Strategies For Investing In The Precious Metals Market

Post on: 26 Май, 2015 No Comment

Loan Central

One of the best avenues of locating a safe haven is to choose investments tools in the precious metals market. The four leading precious metals include palladium, gold, platinum and silver. In the last decade, the spot prices of both palladium and platinum have risen significantly in their respective markets.

At the beginning of 2001, gold was selling at a spot price that is one-fourth what it is today. Even silver is at nearly double the price that it was just five years ago. The spot price of silver continues to fluctuate due to its demand by a large variety of industries. However, overall the silver spot price continues to remain on an upward trend.

Platinum is the most surprising out of the top leading precious metals. In the last few years, it has significantly outperformed other precious metals, especially gold. This is due to its anti-corrosive properties, and its effectiveness in industrial scrubbers.

Palladium continues to rise significantly higher than expected. With the recent demands of an increase in automotive manufacturing in China and India, along with the turnaround in the US economy, palladium has never been in greater demand. Manufacturers use palladium in catalytic converters because of its ability to resist corrosion and rust.

Portfolio Diversification

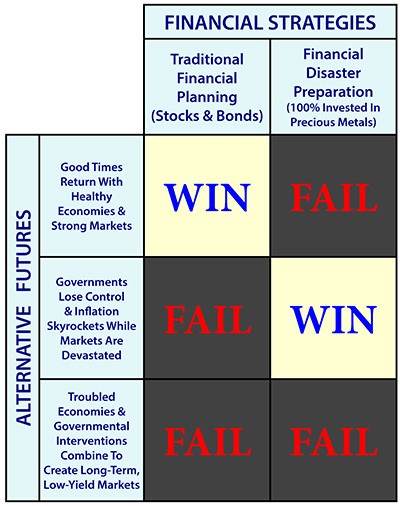

Part of an effective strategy for investing in the precious metals markets is through diversification. Many financial experts highly recommend that individuals diversify their portfolio by purchasing bullion bars, rounds and coins of palladium, gold, platinum and silver. It is their suggestion that at least 10% to 15% of the entire portfolio be invested in precious metal markets.

Timing the Market

Investors involved in the precious metals market use a variety of analysis tools to help them time the market. They use numerous realistic and flexible proven data points to determine the exact timing for entering the market. In addition, they use the analysis tools to help maintain or hold their position, or to decide when to sell off their assets.

Smart Finance

Many of these investors have the ability to develop proven strategies to determine when the opportune time has arrived for making large purchases of bullion bars, rounds and coins of gold, palladium, silver and platinum.

Available Products

In addition, there is a huge array of other available products for investing heavily in the precious metals market. Many investors buy stock in mining companies that mine precious metals from the earth. Others purchase certificates, while many simply purchase the bullion bars, rounds and coins. Bullion is poured at 99.9% purity and can hold its intrinsic value because of its low commission price when purchasing and selling the asset.

Many investors first beginning to become involved with precious metals elect to purchase silver bullion bars and coins because of its low spot price per troy ounce. The spot price of palladium is significantly lower per troy ounce than both gold and platinum, and serves as an easy investment tool when just starting out in the precious metals market.

Finding a Dealer

It is important that the investor take the right amount of time to research reputable dealers at physical brick-and-mortar stores and online. The dealer they choose should be highly experienced and knowledgeable about every type of precious metals investing tool. They should have a skilled staff that is able to provide the answers that every investor needs to know.

Like any strategy designed for generating profits in a diversified portfolio, it is important that the investor create an end strategy. This will allow them to understand when the asset should be traded or held. Long-term investors can withstand significant downturns in the precious metals market, while short-term investors need to spend more time analyzing their exit strategy.