Tax Deduction for a Net Operating Loss (NOL)

Post on: 26 Июнь, 2015 No Comment

Talk to a Local Taxation Attorney

There are times when you lose money. Businesses big and small, and sometimes even individuals, may have more costs and expenses than they have in income or profits. Is there an upside?

The tax deduction for a net operating loss (NOL) can help you recover some of the loss. The recovery usually isn’t in the same year as the loss and you won’t get back everything you lost. Also, figuring out how much you can deduct is complicated. Your potential tax savings, however, make it worth your time to learn how NOLs work.

What’s an NOL and Who Can Claim It?

Generally, NOLs come up when you have more tax deductions than taxable income. You can figure this out easily by completing your tax return. You may have an NOL if you have a negative number on the line for taxable income before you deduct your personal exemptions (line 41 on Form 1040 ).

NOLs usually happen in business — from sole proprietorships to big corporations. It’s possible, though, for an individual taxpayer’s casualty and theft losses or business expenses to create an NOL. In such cases, you follow the rules for non-corporate taxpayers, such as sole proprietorships and independent contractors .

Other forms of businesses, like partnerships. limited liability companies (LLCs) and S-Corporations. generally can’t take deductions for NOLs.

The idea behind NOLs is simple enough: If your business losses are more than your total income for the year, you can use the excess loss to lower your income and reduce your taxes in another year. For example, if you have an NOL in 2010, you can use it to lower your taxes in 2009 or 2008, or possibly in 2010 and later. This is done through the carryback and carryforward rules .

How Much?

Use the information on your tax return and Form 1045 to figure this out. Be careful. The rules and formulas are complicated, and they’re different for non-corporate and corporate taxpayers.

Non-Corporate Taxpayers

There are a number of deductions you may have taken when completing your tax return that you can’t include when figuring out your NOL. For example, when calculating your NOL, you can’t include:

- Personal exemptions for yourself, spouse, children and other dependents

- Net capital losses — the amount that your capital losses are more than your capital gains. Capital gains and losses come from the sale of capital assets, like stocks

- NOL deductions from prior years

- Non-business deductions for things like alimony you paid; certain itemized deductions, like medical payments and charitable contributions; and the standard deduction, if you didn’t itemize

The NOL calculation does include:

- Itemized deductions for casualty and theft losses, state income tax on business profits, and any employee business expenses

- Moving expenses

- The deduction of half of your self-employment tax

Example

Say you’re the sole proprietor of a small business, and you also have a part-time job. Your 2010 tax return looks like this:

Your income totals $5,500:

- Wages from part-time job = $3,500

- Interest income from personal savings account = $500

- Net long-term capital gain on the sale of gold held for investment = $1,500

Your deductions total $18,350:

- Net business losses = $7,500 (gross income $68,500 minus $76,000 in expenses)

- Net short-term capital loss on sale of stock = $1,500

- Standard deduction = $5,700 (you’re single)

- Personal exemption = $3,650

Your deductions are more than your income, so you may have an NOL. To find out, go to Form 1045 and take out certain items:

- Non-business net short-term capital loss on sale of stock = $1,500

- Non-business deductions = $5,200 (standard deduction minus non-business interest income, or $5,700 — $500)

- Personal exemption = $3,650

- Total = $10,350

So, for 2010, you have an NOL of $2,500: Deductions — Form 1045 removed items — total income ($18,350 — $10,350 — $5,500).

Corporate Taxpayers

A corporation generally figures and deducts an NOL the same way as non-corporate taxpayers. First check if you have an NOL. The key figure is on of line 28, Form 1120. If it’s negative, there may be an NOL.

The main differences between corporate and non-corporate NOLs are that corporations:

- Can’t use the domestic production activities deduction to create or increase an NOL

- Can use the deduction for dividends paid on certain preferred stock of public utilities, without limiting it to its taxable income for the year

- Can take the deduction for dividends received, without regard to the aggregate limits that normally apply

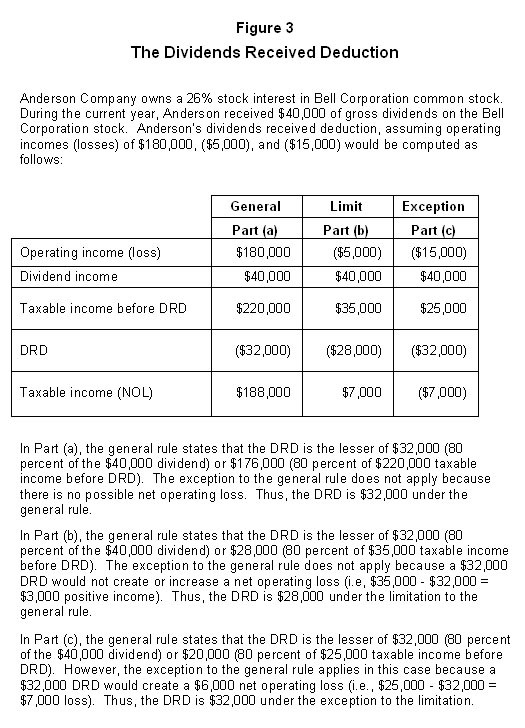

The last difference is probably the most used and most important for many corporations. Normally, a corporation can deduct dividends-received from other U.S. corporations, but the deduction is limited to a total of either 70 or 80 percent of the corporation’s taxable income. However, if the corporation has an NOL, the limit doesn’t apply.

For example. In 2010, corporation A had $500,000 of gross income from business operations and $625,000 of allowable business expenses. It also received $150,000 in dividends from a U.S. corporation for which it can take an 80 percent deduction, which normally would be limited to 80 percent of its taxable income before the deduction. Its NOL is $95,000:

- Gross income = $650,000 (Business income + dividends, or $500,000 + $150,00), minus

- $625,000, deductions for expenses minus

- $120,000, deduction for dividends-received ($150,000 x 80 percent). If the special rule wasn’t there, the corporation’s deduction for the dividends-received would’ve been $20,000, or 80 percent of its taxable income before the deduction ($25,000 x 80 percent)

To report NOLs, corporations use:

Questions for Your Attorney

- What kinds of records do I need to keep to prove a net operating loss for my small business?

- My small business had net operating losses for the past two years. Is there a limit on how many NOLs I can use?

- I bought an existing small business in 2009, and at that time it was operating at a loss. Can I use those losses when calculating my 2010 net operating loss?