Take Advantage Of The Volatile Market Through Dollar Cost Averaging

Post on: 26 Июнь, 2015 No Comment

Semi-Retirement Made Earlier and Easier

Take Advantage Of The Volatile Market Through Dollar Cost Averaging

For the past couple of weeks, some Asian currencies have been hit pretty badly and the Singapore dollar climbed to record highs against many of our neighbours currencies. Since I go to Johor Bahru pretty often, I took a leisurely walk to Change Alley during lunch time last Friday to check out the exchange rates. Unfortunately, most people thought the same way too and the place was super crowded.

Singaporeans definitely know a bargain when they see one.

Apparently, this bloodletting is due to big institutional funds withdrawing their funds from Asia. And obviously, the stock markets have not been spared. It was a sea of red for many Singapore counters last week. The queues at the money changers probably doubled after the Sing dollar appreciated by about 5% against the Malaysian Ringgit in the past 3 months. So Singaporeans should be investing more since Mr Market is currently giving a 10% discount on the STI (if you compare it to STI closure of 3454 on May 22), isnt it? Yippee!

However, our local newspaper urges caution. This is what I picked out from yesterdays The Sunday Times Invest Section:

First article:

With the proposal to reduce the size of 1 lot from 1000 to 100 shares, investors could find it easier to cough up the capital to purchase some blue chip stocks. However, blue chips are no guarantees towards investment success. You could have lost quite a bit of money if you invested in SMRT or NOL or even Wilmar. Even if you bought the businesses with good prospects, you could time your purchases badly and suffer a loss. Best to proceed with caution.

Another article:

All of us should have sold all our equities three months ago when the market was at its peak! But what now if we had missed the boat? Should we continue practicing what Buffett keeps telling us and stay invested? Or perhaps we could sell all our equities and conserve cash to see if cheap becomes cheaper. Otherwise, we could explore alternatives like gold, CPF accounts or properties.

Just a couple of months ago, these investing columns were raging about the undervalued equity markets and the allure of Reits but all of a sudden, its about exercising prudence. The mood has changed. Instead of preaching about the historical 10% annualised return that one should be getting on average, experts are now informing the masses that there is a real possibility of losing their pants in the market.

And many new investors are getting cold feet, with comments like With the latest turmoil, is this the right time for me to start investing? and Its better to observe this crisis unfold before I start my passive investing program . Yes, there is a chance that we could see further corrections of 10/20 or even 30% in the markets. I also know that you probably wont feel too good seeing your first $100 in the POSB Invest-Saver lose 10% of its value. But theres also a good chance it might just bounce back after a week?

In a perfect world, the STI and all stock prices would jump by 1% a month and everybody would receive the same high returns of >12% every year. We wouldnt have to worry about timing our purchases. However, in reality, when we invest in the stock market, we have to accept the volatility that comes along in the same package as the profits.

And since you cant avoid it, why not embrace and take advantage of volatilitys characteristics through dollar cost averaging.

====================

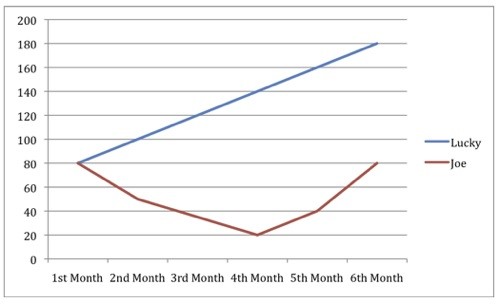

Let me explain with a simple illustration:

Suppose I have $600/month to invest in Sep, Oct and Nov and would like to liquidate the investments in Dec. There is this quality ETF/stock named Z that I am interested in.