Strong dollar stock market flout conventional wisdom

Post on: 7 Июль, 2015 No Comment

One of the more complicated areas of the financial world is currency markets. The currency market actually dwarfs both the stock and bond markets and affects almost every other part of the economy, all without being noticed by the typical investor/consumer day to day.

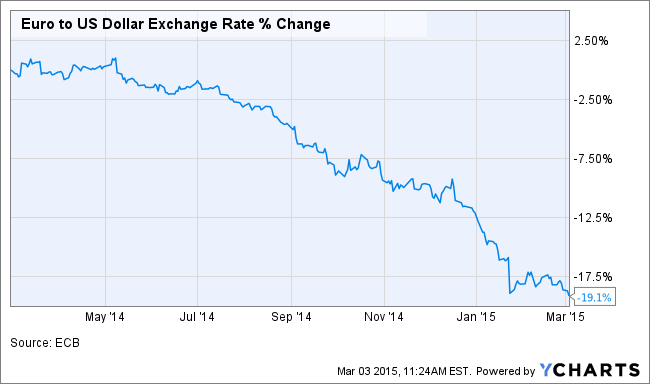

Some dramatic events have been occurring in the currency markets over the past few months, and it is helpful to understand how these events could affect our investment and consumer outcomes.

The primary trend in the currency market is the U.S. dollar is strengthening considerably against every other major currency, and for you gold bugs out there, this trend has also manifested in gold prices as well.

All the major currencies of most note are at a multiyear low against the dollar and when the trend is this pervasive, it really is about the denominator currency, in this case the dollar. Strength in the dollar is attributed to the more robust economic activity in the U.S. versus these other markets and because our interest rate environment is transitioning to what is assumed to be one of rising rates, whereas other economies continue to be dominated by sinking interest rates.

Conventional thinking has held a strong dollar is a negative for stocks as it indicates outflow from the capital markets and increasing demand for cash. Anecdotally in this particular situation however, the U.S. stock market has moved higher right along with the dollar for the past few years, flouting this conventional wisdom.

In this regard, Goldman Sachs recently released research questioning the accuracy of this conventional wisdom in a historical sense as well. The research team did a nice job showing a rising dollar typically indicates a strengthening economy, which has historically been supportive of stock prices. So from an investor’s point of view, I would expect the stronger dollar to affect certain sectors of the market (manufacturing and energy). But the stronger dollar does not concern me from an overall strategy perspective at this time.

From an economic point of view, a stronger dollar is expected to affect the competitiveness of U.S. exports as our products become more expensive in the context of a foreign consumer’s purchasing power. This paradigm in certainly true, but I do question the overall economic impact this has on our domestic economic growth. The U.S. economy is founded in domestic consumption, and those products we do export tend to be highly specialized (technology and machinery) or highly necessary (agriculture) and so somewhat insulated from pricing pressure.

And, finally, the icing on the cake, the strong dollar will definitely affect retail gas prices, which have been falling for weeks. I recently filled a 55-gallon RV tank for $3.15 a gallon in Lafayette, quite a nice “strong dollar” dividend.

Opinions are solely the writer’s. F. Marc Ruiz is a local investment strategist and co-host of Your Mind on Money at noon Mondays on WLPR-FM 89.1 The Lakeshore. Reach him at upirmndonmoney@lakeshoreptv.com.