trader a higher likelihood of initiating high probability directional trades in the forex market. Read More

The Bullish Piercing Line Candlestick Chart Pattern

April 12, 2013 at 8:59 AM

Candlestick chart patterns fall into two principal categories: continuation patterns and reversal patterns. Reversal patterns can be either moderately reliable or — as in the case of the Bullish and Bearish Kicking patterns — they can be very reliable. Read More

The Bullish Three Inside Up Candlestick Chart Pattern

April 12, 2013 at 8:58 AM

Candlestick chart patterns typically consist of from one to several Candlesticks and have specific meanings depending on the way they come together. Read More

The Bearish Kicking Candlestick Chart Pattern

April 12, 2013 at 8:56 AM

The accurate interpretation of Candlestick chart patterns (see definition) can clearly indicate possible forex market reversals to forex traders skilled in using them. Read More

The Bearish Dark Cloud Cover Candlestick Chart Pattern

April 12, 2013 at 8:55 AM

A number of Candlestick chart patterns consist of two individual Candlesticks that result in specific interpretations that depend on how they arise (learn about candlesticks). Read More

Triple Exponential Moving Average: The TEMA Indicator

April 12, 2013 at 8:52 AM

Triple Exponential Moving Average, or TEMA, is a type of exponential moving average developed by Patrick Mulloy in 1994. One of the common problems of trading with EMAs or oscillators has always been the inevitable issue of lag encountered in. Read More

Standard Deviation Indicator

April 12, 2013 at 8:39 AM

Standard distribution is the basis that every other pattern of random distribution gravitates to over time, but even those with heavy or long tales, multimodality (such as those with multiple regional means, or medians) eventually converge on the standard distribution. Read More

Regular and Hidden Divergence in Technical Indicators

April 12, 2013 at 8:15 AM

The term divergence has two distinct meanings in common use among technical analysts and forex traders. The first usage refers to the situation that occurs on a chart where a new extreme seen in the price level does not result. Read More

Using Market Sentiment Indicators

April 12, 2013 at 8:05 AM

Many individual traders who are not operating out of large dealing rooms in the Interbank forex market can find themselves somewhat challenged when it comes to gauging the sentiment of the market. Read More

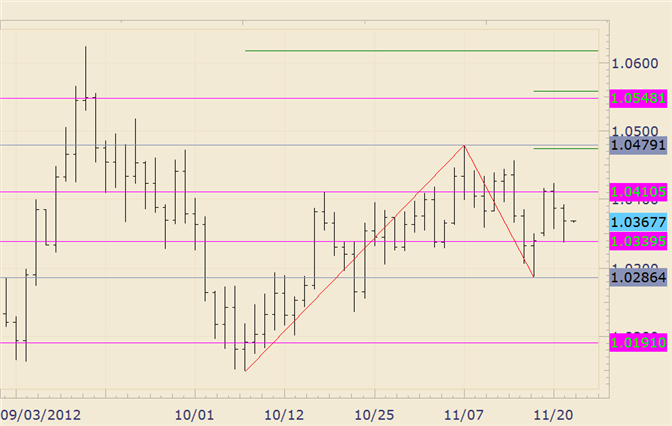

Forex Trend Line Drawing Tips

April 12, 2013 at 8:01 AM

Forex trend line drawing is a critical tool in forex trading analysis. Trend lines allow you to see both support and resistance points on a chart. These are then used to help you determine what type of trading activity to pursue. Read More

Forex Trend Indicators

April 12, 2013 at 7:50 AM

These indicators are used to gauge the strength and direction of a trend. As their name suggests, they are most useful in trending markets, and their usage in ranging markets is to be avoided because of the tendency to give. Read More

Forex Trend Breakout — Methods to Spot a Coming Breakout

April 12, 2013 at 7:47 AM

Support and resistance is a well-known concept in forex and other types of investment. The concept arose from the observation that prices sometimes test a certain limit multiple times. Read More

Forex Oscillators — The Predictive Value of Divergence and Convergence

Oscillators give the trader limit values which he can use to evaluate the price action. The currency price is a number, and its range is limitless (it can move between zero and infinity). Read More

Forex Indicators: Is There a Holy Grail Out There?

Just like gold prospectors of old, every trader suspects that someone out there has the secret, the indicator beyond all indicators that will always give infallible signals and lead him to his vein of gold. Read More