Tactical Hedging Of Foreign Currency Risk Via Us Dollar Etfs 2015

Post on: 10 Май, 2015 No Comment

Sponsored Links

3A%2F%2Fwww.retailinvestor.org%2F?w=250 /% HOW TO HEDGE FOREIGN CURRENCY. A Canadian owning U.S. assets is exposed not only to the performance risk of the asset, but also to exchange rate risk.

3A%2F%2Fwww.investopedia.com%2F?w=250 /% In this case, an investor who wanted to be invested in Canadian equities while minimizing exchange risk could have done so using currency ETFs.

3A%2F%2Fcanadiancouchpotato.com%2F?w=250 /% In the last two years, Canadian ETF providers have finally launched US and international equity ETFs that do away with currency hedging. Yet the strategy remains

3A%2F%2Fwww.zerohedge.com%2F?w=250 /% This page has been archived and commenting is disabled. Greenspan’s Stunning Admission: Gold Is Currency; No Fiat Currency, Including the Dollar, Can

3A%2F%2Fbonds.about.com%2F?w=250 /% In the context of bond funds, currency hedging is the decision by the portfolio manager to reduce or eliminate the fund’s exposure to the movement of foreign

3A%2F%2Fen.wikipedia.org%2F?w=250 /% A hedge fund is an investment vehicle and a business structure that pools capital from a number of investors and invests in securities and other instruments. It is

3A%2F%2Fen.wikipedia.org%2F?w=250 /% In finance, a foreign-exchange option (commonly shortened to just FX option or currency option) is a derivative financial instrument that gives the right but not the

3A%2F%2Fwww.investopedia.com%2F?w=250 /% INVESTOPEDIA EXPLAINS ‘Hedge Fund’ Each hedge fund strategy is constructed to take advantage of certain identifiable market opportunities. Hedge funds use different

3A%2F%2Fnews.investors.com%2F?w=250 /% Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations it may make higher capital gain distributions than other ETFs. Although the Fund invests in very short-term, investment-grade instruments

3A%2F%2Fwww.afr.com%2F?w=250 /% We win the contract at one price, but if the foreign exchange rates move against us before we invoice, we could lose our margin. In a volatile period for the Aussie dollar and currency risk. We see the FX forward contracts and options as tactical

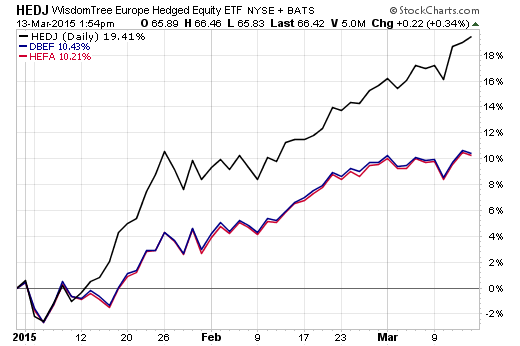

3A%2F%2Fetfdb.com%2F?w=250 /% Hedged ETFs, such as the db X-trackers MSCI international currency-hedged ETFs offer a solution to this problem [see also How To Hedge With ETFs]. ETFdb: What are the benefits to hedging currency risk US Dollar using a one month forward contract (a

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% recently took time to discuss with us key points investors should know about foreign currency risk, highlighting the benefits and potential drawbacks of hedging currency fluctuations [see King Dollar ETFdb Portfolio]. ETF Database (ETFdb): What is

3A%2F%2Fwww.businesswire.com%2F?w=250 /% “We believe a particularly compelling approach in today’s environment is to hedge interest rate risk using ETFs and interest. Foreign investing involves greater and different risks than investing in US companies, including currency fluctuations

3A%2F%2Fwww.biznews.com%2F?w=250 /% NEW YORK, Nov 11 (Reuters) – U.S. investors who believe the dollar’s 2014 surge will continue are pouring money into exchange-traded funds (ETFs) that invest in foreign markets but hedge now currency hedged, said Kubie. “I would see us increasin

3A%2F%2Fwww.investmentnews.com%2F?w=250 /% Financial advisers who found ways to mute the effect of the surging U.S. dollar on clients’ foreign investments an adviser-sold ETF strategist. “We’re a big believer in following momentum on a tactical basis, so hedging out currency and accessing

3A%2F%2Fseekingalpha.com%2F?w=250 /% The arrival of international ETFs has enabled investors to gain exposure to foreign give rise to the currency risk. As an example, if a European investor buys iShares MSCI Japan ETF (NYSEARCA:EWJ), which is denominated in U.S. dollar (USD), 100%