Support and Resistance Trading Levels

Post on: 16 Март, 2015 No Comment

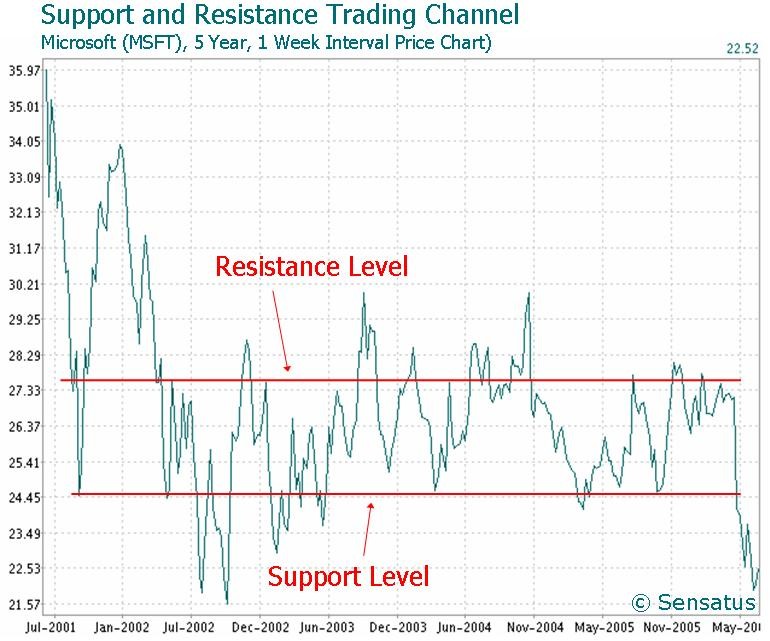

Support and resistance are two major concepts in relation to stock market technical analysis. Support is the price level through which a stock or market seldom falls. Resistance, on the other hand, is the price level that a stock or market seldom surpasses.

Technical analysts often talk about the ongoing battle between the bulls (optimistic investors) and the bears (pessimistic investors), or the struggle between buyers (demand) and sellers (supply). This struggle is often revealed in the price range that a security will seldom move above (resistance) or below (support).

Reasons for Support and Resistance Trading Levels

Support and resistance trading levels are important to technical analysts, especially in terms of market psychology and supply and demand. Support and resistance levels are the levels at which a lot of traders are willing to buy the stock (in the case of a support) or sell it (in the case of resistance).

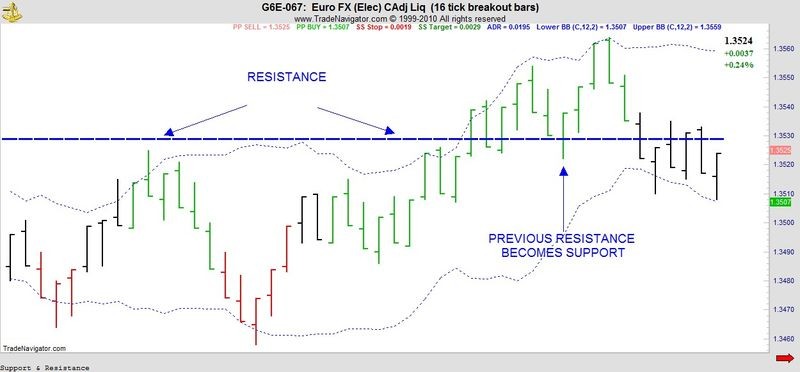

When these trendlines shift or are broken entirely, the supply and demand and the psychology behind the stock’s movements also shift, in which case new levels of support and resistance will likely be established.

Round Numbers and Support and Resistance

Round numbers often represent the major psychological turning points at which many traders will make buy or sell decisions – making this one type of universal support and resistance that tends to be seen across a large number of securities.

Round numbers like 10, 20, 35, 50, 100 and 1,000 tend be important in support and resistance levels. Buyers will often purchase large amounts of stock once the price starts to fall toward a major round number such as $50, which makes it more difficult for shares to fall below the level. On the other hand, sellers start to sell off a stock as it moves toward a round number peak, making it difficult to move past this upper level as well. It is the increased buying and selling pressure at these levels that makes them important points of support and resistance and, in many cases, major psychological points as well.

The Importance of Support and Resistance Technical Analysis

Support and resistance technical analysis is an important trend component because it can be used to make trading decisions and identify when a trend is reversing. For example, if a trader identifies an important level of resistance that has been tested several times but never broken, he or she may decide to take profits as the security moves toward this point because it is increasingly less likely that it will move past this level.

Support and resistance levels both test and confirm trends and need to be monitored by anyone who uses technical analysis. As long as the price of the share remains between these levels of support and resistance, the trend is likely to continue. It is important to note, however, that a break beyond a level of support or resistance does not always indicate a reversal in the trend.

If you are interested in applying support and resistance technical analysis to your stock picks, you may want to consider signing up for a risk-free 14 day free trial of SmarTrend — and take the guesswork out of your trading.