Subprime Are you In or Out

Post on: 16 Март, 2015 No Comment

By Rich LaLonde

Subprime: Are you IN or OUT?

Richard J. LaLonde is the Founder, President and Chief Executive Officer of Auto Credit Express (ACE), a company specializing in Sub Prime since 1992. ACE offers their dealership partners a wide array of products to streamline the Sub Prime process; from the turn key outsourcing of their Sub Prime operations, to an easy to use online selling system. Additionally, ACE offers entry level and advanced sub prime sales and finance training and special finance lead generation. Mr. LaLonde started in the car business in 1981 by serving large dealer groups in public accounting. He then went on to work as a Comptroller for a mega dealer and as a General Manager for Agency Rent-A-Car dealerships. Rich outsold other Agency regions three to one. He recognized the potential Sub Prime displayed and decided to help dealers get into the Sub Prime business by starting his own company. He continues to be the nations leading expert in Sub Prime. Mr. LaLonde is a CPA and received his BBA from Western Michigan University.

In this year of political campaigns the theme that resonates from both parties is one of change. I have served the subprime industry as a consultant for over fifteen years and I can tell you, without hesitation, that it is time for change. In fact the Republicans have a maverick running for president. It is also time for those dealers not doing subprime to be mavericks, themselves, and chart a new course for their business.

For those dealers who are willing to become students of the subprime business and make a minor investment in the proper infrastructure, process and people which will insure their long term success, there has never been a better opportunity than today.

WHAT OPPORTUNITY?

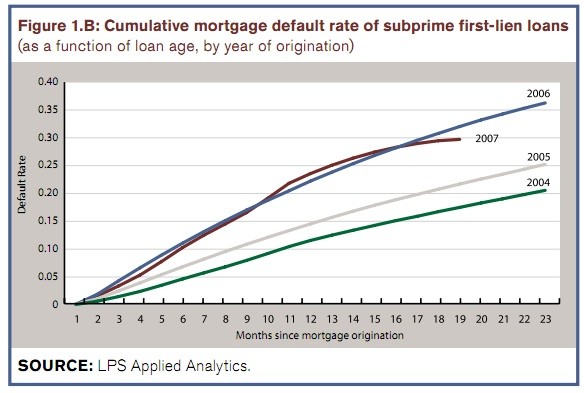

The pool of subprime customers has never been bigger- With the subprime mortgage mess still playing out, with debt levels at record highs, and with record home foreclosures and unemployment rising, new consumers are entering the subprime market in record numbers. This trend will continue throughout our lifetimes and, therefore, not decline any time soon.

The pool of qualified Dealers to serve them is getting smaller- Dealers are exiting the subprime business in record numbers. Why, you might ask? Well there are a number of reasons:

- The subprime GURU effect — In this scenario, a dealer would hire a subprime guru, buy a few leads or do a direct mail campaign, and deliver 10-15 deals a month. The dealer and GM generally didn’t spend a lot of time understanding what the guru was doing or how this individual was conducting their subprime business. If the guru had some success, chances are better than 50/50 (just like Vegas) that there was someone within the dealer’s management staff that didn’t like it and made it difficult for the guru to continue to be successful. The dealer stopped advertising, or buying the right inventory. The next thing you know the guru was on his way to that same dealer’s competitor. Can you blame him? With no real traffic or an opportunity to make a pay check he had no choice but to leave.

- GURU Funding Problems — This can happen if the dealer paid the guru on delivered cars and not funded contracts. Typically, in this situation, the guru gets ahead of the dealer by 2-3 months. When questions finally start getting asked about the funding, the guru is gone-either before you caught him or because you fired him. And by the way, there is nothing that will sour someone’s taste for sub prime more than being caught holding a bag of unfunded contracts.

- GURU Fraud — From power booking cars whose moon roofs just happened to close up by the time they arrived at the auction (after being repossessed) to bogeying pay stubs or the down payment; when your guru is committing fraud and no one is watching you will have problems. We have seen dealers get asked for tens of thousands of dollars (a few for over $100,000) as restitution for these types of issues. This can certainly turn someone away from the subprime business.

- Lenders are Tightening Up — No question about it. Those dealers who have the right processes in place and the right people in the store are not out of business. Lenders still have money to lend and a smaller dealer base to lend it through — sounds like opportunity to me.

Whatever the scenario, you are out of the sub prime business because you relied on that one person, while a local competitor who has the right process in place just got more profitable. There is no one to blame for this but you. As a dealer, you have to inspect what you expect and, as a result your employees will respect what you inspect.

Net Profit- Dealers who can attain an average of Twenty Five (25) additional deals per month will realize a departmental profit in excess of $400,000 per year.